Quick Summary:

- Self-employed maternity pay is available in New Zealand, but it’s not automatic like for employees.

- To qualify, you must:

- Meet the eligibility criteria set by Inland Revenue (IRD).

- Fill out the IRD maternity leave forms (IR880 and IR881).

- Prove your income over the last 12 months.

- You could receive $606.46 per week for up to 26 weeks, depending on your income.

- The process includes:

- Meeting the income threshold.

- Applying at least 6 weeks before your due date.

- Ensuring your tax contributions are up-to-date.

- If your baby arrives early:

- Your payments will start immediately after birth, but the 26-week leave duration is fixed.

- If your baby is late:

- You won’t receive extended leave, but your leave period still starts when your baby arrives.

- Key things to remember:

- Check deadlines to ensure timely application submission.

- Gather the necessary documents for your application.

- You can apply for shared parental leave if your partner meets the eligibility criteria.

So, you’re self-employed and expecting a little one. Congrats! But now, the big question: Can you access self-employed maternity pay? Unlike employees, it’s not as straightforward, but don’t stress. With the right eligibility criteria, you can still qualify for parental leave payments through the government’s paid leave scheme.

The process involves filling out the IRD maternity leave form and meeting an income threshold to ensure you’re eligible. You’ll also need to keep track of your income test and understand the leave duration for self-employed workers. If you qualify, you could get some much-needed financial support during your leave.

But it’s not just about the payments. If you’re running your business during leave, or planning to work from home, you may wonder if that will affect your maternity leave entitlement. We’ll cover that too. And if your baby arrives early, there are some adjustments to keep in mind for your parental leave application.

We’ll go over everything, from the eligibility to shared parental leave, so you can be sure you’re getting the most out of your self-employed benefits. Ready? Let’s dive in!

Can Self-Employed People Get Maternity Pay in New Zealand?

Yes, self-employed people can receive maternity pay in New Zealand, but it’s not as straightforward as for employees. The good news? The government provides a paid leave scheme that self-employed workers can tap into. To qualify, though, you’ll need to meet certain eligibility criteria set out by Inland Revenue Department (IRD).

Being self-employed means you’re your own boss, so you don’t get paid parental leave automatically like employees. But as long as you’ve been paying into the system (through your taxes and income tax returns), you may be able to access parental leave payments when the time comes.

What you need to know: You’ll have to fill out the IRD maternity leave form, prove your income threshold, and meet the required leave duration. It’s not a free pass, but if you’ve been diligent about your tax credits and business income, you’re in the running.

What are the Eligibility Requirements for Self-Employed Mums?

Alright, so here’s where the nitty-gritty comes in. To access maternity leave entitlement as a self-employed mum, you need to meet a few important eligibility requirements:

- Length of Time Working: You’ll need to show that you’ve been working for at least 6 months, filing your taxes with the IRD.

- Income Threshold: Your income test will determine if you’re eligible. You need to meet a minimum income level from your business to qualify for the parental leave payments.

- Tax Payments: You must have been paying taxes and contributing to the tax system. The more you’ve paid into the system (whether through GST or income tax), the higher your chances of qualifying.

- Working During Leave: If you plan on working from home or running your business while on maternity leave, it can affect your entitlement, so be mindful of how much income you’re earning during your time off.

How Much Will You Receive in Maternity Pay?

The method used to calculate maternity pay for self-employed individuals involves a parental leave payment threshold test. The test looks at your average income over the previous year to determine your eligibility and how much you will receive.

To calculate the amount:

- Income Threshold: You must have earned at least $30,000 in the previous 12 months before the birth of your child. If you meet this income threshold, you’re eligible for the full payment.

- Weekly Payment Calculation: The weekly payment is based on your average weekly income over the previous 12 months. So, if you earned more, you’ll get closer to the maximum $606.46 per week. If you earned less, your payment will be adjusted accordingly.

- The Parental Leave Payment Threshold Test: If your income falls below the threshold, you may still qualify for parental leave payments, but at a reduced rate. The key point here is that the test helps determine both your eligibility and the actual amount you will receive during your leave.

Here’s an example to make it clearer:

Let’s say you’ve been self-employed as a photographer, earning $50,000 in the last 12 months. Your weekly income for the year averages to about $1,000. Based on the parental leave payment threshold test, you would qualify for the maximum $606.46 per week for up to 26 weeks.

On the flip side, if you earned $20,000 in the past year, your weekly payment will be lower than $606.46, based on your earnings. In this case, it could be around $400 per week, depending on how the IRD calculates your income.

These payments are taxable, so keep that in mind when planning your finances.

How to Apply for Paid Parental Leave as a Self-Employed Person

Alright, so you’ve made it this far—you’re ready to apply for paid parental leave. No need to panic; the process is pretty straightforward, but you’ll need a couple of forms, and some documents handy. Here’s how to get things rolling.

First, you’ll need to fill out the IRD maternity leave forms. The key forms for self-employed folks are IR880 and IR881. These will kick-start the process, and you can get them online, so no need to head to an office (yay for that).

Here’s how to apply in 5 easy steps:

- Fill Out the IR880 Form: This is your initial parental leave application. You’ll need to enter your details and income info for the last 12 months to meet the income threshold.

- Submit the IR881 Form: This one comes in a little later. It’s for reporting your earnings during your parental leave.

- Upload Documents: Make sure your income records, like your tax returns, are in tip-top shape and uploaded to the IRD system.

- Check Your Eligibility: Once you’ve submitted your application, the IRD will assess your eligibility based on your income and other factors.

- Wait for Approval: The IRD will get back to you with your eligibility status and the weekly payment amount you qualify for.

Here’s a table to make the forms clearer:

| Form Name | Purpose | Link to Form |

|---|---|---|

| IR880 | Initial Parental Leave Application | Download IR880 |

| IR881 | Report Earnings During Parental Leave | Download IR881 |

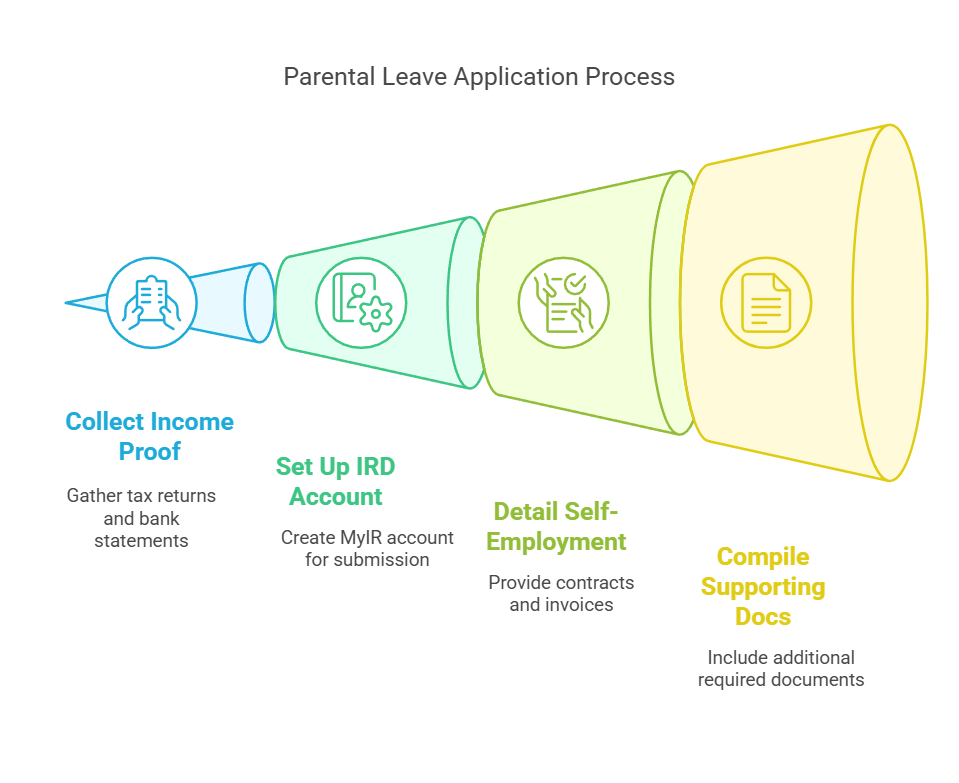

What Documents Will You Need to Apply for Parental Leave?

Now, let’s talk about the paperwork you’ll need to make the application process smooth sailing. Here’s the list:

- Income Statements: You’ll need to provide proof of your earnings for the last 12 months. This can include:

- Tax returns

- Bank statements showing business income

- GST returns (if applicable)

- IRD Account: If you don’t already have a MyIR account, get that sorted. It’s where you’ll submit your forms and track the progress of your application.

- Self-Employed Details: You’ll be asked to provide a detailed breakdown of your self-employed work. This could include contracts, invoices, and any other documents proving your business activity.

- Supporting Documents: In some cases, you may be asked for extra documents, like a letter from your accountant or evidence of your self-employed benefits and income tax contributions.

Deadlines and Key Dates for Applying

When it comes to paid parental leave, timing is crucial. You want to make sure your application is in on time to avoid any delays in your payments. Here’s what you need to know about the deadlines:

- Application Deadline: You should submit your IR880 form at least 6 weeks before your due date. The earlier you apply, the better—especially if you have an early birth. You can apply up to 3 months before your expected delivery date.

- Leave Duration: The maximum period for parental leave payments is 26 weeks. Your payments will start after you’ve given birth, so plan accordingly.

- Payment Dates: Once your application is approved, the IRD will begin making payments, typically starting within 4 weeks of your application being processed. Don’t leave it until the last minute to get everything in order!

It’s a good idea to keep a calendar or reminder to ensure you stay on top of all these dates, so your parental leave application isn’t delayed.

What Happens If Your Baby Arrives Early or Late?

Ah, the joys of babies—always keeping you on your toes, right? Whether your little one arrives a little early or decides to take their sweet time, you might be wondering if it’ll affect your parental leave payments.

First things first: Yes, your payments can be adjusted if your baby arrives early. Here’s the thing: you’re entitled to maternity leave payments for up to 26 weeks, but if your baby shows up sooner than expected, your leave can start earlier, and your leave payments will begin as soon as the baby is born.

On the flip side, if your baby is late, your payments won’t just keep stretching out. Parental leave payments only cover 26 weeks, no matter when your baby decides to show up. So, if you’re past your due date and still working, don’t worry—you’ll still get the same amount of leave time, but you’ll just have to adjust your start date.

In both cases, the key thing to remember is that the leave duration is set. So if your baby arrives a few days early or late, your payments can start on the day your baby is born, but the 26-week clock starts ticking from then. It’s pretty flexible, so don’t stress too much if your baby isn’t on the same schedule as you.

Frequently Asked Questions (FAQ)

Do self-employed people get maternity pay in NZ?

Yes, self-employed people in New Zealand can receive maternity pay, but there are specific eligibility criteria you must meet. You’ll need to prove your income over the last 12 months and fill out the necessary IRD maternity leave forms. Payments are made through the government’s paid leave scheme, so it’s not automatic—you’ll need to apply for it.

Who is eligible for IRD maternity leave payment?

To be eligible for the IRD maternity leave payment, you must be self-employed, meet the income threshold (earning at least $30,000 in the past year), and have been working for at least six months. You must also be registered with the IRD and have submitted your tax returns.

How much maternity pay will I get in NZ?

If you qualify, the maximum maternity pay in New Zealand is $606.46 per week (before tax), and this is paid for up to 26 weeks. The exact amount you receive will depend on your income over the previous year and whether you meet the income threshold.

Can I transfer my maternity leave payments to my partner?

Yes, you can transfer your parental leave payments to your partner if they meet the eligibility criteria. This is called shared parental leave and can be a good option if your partner wants to take time off to help care for the baby while you return to work.