How to calculate diminishing value depreciation—it sounds complex, but it’s actually pretty straightforward once you break it down. Whether you’re running a business, managing a rental property, or just trying to get your accounting right, understanding how this method works can save you both time and tax headaches.

The diminishing value (DV) method is popular because it lets you claim higher depreciation in the early years of an asset’s life, reflecting the reality that many assets lose value faster at the start. But how do you actually calculate it?

In this guide, I’ll walk you through the diminishing value depreciation formula, a simple step-by-step calculation method, and a real-world example. By the end, you’ll know exactly how to work it out—and when to use it.

Let’s get started.

What is diminishing value depreciation?

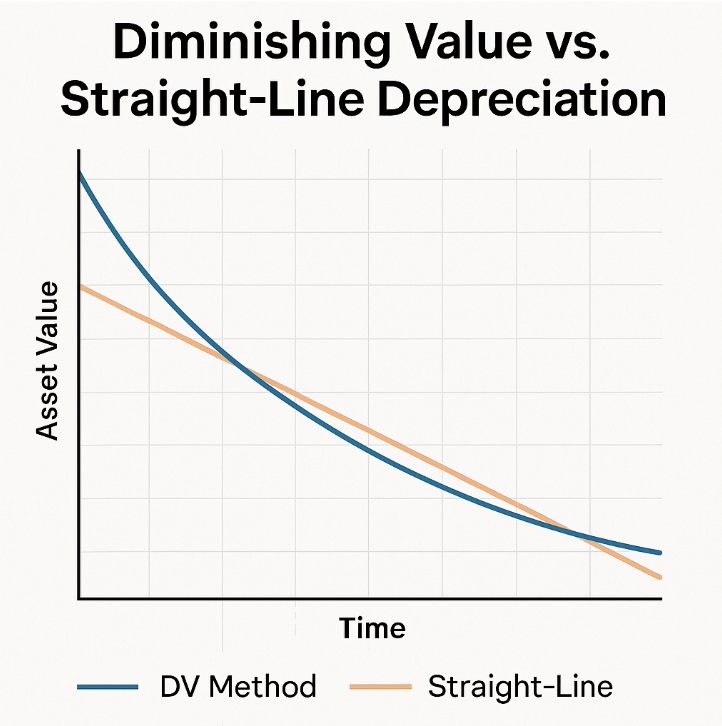

Diminishing value depreciation (or DV method depreciation) is an accounting method that lets you claim higher depreciation in the early years of an asset’s life. Unlike straight-line depreciation, where you deduct the same amount each year, diminishing value applies a percentage to the asset’s current book value—so the amount you claim decreases over time.

This method is commonly used for business assets that lose value quickly, such as:

- Vehicles

- Machinery

- Technology and equipment

In fact, if you’re claiming a vehicle tax deduction (learn more about vehicle tax deductions), chances are you’ll be using the diminishing value method.

The diminishing value depreciation formula

The formula for diminishing value depreciation is simple:

Depreciation = Adjusted Tax Value × Depreciation Rate

Here’s what each term means:

- Adjusted Tax Value: The asset’s cost minus any depreciation already claimed.

- Depreciation Rate: The percentage rate set by the IRD (or ATO if you’re in Australia).

This means your depreciation claim changes every year as the asset’s value decreases.

Pro tip: If your asset is a low-value asset (check the NZ low-value asset threshold), you might be able to expense the entire cost upfront instead of using depreciation.

Step-by-step: How to calculate diminishing value depreciation

Let’s walk through the process.

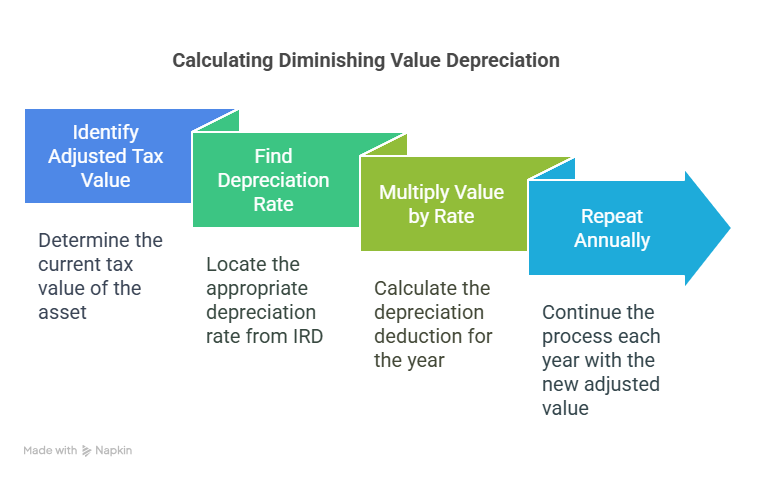

Steps to calculate diminishing value depreciation:

- Identify the adjusted tax value of your asset.

- Find the correct depreciation rate using the IRD’s published rates.

- Multiply the adjusted value by the depreciation rate to get your deduction for the year.

- Repeat each year using the new adjusted value after deducting the previous depreciation.

Real-world example: Diminishing value depreciation calculation

Let’s say you purchase equipment for $10,000 and the IRD sets the depreciation rate at 20%.

| Year | Adjusted Value | Depreciation | New Value |

|---|---|---|---|

| 1 | $10,000 | $2,000 | $8,000 |

| 2 | $8,000 | $1,600 | $6,400 |

| 3 | $6,400 | $1,280 | $5,120 |

As you can see, the depreciation expense gets smaller each year because the percentage applies to a lower value over time.

When to use diminishing value vs straight-line depreciation

So, when should you use diminishing value depreciation instead of straight-line?

Best for DV method:

- Assets that lose value quickly (e.g., vehicles, electronics, some machinery).

- When you want to claim higher deductions in the early years.

Best for straight-line:

- Assets with a consistent lifespan and use (e.g., buildings, large furniture).

- When steady, predictable deductions are preferred.

Many business owners choose DV for faster tax relief, especially when cash flow is tight in the early years of asset ownership.

If you’re unsure which method suits your situation, don’t guess—talk to us and we’ll guide you through the best option for your business.

Bonus: Tools to simplify your depreciation calculations

Don’t want to crunch the numbers by hand every year? Here are some helpful resources:

- IRD Depreciation Rate Finder

- Free online depreciation calculators

- Accounting software like Xero, MYOB, or QuickBooks

If your accountant uses one of these tools, it’s even easier to stay on track and avoid errors.

Conclusion

Diminishing value depreciation can be a powerful way to claim higher deductions in the early years of an asset’s life—especially for assets like vehicles and equipment that lose value quickly.

By understanding the simple formula, following the step-by-step method, and using the right depreciation rate, you can maximise your tax claims and manage your business finances more effectively.

And if you want tailored advice? Contact us—we can help you work out the best depreciation method for your situation.

FAQ about how to calculate diminishing value depreciation

What is the formula for diminishing value depreciation?

Depreciation = Adjusted Tax Value × Depreciation Rate.

Can I choose between diminishing value and straight-line depreciation?

Yes, in most cases. Some assets may have default methods required by tax authorities.

How do I find the right depreciation rate?

Use the IRD’s Depreciation Rate Finder or consult your accountant.

Does diminishing value depreciation reduce over time?

Yes. Since it applies to a decreasing value each year, the deduction amount gets smaller annually.