So, what is terminal tax exactly and why does it feel like a surprise bill every April?

If you’re self-employed, run a small business, or file your own tax return in New Zealand, chances are you’ve come across the term but never quite understood what it means. Simply put, terminal tax is the final income tax payment you make after the end of the financial year. It’s what you owe after your provisional tax has been accounted for—if you didn’t pay enough in advance, this is where the IRD catches up with you.

In this guide, we’ll break down terminal tax NZ into plain English: what it is, when it’s due, how it’s calculated, and how to avoid nasty penalties. You’ll also find a handy comparison with provisional tax, tips for managing your cash flow, and answers to the most common questions people ask when this bill arrives.

Let’s clear up the confusion because when it comes to tax, clarity is money.

What is terminal tax in New Zealand?

Let’s keep it simple: terminal tax is the final amount of income tax you owe the IRD after your tax return has been filed. It’s based on your actual income for the year, minus any tax you’ve already paid and usually through provisional tax.

If you underpaid during the year (or didn’t pay anything at all), terminal tax makes up the shortfall. This applies to self-employed individuals, freelancers, small business owners, and anyone who earns income not taxed at source.

When is terminal tax due?

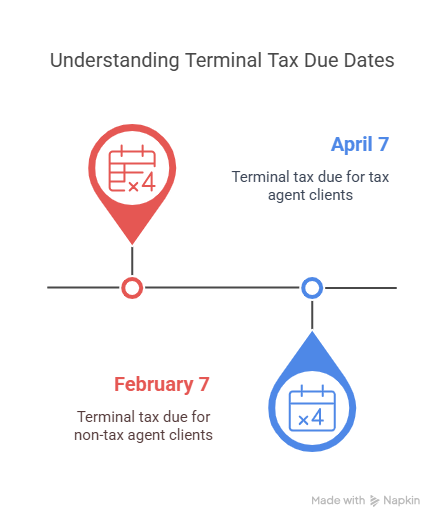

Terminal tax isn’t due at the same time for everyone—it depends on whether you have a tax agent or not. The IRD sets two main dates each year.

Terminal tax due dates:

- 7 February – if you don’t have a tax agent

- 7 April – if you do have a tax agent

- Due dates may be extended if they fall on weekends or public holidays

Your tax return must be filed first so IRD can calculate your final bill. Once that’s done, terminal tax is the payment that balances the books.

How is terminal tax calculated?

Your terminal tax is the difference between what you owe for the tax year and what you’ve already paid. If your provisional tax didn’t cover your total tax bill, terminal tax picks up the slack.

Let’s look at an example.

Sample terminal tax calculation:

| Tax Year | Taxable Income | Tax Owed | Provisional Tax Paid | Terminal Tax Due |

|---|---|---|---|---|

| 2023 | $95,000 | $22,420 | $16,000 | $6,420 |

This means you’d need to pay $6,420 by the terminal tax deadline.

IMAGE: Example IRD tax summary showing terminal tax due section

External link: Use IRD’s income tax calculator here

Terminal tax vs provisional tax: What’s the difference?

This one causes a lot of confusion. So let’s break it down.

Provisional tax:

- Paid during the tax year (in 1–3 instalments)

- Based on estimated income

- Helps spread your tax bill

Terminal tax:

- Paid after the tax year ends

- Based on actual income

- Makes up any shortfall (or is refunded if you overpaid)

If your income was higher than expected, your provisional tax won’t be enough—and that’s when terminal tax kicks in.

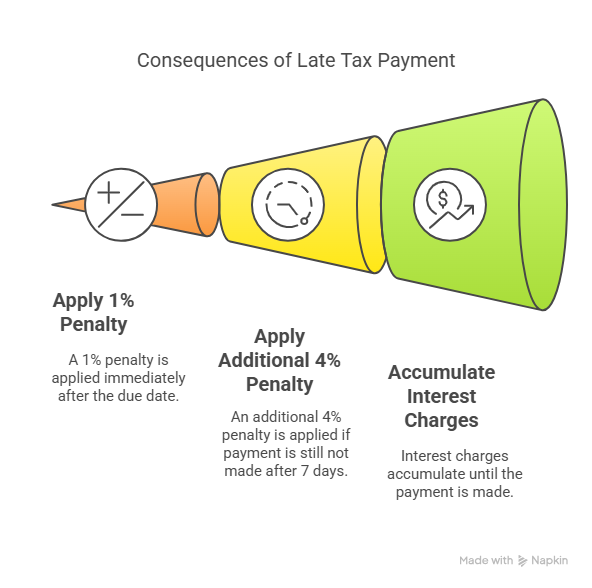

What happens if you miss your terminal tax payment?

Let’s be blunt: IRD doesn’t mess around with late payments. If you miss your terminal tax due date, penalties and interest start building immediately.

Here’s what could happen:

- A 1% late payment penalty the day after it’s due

- An additional 4% if still unpaid after 7 days

- Interest charges (currently 10.39%) until it’s paid

That $6,000 bill can quickly become $6,600 if you’re not careful.

The good news? You can contact IRD for a payment arrangement if you’re struggling—but don’t ignore the notice.

External link: IRD’s late payment penalties info

Bonus: Tips to manage your terminal tax like a pro

Terminal tax shouldn’t be a surprise. Here are some easy ways to stay on top of it:

Smart terminal tax tips:

- Set aside 30% of each invoice for taxes during the year

- Use cloud accounting tools like Xero or MYOB to track income & estimates

- Ask your accountant to review your year-end estimate early

- Mark key tax dates in your calendar and set reminders

If you need help with your tax affairs, check it out our article: How much does a personal tax accountant cost? for more information.

Conclusion: Terminal tax made simple

If you’ve ever opened a surprise tax bill and wondered what is terminal tax and why am I paying this, now you know.

Terminal tax is simply the final balancing payment of your income tax after your return is filed. It catches any shortfall from your provisional tax and ensures the IRD gets what it’s owed. While it may feel like a sting, it’s entirely manageable—if you plan ahead.

Know your due dates. Use tools to track your income. Talk to a tax advisor if you’re unsure (they’re worth it). And if you need help, BH Accounting is here to connect you with experienced professionals who can take the stress off your shoulders.

Because tax doesn’t have to be scary—it just needs to be understood.

FAQ about terminal tax in NZ

Is terminal tax the same as income tax?

Not quite. Terminal tax is the final payment of income tax—what you still owe after filing your return.

Do I need to pay terminal tax if I’ve already paid provisional tax?

Only if you underpaid. If your provisional tax covered your full bill, you may not owe anything further.

Can terminal tax be refunded?

Yes. If you’ve overpaid your tax for the year, IRD may refund it or apply it to your next tax year.

Can I pay terminal tax in instalments?

Yes. You can set up a payment plan with IRD, but it’s best to contact them before the due date.

How can I estimate my terminal tax?

Use the IRD calculator or work with an accountant to avoid nasty surprises.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.