What is GST inclusive and exclusive? If you run a business—or even if you’re just trying to understand a quote—you’ve probably seen both terms. But what do they actually mean, and why does it matter?

Put simply, GST inclusive means the price already includes GST (Goods and Services Tax). GST exclusive means GST needs to be added on top of the listed price. Knowing the difference is crucial when quoting, invoicing, or buying and selling goods and services in New Zealand.

In this guide, I’ll explain what both terms mean, show you how to calculate GST inclusive and exclusive prices, and give you practical examples so you can confidently handle GST in your business or personal finances.

Let’s break it down.

What does GST inclusive mean?

GST inclusive means the price already includes GST (Goods and Services Tax). This is the total price a buyer will pay—no extra tax added at the checkout.

In New Zealand, it’s a legal requirement to display GST inclusive prices to consumers. You’ll see inclusive pricing in most retail stores, supermarkets, trades invoices for homeowners, and hospitality. The official GST rules in New Zealand explain when and how GST-inclusive pricing must be displayed for consumers.

Example:

If an item is listed as $115 GST inclusive, it means $100 + $15 GST.

What does GST exclusive mean?

GST exclusive means the price does not include GST—GST must be added on top.

This pricing style is commonly used for business-to-business (B2B) transactions where both parties are GST registered.

Example:

If a service is quoted at $100 GST exclusive, the final price will be $115 ($100 + $15 GST).

If you’re running a business and not yet GST registered, check this guide on how to become GST registered. Understanding whether to quote inclusive or exclusive pricing often starts with registration status.

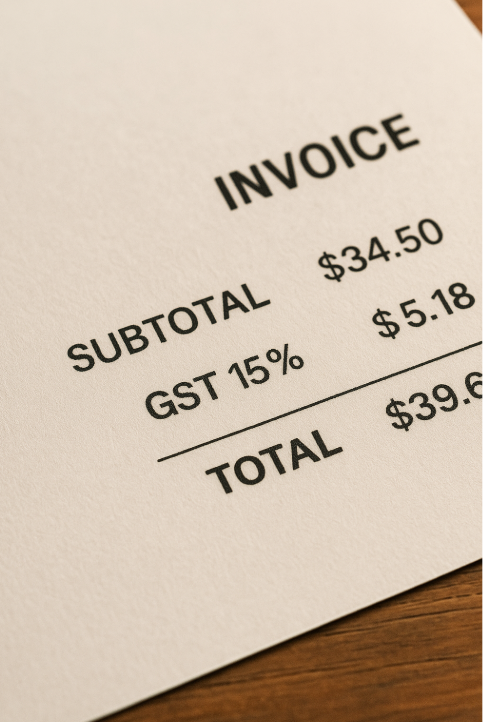

IMAGE: Invoice example showing GST exclusive pricing with GST added at the bottom.

Difference between GST inclusive and exclusive

Here’s a quick comparison:

| Feature | GST Inclusive | GST Exclusive |

|---|---|---|

| GST already included? | Yes | No |

| Common use | Retail, consumer sales | B2B quotes, trade invoices |

| Calculation method | Divide by 1.15 | Multiply by 1.15 |

Pro tip: Some services and goods in NZ might be zero-rated GST (meaning GST applies at 0%). If this affects your business, see this guide on zero-rated GST in NZ.

IMAGE: Comparison table highlighting the key differences.

How to calculate GST inclusive and exclusive prices

Here’s how to do the maths.

GST inclusive formula:

Exclusive price = Inclusive price ÷ 1.15

GST exclusive formula:

Inclusive price = Exclusive price × 1.15

Example 1 (Inclusive to Exclusive):

Price = $115 → $115 ÷ 1.15 = $100 exclusive

Example 2 (Exclusive to Inclusive):

Price = $100 → $100 × 1.15 = $115 inclusive

Tip: Whether you calculate GST using the payment basis or invoice basis affects when you report and pay GST—not how you calculate the price (learn more about payment basis or invoice basis).

When should you use GST inclusive vs exclusive pricing?

Use GST inclusive when:

- Selling directly to consumers (retail, hospitality, trades to homeowners)

- Displaying pricing to the public (NZ consumer law requires this)

Use GST exclusive when:

- Quoting or invoicing GST-registered businesses

- Preparing B2B estimates where GST is added separately

Also, remember that your GST filing frequency (such as the 2-monthly GST due dates) affects when GST is reported—not how you show prices.

Common mistakes to avoid

Here are the errors I see most often:

- Mixing up inclusive and exclusive pricing in quotes

- Forgetting to add GST to exclusive prices before invoicing

- Displaying exclusive prices to consumers (illegal unless specifically allowed)

- Using the wrong formula when calculating backwards

- Confusing zero-rated GST with GST exclusive pricing

If you buy or sell residential property, remember: you generally can’t claim GST unless certain rules apply. Here’s more on claiming GST on residential property expenses.

Conclusion

GST inclusive and exclusive pricing is simple once you know the difference. GST inclusive means the price already has GST built in (usually for consumers), while GST exclusive means GST needs to be added on top (common in B2B pricing).

Knowing how to calculate both—and when to use them—can save time, prevent errors, and keep your business compliant.

If you’re unsure how to apply GST to your pricing or invoicing, feel free to contact us for advice tailored to your business.

FAQ about what is GST inclusive and exclusive

What does GST inclusive mean?

It means the price already includes GST—no extra tax will be added at checkout.

What does GST exclusive mean?

It means the price does not include GST—you must add GST to find the total.

How do I calculate GST exclusive from an inclusive price?

Divide the inclusive price by 1.15 to get the exclusive amount.

Can I quote GST exclusive prices to consumers?

No. New Zealand consumer law requires GST-inclusive pricing for consumers.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.