Thinking about the costs of winding up a Trust? You’re not alone. Whether you’re a trustee trying to do things by the book, you have an non-active Trust or a beneficiary wondering where the money’s going, it’s natural to ask: how much is this going to cost me?

In this guide, we’ll break down the costs of winding up a Trust in plain English—no legal jargon, no fluff. From trust wind-up fees to trustee exit costs, and even the hidden charges around final distribution expenses, we’ve got your back. We’ll also cover how to minimise surprises, avoid overpaying, and stay compliant with the rules (especially if you’re in New Zealand).

Why? Because when it comes to dissolving a family trust, you need answers—not more confusion.

You’ll learn what steps are involved, where the money goes, and how professionals like accountants or lawyers can help—or hurt—your wallet.

Stick with us to get a full picture of what it really takes (financially) to wrap up a trust properly. Let’s make the costs of winding up a Trust as transparent as possible.

What Does Winding Up a Trust Mean?

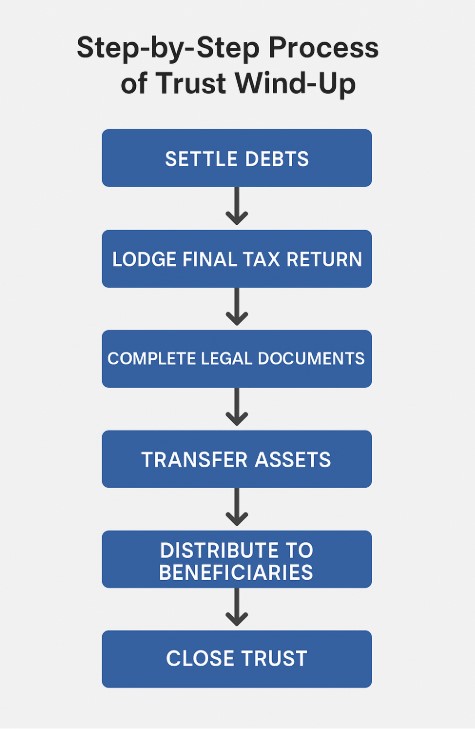

Winding up a trust means legally closing it. That includes settling debts, distributing assets, and completing final tax and legal obligations. It might sound simple, but the process can be layered, especially depending on the type of trust and number of beneficiaries involved.

Most commonly, trusts are wound up because the original purpose has been fulfilled, tax laws have changed, or the trust is no longer needed. Whatever the reason, it’s important to follow the correct procedure to avoid penalties or delays.

What Are the Main Costs of Winding Up a Trust?

So, how much does it actually cost to shut down a trust? The costs of winding up a Trust can vary widely, but they usually fall into a few major categories. Understanding them upfront helps you plan and avoid surprises.

Professional fees (legal, accounting, trustee)

This is usually the biggest line item. You’ll likely need legal advice, accounting work, and trustee admin time.

- Lawyers: Draft closure documents, review the deed, and ensure legal compliance

- Accountants: Prepare final financial statements and file last tax returns

- Trustees: Charge for their time or a fixed exit fee

Depending on the complexity, fees can range from $1,000 to over $5,000 NZD.

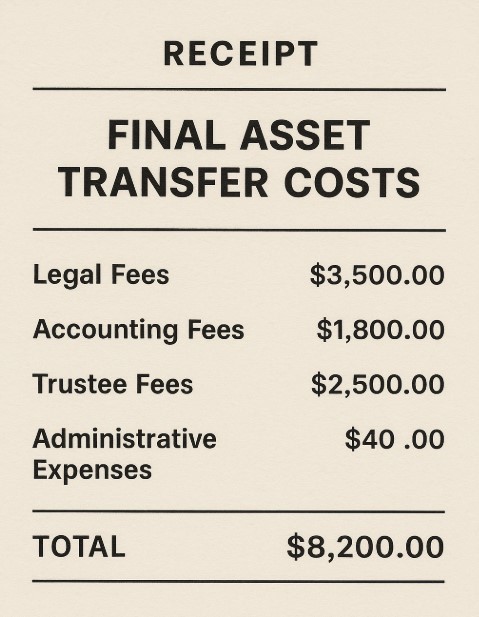

Final distribution and asset transfer costs

Once debts are paid and obligations met, you’ll need to transfer assets to beneficiaries. These steps aren’t free either.

- Property transfers and registration costs

- Asset valuations (especially for real estate or investments)

- Brokerage or legal fees for selling shares or units

Typical services that incur fees

- Legal document drafting

- Title transfers and property conveyancing

- Final tax return preparation and lodgement

- Trustee resignation and beneficiary notices

Summary Table: Breakdown of Common Trust Wind-Up Fees

Here’s a quick look at the most common costs, what they cover, and what you can expect to pay:

| Expense Type | Estimated Cost (NZD) | Description |

|---|---|---|

| Legal fees | $1,000 – $3,500 | Document drafting, trust deed review, legal checks |

| Accounting & tax filing | $500 – $2,000 | Final IRD returns, tax compliance, financial reports |

| Trustee fees | $300 – $2,000+ | Time-based or fixed exit fees |

| Property transfer costs | $300 – $2,500+ | Valuation, title registration, legal fees |

Source: New Zealand Law Society – Family Trusts

Factors That Affect the Total Cost

Not all trusts are built the same, so the costs of winding up a Trust depend heavily on several variables. Here’s what can increase or reduce your final bill.

Trusts with more assets, properties, or overseas beneficiaries typically cost more to wrap up. You’ll also pay more if there’s legal conflict, tax complications, or a complex trust deed.

What drives up the costs

- Ongoing legal disputes between beneficiaries

- Multiple properties or international assets

- Incomplete or outdated trust documentation

- Cross-border tax considerations

On the flip side, smaller or simpler trusts—like those with one asset and a single beneficiary—can often be closed with minimal professional involvement.

Can You Minimise the Costs of Trust Closure?

Good news: Yes, there are ways to keep things simple and save money. While some fees are unavoidable, being proactive and well-organised can significantly reduce what you pay.

Choose professionals with flat-fee packages, consolidate asset transfers early, and avoid letting the trust sit dormant (which may trigger additional compliance costs later).

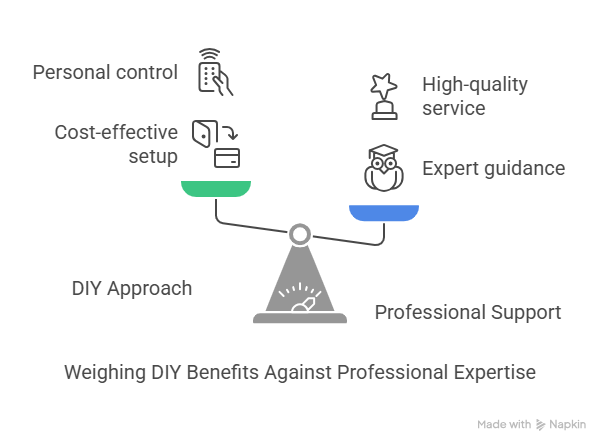

DIY vs. Professional Support – Pros and Cons

Some people opt to handle the wind-up themselves. That’s possible if the trust is simple—but be cautious.

DIY Pros:

- Cheaper upfront (especially for basic family trusts)

- Full control over timing and tasks

DIY Cons:

- High risk of errors or missed obligations

- No legal protection if something goes wrong

- Still may need professional help for IRD filing or conveyancing

FAQ about Costs of Winding Up a Trust

How long does it take to wind up a trust?

Typically, it takes between 3 to 12 months. It depends on how quickly assets can be transferred and whether tax issues or disputes delay the process.

Are trustee fees tax-deductible during wind-up?

In some cases, yes. If the fees are considered part of trust administration, they may be deductible. Your accountant can confirm based on your situation.

Do beneficiaries pay taxes on distributions?

Possibly. If the trust made income before closing, beneficiaries might owe tax on their share—especially if it’s a discretionary trust.

Can a trust be closed with outstanding debts?

No. All debts must be paid before any final distributions. Creditors have priority over beneficiaries.

Who can help with winding up a trust?

Legal professionals, chartered accountants, and trust companies are the go-to experts. Or you can start by reaching out to BH Accounting to be referred to someone trustworthy.

What You Should Remember About the Costs of Winding Up a Trust

Winding up a trust isn’t free, but knowing what to expect makes a world of difference. From legal and accounting fees to trustee exit costs and asset transfer expenses, the total costs of winding up a Trust can add up quickly—especially if you’re unprepared.

The key? Get informed, plan ahead, and don’t be afraid to ask for help. Whether you’re handling a family trust dissolution or closing a more complex structure, there are ways to keep it simple and cost-effective.

💡 Need a second opinion or a trusted referral? BH Accounting is here to guide you to the right experts—because peace of mind is worth every cent.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.