Thinking of going solo with your own business in New Zealand? Good on ya. Becoming a sole trader is the easiest way to dip your toes into entrepreneurship without jumping through a hundred bureaucratic hoops. It’s simple, quick, and you stay in charge. No board meetings, no shareholders, no drama.

Here’s what you actually need to know to get started without stuffing it up.

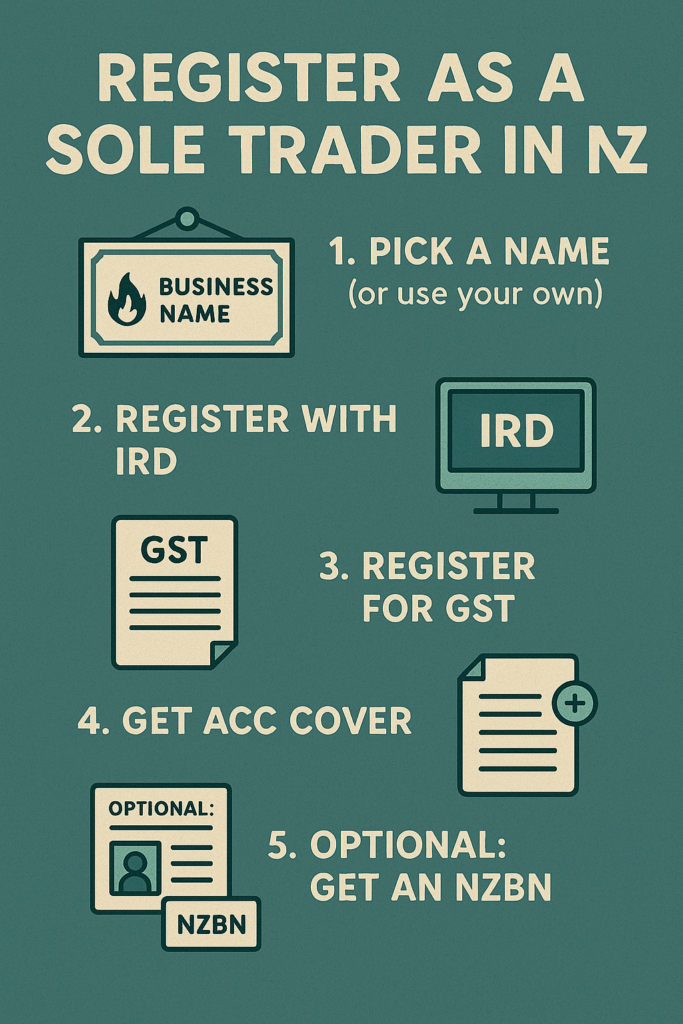

Essential steps to register as a sole trader in New Zealand

Being a sole trader is as straightforward as business structures get here in NZ. No need to form a company or fork out big bucks to get started. You run the show, make the calls, and yep—you’re also on the hook if things go sideways. So, make sure you’re ready to back yourself.

Here’s how to kick things off:

- Pick a name (or use your own)

- Register with IRD (you’ll need a myIR account and an IRD number)

- Register for GST (only if you’re turning over more than $60k)

- Get ACC cover (you’ll be auto-enrolled after IRD rego)

- Optional: Get an NZBN (makes you look more legit)

It all starts with the IRD—tell them you’re going self-employed, and they’ll loop in ACC, who’ll chuck you into CoverPlus and send you a bill (because of course they will). But hey, at least you’re covered if you take a tumble chasing an invoice.

Choosing your business name and tax obligations

Your business name is kinda your public face. You can just go with your own name, or spice it up with “trading as…” and something catchy like Kev’s Kiwi Fencing. Just check it’s not already taken.

Use ONECheck to make sure your name isn’t already locked in by someone else. It also helps you check if:

- The domain name is free

- Social media handles are available

- The name’s trademarked or registered

Now, the fun part: taxes.

As a sole trader, your tax setup is simple-ish, but still important:

- You file your individual tax return each year (with biz income included)

- You register for GST if you earn over $60k. I recommend to file a return every two months.

- You might have to pay provisional tax during the year

- You need to keep solid records (don’t rely on your glovebox)

- You separate personal and business money (yes, seriously)

Here’s a quick cheat sheet:

| Annual Turnover | GST Registration | Filing Frequency |

|---|---|---|

| Under $60,000 | Optional | Monthly, 2-monthly, or 6-monthly (if rego) |

| $60,000 or more | Mandatory | Monthly, 2-monthly, or 6-monthly |

So, if you’re pulling in a bit of coin, sort out that GST—because the IRD definitely will if you don’t.

Recommended registrations and business management

Now, these aren’t must-do steps, but they’ll make your life a lot easier.

RealMe Login

Set this up once and use it across loads of government services like IRD, ACC, and NZBN. One login to rule them all. It’s free and saves time.

NZBN (New Zealand Business Number)

Makes your business searchable and a bit more official-looking. You’ll need your RealMe login to get one, and it’s also free. Clients and suppliers will think you’re flash.

Business bank account

Not required—but highly recommended. Mixing your farm expenses with fish’n’chip runs isn’t a great look when tax time rolls around. A business account makes tracking your income, expenses, and profit cleaner. Most banks have low-fee options just for sole traders.

Also: don’t forget the legal stuff.

If you’re selling stuff or services, you need to:

- Follow health and safety rules (even if it’s just you)

- Stick to fair trading laws

- Get licensed if your industry needs it (think trades, hospitality, etc.)

And if you hire anyone, make sure you’re not winging it—there are employment rules, even for mates.

Protecting your business and planning for growth

Here’s the catch: being a sole trader means you’re the business. That means your personal assets (like your house, ute, or Xbox) could be at risk if something goes wrong. Ouch.

Insurance to think about:

- Public liability – If someone trips over your stuff

- Professional indemnity – If your advice or work goes sideways

- Business interruption – If you can’t work for a bit

Also, chat with a good accountant or small business lawyer. They can:

- Help with tax planning

- Make sure you’re ticking all the compliance boxes

- Give you advice for future-proofing your setup

And once you start growing? You might want to level up to a company structure. It offers better protection and can help if you’re chasing funding, partnerships, or just want to separate your personal and business finances properly.

Final word

Going sole trader in NZ is one of the easiest ways to start a business—but that doesn’t mean you should take it lightly. Tick the boxes early, get your systems sorted, and plan for growth.

And hey—if all this sounds like a lot, don’t stress. That’s what BH Accounting is here for. We’ll help you get registered, set up, and actually understand what the heck you’re doing—without the jargon.

Ready to give it a crack?