What is IETC? If you’ve seen this term on your tax return or payslip and wondered what it means, you’re not alone. IETC stands for Independent Earner Tax Credit—a tax credit designed to give a bit of extra financial help to New Zealanders earning a modest income.

If you earn between $24,000 and $66,000, you may be entitled to up to $520 per year. The credit reduces gradually if you earn between $66,001 and $70,000, and it’s not available if your income is higher than that. It’s designed for people who don’t receive other government benefits like Working for Families or NZ Super.

In this guide, I’ll explain exactly what the Independent Earner Tax Credit (IETC) is, who can claim it, how much it’s worth, and how to make sure you’re getting the credit you’re entitled to.

Let’s break it down.

What does IETC mean?

IETC stands for Independent Earner Tax Credit. It’s a tax credit available to New Zealanders earning a modest income who don’t receive other tax credits or government benefits like Working for Families or NZ Superannuation.

The credit is designed to reduce the amount of tax you pay if you meet the income criteria. It’s either applied automatically by your employer or claimed when you file your tax return.

The IRD’s guide to the IETC provides the official details, but we’ll break it down in simple terms here.

Who can claim the IETC?

To be eligible for the IETC in 2025, you must:

- Be 15 or older

- Be a New Zealand tax resident

- Earn between $24,000 and $70,000 annually

- Not receive:

- Working for Families Tax Credits

- An income-tested benefit

- NZ Superannuation or Veteran’s Pension

- A student allowance or overseas equivalents

Note: If you receive any of these during the year, you can’t claim the IETC for those months.

If you’re self-employed or considering starting a business, understanding credits like this can help with income tax planning. You might also want to check out our guide on how to become GST registered if you’re setting up as a sole trader.

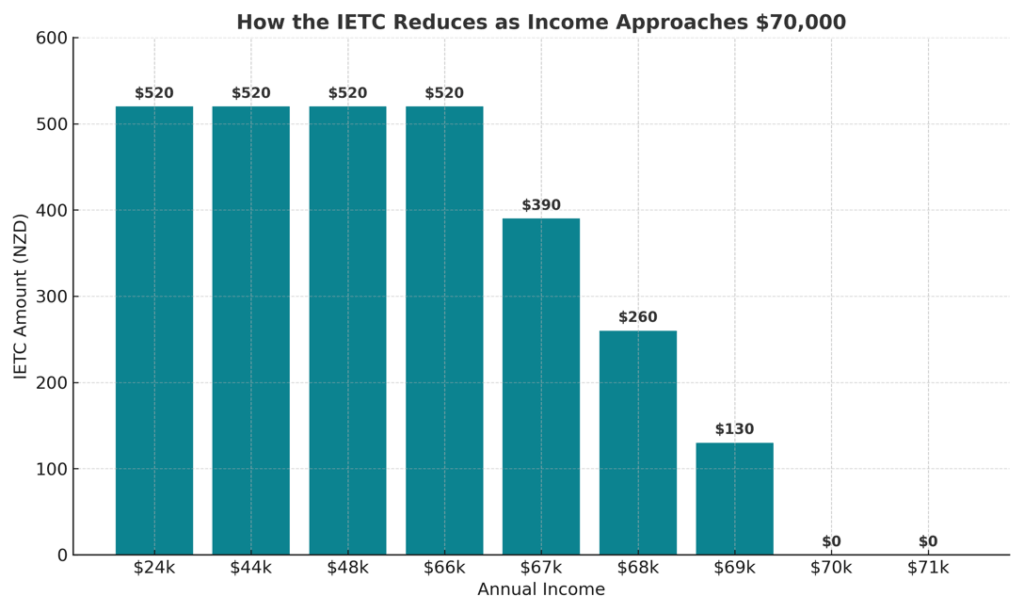

How much is the IETC worth?

The maximum you can receive is $520 per year ($10 per week).

- Full credit applies if your income is between $24,000 and $66,000.

- The credit reduces (phases out) for incomes between $66,001 and $70,000 at 13 cents for every dollar over $66,000.

- No credit is available if you earn over $70,000.

Example:

If you earn $65,000 → Full $520 credit

If you earn $68,000 → Reduced credit

If you earn $71,000 → No credit

How to claim the IETC

You can receive the IETC in two ways:

- Automatically applied through your employer’s payroll if you use the M or ME tax code.

- Claimed manually when filing your IR3 tax return if it wasn’t applied during the year.

If you’re not sure whether you should file an IR3, or if you need to claim the IETC manually, feel free to contact us—we can help make sure you get what you’re entitled to.

Tip: If you use the payment basis or invoice basis for GST (learn more here), it doesn’t affect your eligibility for IETC, but it’s important to stay consistent when reporting income.

What happens if you earn over the IETC threshold?

If your income ends up over $70,000 during the year:

- You won’t be entitled to the credit.

- If you already received some IETC payments, you may need to repay them when you file your tax return.

This often happens when people receive bonuses, extra income, or start earning more later in the year. It’s important to review your income regularly—especially if you work variable hours or have multiple income sources.

If you invest in rental property, keep in mind that rental income counts toward your total income. Also, if you claim GST on residential property expenses (more info here), it won’t directly affect IETC eligibility, but total taxable income will.

Common mistakes and tips

Avoid these common IETC mistakes:

- Using the wrong tax code (causes over or underpayment)

- Forgetting to update your income estimate if your earnings change

- Assuming the credit applies automatically when self-employed

- Failing to file an IR3 if you need to claim manually

- Not notifying IRD when starting or stopping other benefits

Pro tip: If you’re on the 2-monthly GST filing cycle (due dates here), use the same income figures across GST and income tax filings to avoid discrepancies.

Conclusion

The Independent Earner Tax Credit (IETC) is a valuable tax credit for New Zealanders earning between $24,000 and $70,000 who don’t receive other government support. It can reduce your annual tax bill by up to $520—but you need to meet the eligibility criteria and ensure it’s either applied automatically or claimed when you file your tax return.

If you’re unsure whether you qualify or how to claim it, get in touch with us. We’ll help you make sure you’re receiving every tax credit you’re entitled to.

FAQ about what is IETC

What is IETC?

IETC stands for Independent Earner Tax Credit—a credit of up to $520 for eligible New Zealanders earning between $24,000 and $70,000.

How much is the IETC worth?

Up to $520 per year, reducing gradually for incomes over $66,000.

Who qualifies for the IETC?

New Zealand tax residents aged 15+ earning between $24,000 and $70,000 who don’t receive other benefits or tax credits.

Can I get the IETC automatically?

Yes, if you use the correct tax code (M or ME). Otherwise, you can claim it when filing an IR3 tax return.

Do I have to repay IETC if I earn too much?

Possibly. If your income ends up over $70,000, some or all of the credit may need to be repaid.