So, what does FBT mean exactly? If you’ve been scratching your head over that three-letter acronym, you’re not alone. Fringe Benefit Tax (FBT) often catches business owners off guard—especially when it’s time to account for non-cash employee benefits like company cars, gym memberships, or discounted goods.

The good news? It’s not as complicated as it sounds. But it is something you need to get right. Whether you’re a new employer or just reviewing your current systems, understanding FBT in New Zealand is key to staying compliant and avoiding unexpected costs.

In this article, we’ll walk you through everything you need to know—from what FBT is, to how it’s calculated, what’s taxable, and how to file correctly. You’ll also find tips for planning smarter and avoiding common mistakes that cost businesses time and money. Ready to make sense of it all? Let’s break it down.

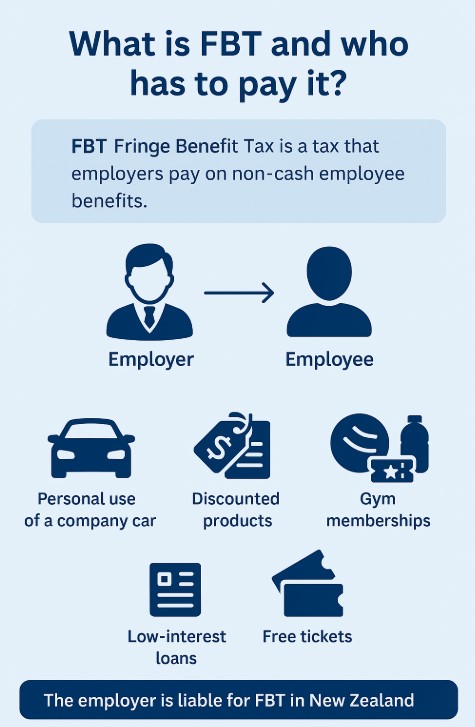

What is FBT and who has to pay it?

Let’s start at the beginning: FBT, or Fringe Benefit Tax, is a tax employers pay when they give their employees perks beyond their regular salary or wages. These are usually non-cash employee benefits, like the personal use of a company car or discounted products.

The key point? It’s the employer, not the employee, who’s responsible for paying FBT. And in New Zealand, if you’re offering extras to staff—even if they’re shareholders—you might be on the hook for it.

Common fringe benefits subject to FBT in New Zealand

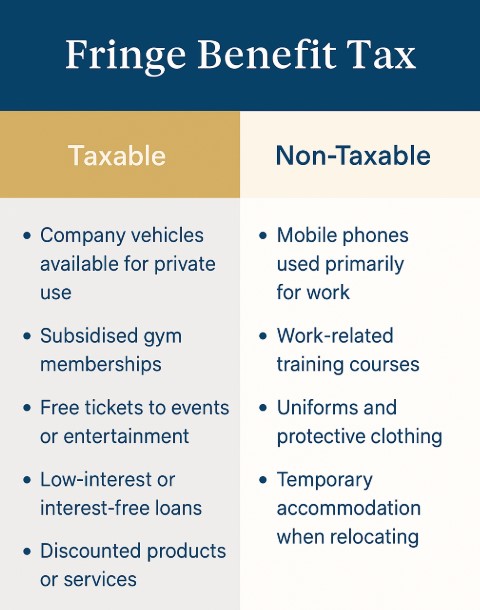

Not all perks are created equal. Some are tax-free, but many fall under the FBT rules. Here’s a breakdown to help you spot the difference.

Common taxable benefits:

- Company vehicles available for private use

- Subsidised gym memberships

- Free tickets to events or entertainment

- Low-interest or interest-free loans

- Discounted products or services

Benefits that may be exempt from FBT:

- Mobile phones used primarily for work

- Work-related training courses

- Uniforms and protective clothing

- Temporary accommodation when relocating

These rules apply whether you’re running a large operation or a small business with just a few employees. If you’re providing value outside of salary—especially to shareholder-employees—you need to check if FBT applies.

How is FBT calculated in NZ?

Now for the maths. Calculating Fringe Benefit Tax isn’t complicated—but you do need to pick the right method and rate based on your situation. In New Zealand, there are three main methods: the single rate, alternate rate, and attribution method.

Table – FBT calculation methods:

| Method | When to Use | 2025 FBT Rate |

|---|---|---|

| Single rate | Most small businesses | 63.93% |

| Alternate rate | If tracking individual employee perks | Varies by income |

| Attribution method | For close FBT/payroll alignment | Requires detailed records |

Most small businesses stick to the single rate to keep things simple, especially if they provide the same benefit across the board (like a company vehicle). But if you’re managing multiple benefits or tracking them per staff member, the alternate rate could save you money—if you do the work.

When and how to file FBT returns

So, you’ve confirmed FBT applies to your business—now what? Time to file. The IRD requires you to file quarterly or annually, depending on how often you provide benefits and your business setup.

Steps to file your FBT return:

- Identify which fringe benefits you provided

- Choose your calculation method

- Complete form IR420 (or file through myIR)

- Pay the calculated FBT by the due date

- Keep records to support your calculations

FBT due dates on IRD’s website

If you’re new to filing or unsure about the best method for your business, this might be a good time to consider hiring a professional. Here’s a quick guide on how much a personal tax accountant costs.

Common FBT mistakes and how to avoid them

Even experienced employers get caught out with FBT. One oversight can lead to penalties, interest, or worse—an IRD audit.

Bullet list – Common FBT mistakes:

- Forgetting to declare private use of company vehicles

- Not distinguishing between work tools and personal perks

- Applying the wrong FBT calculation method

- Missing filing deadlines

- Providing benefits to shareholders and failing to report them

And here’s the catch: some benefits don’t look like “benefits” on the surface—like discounted services for a director or shareholder. But to the IRD, they absolutely might qualify.

Learn how this ties into your shareholder current account and how benefits can affect your balance.

Bonus for understanding FBT: Tax planning tips

Once you’ve wrapped your head around FBT, you can use that knowledge to make smarter decisions. Here are some tips to reduce your liability—or at least plan for it better.

FBT tax planning tips:

- Use exempt benefits where possible (like work phones or training)

- Avoid company cars unless absolutely necessary

- Bundle your FBT process with GST or payroll to streamline admin

- Track benefits regularly—don’t wait until the end of the quarter

- Talk to an accountant about the best calculation method for your business

IMAGE: Visual of an FBT planning calendar with reminders and due dates.

Want help? Here’s what you need to know about the cost of hiring a tax advisor.

FBT doesn’t have to be complicated

So, what does FBT mean in practice? It means understanding the value of the perks you give your team—and making sure you’re handling them properly. Whether it’s a company car, subsidised gym membership, or a discount on your own services, if it’s a benefit, there’s a good chance Fringe Benefit Tax applies.

By now, you should have a solid grasp of how FBT in New Zealand works: what it covers, how it’s calculated, when it’s due, and what to watch out for. It might seem like just another layer of admin, but staying on top of your employer tax obligations can save you from unexpected penalties and help you structure your business more efficiently.

Need help figuring out if FBT applies to your business or how to handle it correctly? At BH Accounting, we connect you with the right professionals—so you can stop guessing and start planning with confidence.

FAQ about FBT in New Zealand

What does FBT stand for?

FBT stands for Fringe Benefit Tax—a tax employers pay on non-salary benefits provided to staff.

Do all companies have to pay FBT?

Not necessarily. Only if you provide taxable benefits like cars, tickets, or goods for personal use.

How much is FBT in NZ?

The standard FBT rate in 2025 is 63.93%, but it can vary if you use alternate methods.

Are shareholders included in FBT rules?

Yes. If shareholder-employees receive fringe benefits, you may be required to declare and pay FBT.

Can I avoid paying FBT?

You can’t avoid it altogether, but you can reduce your exposure by offering exempt benefits and using smart structuring.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.