Thinking about getting GST registered but not sure where to start?

You’re in the right place.

In New Zealand, registering for GST (Goods and Services Tax) isn’t just a box to tick — it can change the way you run your business. Whether you’re a freelancer, a sole trader, or running a growing company, knowing when and how to register is crucial if you want to stay compliant and avoid unnecessary headaches.

The good news?

Getting GST registered is free, straightforward, and faster than you might think — once you know the steps.

In this guide, we’ll break down:

- Who needs to register for GST

- How much income triggers mandatory registration

- The exact steps to register

- What happens after you’re registered

Let’s dive in and get you sorted — no jargon, no fluff, just practical advice you can actually use.

What is GST and who needs to register

Before we jump into the registration steps, let’s quickly cover the basics.

Quick definition of GST

GST, or Goods and Services Tax, is a 15% tax added to most goods and services sold in New Zealand.

When you’re GST registered, you collect this tax on behalf of the government every time you sell something, and in return, you can claim GST back on your business expenses.

Think of it as helping the government while keeping your business expenses a little lighter.

Pretty straightforward, right?

When GST registration is mandatory

Here’s the big rule:

You must register for GST if your turnover (your total sales, not profit) is more than $60,000 in the last 12 months or is expected to go over $60,000 in the next 12 months.

A few common triggers:

- You’re a freelancer who’s picking up bigger contracts.

- You’ve opened a physical or online store.

- You’re running a service business (like landscaping, consulting, or design) and your bookings are booming.

There are also some special cases where you must register even if you haven’t hit $60,000 yet, like if you charge GST-inclusive prices or work in certain industries (for example, taxi drivers must register regardless of income).

If you’re getting close to that $60,000 mark, it’s a good idea to start the registration process early. It’s better to be ahead of it than scrambling to catch up.

Voluntary GST registration

Now, here’s the twist:

Even if you don’t hit $60,000, you can choose to register voluntarily.

Why would you do that?

- You can claim GST back on your business expenses (think laptops, supplies, travel costs).

- It can make your business look more established and professional, especially if you work B2B.

Quick heads-up: Once you register voluntarily, you have to play by the rules, meaning regular GST filing even if your income is low. Certain supplies are also treated differently under GST rules. For example, some goods and services are zero-rated. Learn more about what zero-rated GST means here.

How much income before you must register for GST

In New Zealand, the magic number you need to remember is $60,000.

If your total turnover (not your profit) goes over $60,000 in the last 12 months, or you expect it will in the next 12 months, you must register for GST.

Turnover means your gross income, before you take off any expenses. So even if your actual profit is small, it’s your sales total that matters.

Here’s a quick summary:

| Situation | Do you need to register for GST? |

|---|---|

| Your turnover is less than $60,000 and not expected to go over | No, registration is optional |

| Your turnover has exceeded $60,000 in the last 12 months | Yes, you must register |

| You expect your turnover will exceed $60,000 in the next 12 months | Yes, you must register |

It’s all about expectations too . You don’t have to wait until you actually hit $60,000. If you sign a new contract or land a client that clearly pushes your income past the threshold, you should register straight away.

Tip: It’s smart to monitor your monthly income, especially if your business is growing faster than expected. Staying on top of it avoids nasty surprises with the IRD later!

How much does it cost to become GST registered in NZ

Good news! Registering for GST is completely free.

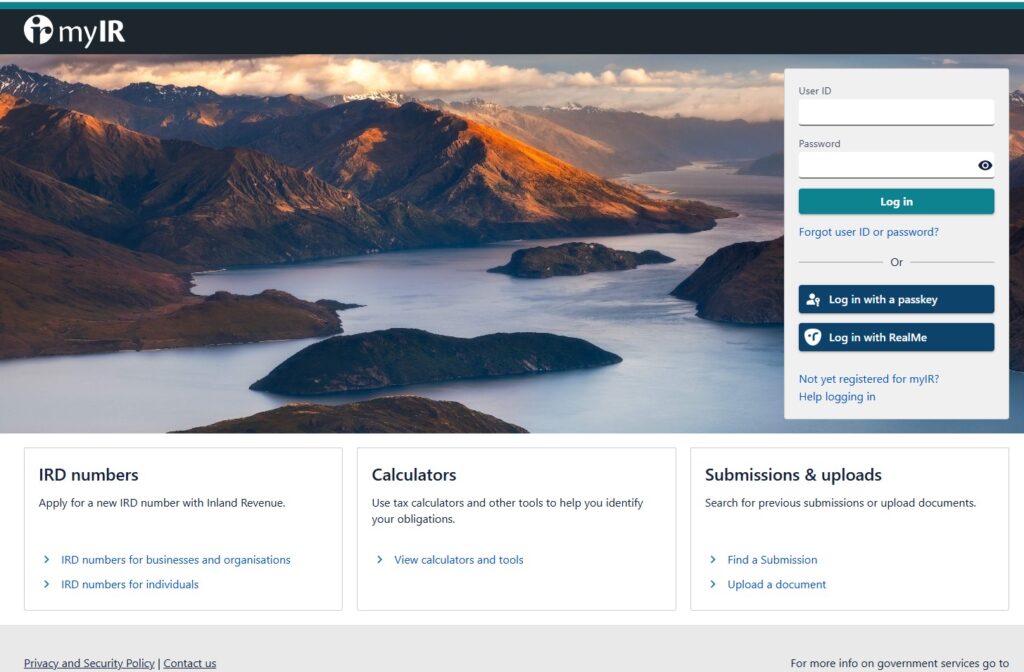

There’s no fee when you register through the IRD’s online portal (MyIR). Whether you’re a sole trader, a company, or a partnership, it costs $0 to get GST registered. It’s one less thing to stress about when you’re setting up or growing your business!

However, there can be some indirect costs to keep in mind:

- You might need to pay for accounting software (like Xero, QuickBooks or MYOB) to help you manage your GST returns.

- If you prefer not to handle GST yourself, you might also pay an accountant to take care of it for you.

How to register for GST step-by-step

Getting GST registered sounds complicated, but it’s actually pretty simple once you know what to expect.

Here’s how to do it without getting lost along the way.

What you need before you start

Before you jump into the registration, make sure you have these ready:

- Your IRD number (personal or business, depending on your setup)

- Your business trading name

- Your business industry or activity type

- Your New Zealand bank account details

- An idea of your accounting basis (payments, invoice, or hybrid method)

Don’t worry — Not sure whether to pick payment basis or invoice basis? Here’s a full guide to help you choose the right GST method for your business. You can always ask your accountant too.

How to register online (MyIR)

Here’s the easy path:

- Log in to your MyIR account at ird.govt.nz

- Click on “I want to…” and choose “Register for new tax accounts”

- Select Goods and Services Tax (GST) from the options

- Fill in the required details (like your business start date and expected turnover)

- Choose your filing frequency (monthly, two-monthly, or six-monthly)

- Submit your application

After that, IRD will usually confirm your GST registration within a few days.

You’ll receive a GST number and you can start charging GST on your invoices from your effective registration date.

Can you register over the phone or by paper form?

Yes, but honestly — online is way faster and easier.

Phone and paper registrations are still possible if you can’t access MyIR, but expect longer processing times.

If you’re unsure or stuck during the online process, IRD’s helpdesk can guide you through it step-by-step too.

Can a sole trader be GST registered

Absolutely — sole traders can register for GST just like companies, partnerships, or trusts.

The process is exactly the same:

- If your turnover has passed $60,000 (or you expect it to), you must register.

- Even if you’re under the threshold, you can choose to register voluntarily.

You’ll need your personal IRD number when applying, and you’ll be responsible for filing GST returns yourself.

If you later switch to running your business through a company, you can update your GST registration details without too much hassle.

Example:

You’re a freelance graphic designer making $65,000 per year. Even though it’s just you — no employees, no company setup — you still need to register for GST because you crossed the threshold.

Being a sole trader doesn’t mean you’re off the hook when it comes to GST!

Is it worth being GST registered

Whether registering for GST is “worth it” depends on your situation.

For some businesses, it’s a no-brainer. For others, it might create extra admin without much benefit.

Here’s a quick breakdown:

When being GST registered is a good idea

- You mostly sell to businesses: Other businesses are usually GST registered too, so they can claim back the GST you charge. Being GST registered can make you look more professional.

- You have a lot of expenses: You can claim back GST on your business costs — things like laptops, equipment, software, and travel expenses. This can save you money over time.

- You’re growing fast: If you’re close to the $60,000 threshold, registering early avoids rushing later. It also shows you’re serious about your business.

When it might not be worth it (yet)

- You sell mainly to the public (B2C): Your prices might need to go up by 15% once you add GST, making you less competitive if your customers aren’t GST registered themselves.

- You’re just starting out with low turnover: If you’re earning a few thousand dollars a year as a side hustle, registering voluntarily might create more admin than it’s worth — especially if you don’t have many expenses to claim back.

If you’re unsure, you can always start without GST and register later when it makes sense.

But once you register, you have to file GST returns regularly — even if you have no sales for a period. No going back!

What happens after you become GST registered

Once you’re GST registered, there are a few new habits you’ll need to get into.

Nothing too scary — but you’ll want to stay organised to avoid stress later on.

Filing GST returns

You’ll need to file regular GST returns with the IRD.

When you register, you choose how often you want to file: monthly, two-monthly (the most common for small businesses), or six-monthly if your turnover stays under $500,000.

In each return, you simply report two things: the GST you collected on your sales, and the GST you paid on your business expenses.

The difference between those two amounts is either what you pay to the IRD or what you claim back as a refund.

It’s important to set calendar reminders and stay on top of your filing dates. Missing a GST deadline doesn’t just cause stress — it can also lead to penalties and extra interest charges.

Keeping good records

Once you’re registered, you’re expected to keep tidy, accurate records.

This means keeping copies of your tax invoices for both sales and purchases, receipts for expenses, and proof of any adjustments like credit notes or bad debts.

The IRD requires you to keep these records for at least seven years.

Good record-keeping makes GST returns faster and less stressful, and it massively reduces the hassle if you’re ever audited.

Common mistakes to avoid

Newly registered businesses often trip up in a few places.

Missing filing deadlines is a big one, and the IRD charges late fees if you’re not on time.

Another common mistake is claiming GST on non-business expenses, like private purchases, which can trigger penalties if you’re audited.

Some businesses also forget to charge GST correctly, especially when selling to other businesses, or they register for GST and then forget they have ongoing filing obligations, even if they have no sales for a period.

A little bit of planning up front saves a lot of trouble later.

Using accounting software, setting filing reminders, and getting advice from a tax professional can make the whole process smoother.

Mixing up GST with other tax types like Fringe Benefit Tax (FBT) can also cause trouble. Check out our guide on the key differences between FBT and GST.

Final thoughts

Getting GST registered might sound intimidating at first, but once you know the rules, it’s actually a simple and smart move for many businesses.

Whether you’re just hitting the $60,000 threshold or planning ahead, understanding when and how to register can save you a lot of stress later on.

Remember: registering for GST is free, straightforward, and totally doable online in just a few steps.

Once you’re set up, staying organised with your returns and records will make life much easier.

Still feeling unsure about your situation?

You don’t have to figure it out alone. BH Accounting is here to help connect you with trusted tax professionals who understand the New Zealand system inside and out.

Whether you’re a freelancer, a small business owner, or somewhere in between, getting the right advice can make a big difference.

Sort it out now, and your future self will thank you.

FAQs about GST registration in NZ

How much does it cost to be GST registered in New Zealand?

Registering for GST through the IRD is completely free.

There’s no application fee, no hidden charges, and no ongoing registration costs.

However, once registered, you might want to invest in accounting software or professional help to manage your GST returns.

How can I get GST registered?

You can register for GST easily online through your MyIR account at ird.govt.nz.

Once logged in, you simply select “Register for new tax accounts,” choose GST, fill in your business details, and submit your application.

It usually takes just a few days to get confirmed.

Is it worth being GST registered?

It depends on your situation.

If you have a lot of business expenses or mainly work with other GST-registered businesses, being GST registered can save you money and make your business look more professional.

If you mainly sell to the public and your turnover is low, registering voluntarily might create extra admin without big benefits.

The key is weighing up the advantages against the extra filing responsibilities.

How much income before you must be GST registered?

You must register for GST if your turnover is over $60,000 in the last 12 months, or if you expect it will be over $60,000 in the next 12 months.

Turnover means total sales before expenses, not your profit.

If you’re getting close to that amount, it’s smart to start the registration process early.

Can a sole trader be GST registered?

Yes, sole traders can and often do register for GST.

The process is the same as for any other type of business.

As a sole trader, you’ll use your personal IRD number when registering, and you’ll need to handle your own GST returns unless you hire someone to do it for you.

What is the minimum income to pay GST?

There’s no “minimum income” where you automatically pay GST.

Instead, the $60,000 turnover threshold determines when you must register.

If your income stays under $60,000, you don’t have to register unless you choose to do so voluntarily.

Once you’re registered, you charge and collect GST on all taxable sales, no matter how small your income.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.