Thinking about setting up a family trust in New Zealand? You’re not alone. Many Kiwis use trusts to protect assets, manage wealth, and plan for the future—but getting it right is crucial.

A family trust isn’t just for the wealthy. It can help safeguard property, ensure financial security for your loved ones, and even offer tax benefits (if structured correctly). But before you jump in, you need to understand how it works, the setup process, and the legal responsibilities.

This guide breaks it all down—who needs a family trust, how to set one up, and the mistakes to avoid. Let’s dive in. 🚀

What Is a Family Trust?

A family trust is a legal structure where assets are held and managed by trustees for the benefit of specific individuals, known as beneficiaries. Once assets are transferred into the trust, they are no longer personally owned by the settlor, providing a layer of protection and control over how they are used.

Why Do People Set Up a Family Trust?

People establish family trusts for various reasons, including:

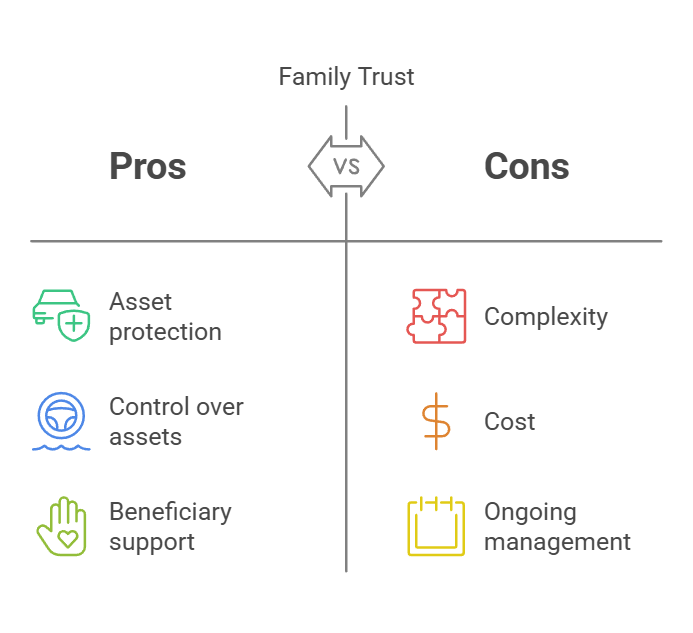

- ✅ Asset protection – Shields property and wealth from creditors or legal claims.

- ✅ Estate planning – Ensures assets are distributed according to your wishes.

- ✅ Tax planning – Can offer tax benefits (but don’t set up a trust just to dodge taxes!).

- ✅ Protecting family wealth – Helps preserve assets for future generations.

Who Should Consider a Family Trust?

A family trust may be beneficial for:

- ✔ Business owners – Protect assets from business risks.

- ✔ High-net-worth individuals – Manage investments and property more effectively.

- ✔ Families with vulnerable beneficiaries – Ensure financial stability for children, dependents, or those unable to manage money independently.

If you want long-term control over your assets, a family trust could be the right move—but it needs to be set up properly to be effective. 🚀

How Does a Family Trust Work?

A family trust operates as a separate legal entity that holds assets on behalf of its beneficiaries. Once assets are transferred into the trust, they are no longer personally owned by the settlor, and the trustees become responsible for managing them according to the trust deed.

The Key Players in a Family Trust

- ✔ Settlor – The person who creates the trust and transfers assets into it. Once assets are in the trust, they are no longer in the settlor’s personal name.

- ✔ Trustees – Individuals or institutions that manage the trust, make decisions about assets, and ensure they are handled according to the trust deed. Trustees have a legal obligation to act in the best interest of beneficiaries.

- ✔ Beneficiaries – The individuals or groups who benefit from the trust. This usually includes family members, children, or even charities. Beneficiaries can receive distributions based on the trust’s rules.

- ✔ Appointor (Optional) – A person who has the power to remove and appoint trustees. This role can be useful for ensuring control over the trust remains in the right hands.

How Assets Are Managed in a Trust

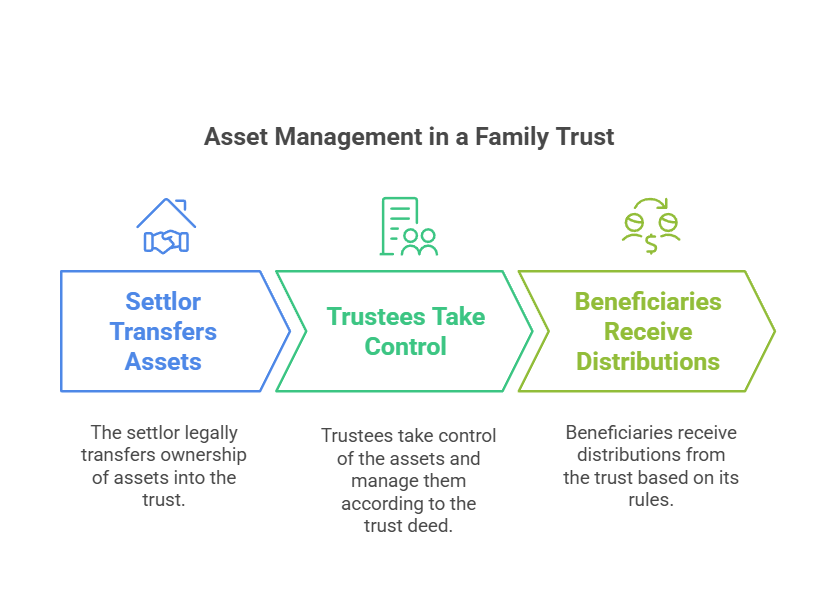

Once a family trust is set up, assets must be legally transferred into it. Here’s how it works:

1️⃣ The settlor transfers ownership of assets (e.g., property, cash, investments) into the trust.

2️⃣ The trustees take control of the assets and manage them according to the trust deed.

3️⃣ Beneficiaries receive distributions based on the trust’s rules—this could be in the form of financial support, education expenses, or property ownership.

A well-managed trust ensures assets are protected and used for the benefit of beneficiaries, while also complying with legal and tax requirements. 🚀

Step-by-Step Guide to Setting Up a Family Trust in New Zealand

Setting up a family trust isn’t just about signing a few papers and moving on. It’s a structured process that requires careful planning to make sure it works the way you want it to. Here’s how to do it, step by step.

Step 1: Decide If a Family Trust Is Right for You

Not everyone needs a trust. Before jumping in, ask yourself: What am I trying to protect? If you’re looking to secure assets, plan your estate, or support vulnerable family members, a trust could be a great option.

That said, trusts aren’t tax loopholes. If your main goal is to avoid tax, think again—the IRD has rules in place to prevent abuse. The best move? Talk to a lawyer or accountant before making any big decisions.

Step 2: Choose the Trustees

Your trustees are the guardians of your trust, so choosing the right people is crucial. You want reliable, financially responsible individuals who will act in the best interests of the beneficiaries—not just in their own interest.

You can choose:

✔ Family members – Keeps control within the family but could create conflicts.

✔ Independent trustees (lawyer/accountant) – Adds professionalism and neutrality.

✔ Corporate trustee (trust company or law firm) – More expensive but provides legal security.

Most experts recommend having at least one independent trustee to keep things fair and prevent legal challenges.

Step 3: Draft the Trust Deed

The trust deed is the rulebook for your trust—it decides how everything will be managed. This legal document should include:

- The name of the trust

- The settlor’s details (the person creating the trust)

- The trustees and their responsibilities

- The beneficiaries and how they receive assets

- Any special conditions (e.g., age limits on inheritance)

Because the trust deed is legally binding, it’s best to have a lawyer draft or review it to make sure everything is correct.

Step 4: Transfer Assets to the Trust

Once the trust is set up, you need to move assets into it—this could be property, cash, shares, or investments. This step is critical because a trust without assets is just an empty shell.

Some key points:

✔ Transferring assets means they are no longer in your personal name—they legally belong to the trust.

✔ If you transfer property, the title needs to be changed, and there may be legal fees involved.

✔ Be clear on which assets go into the trust and which stay in your name—not everything needs to be transferred.

Once the assets are in, the trust officially starts working to protect them.

Step 5: Open a Family Trust Bank Account

Why does a trust need its own bank account? Simple: to separate trust money from personal finances. Mixing the two can lead to legal trouble and make trust management a nightmare.

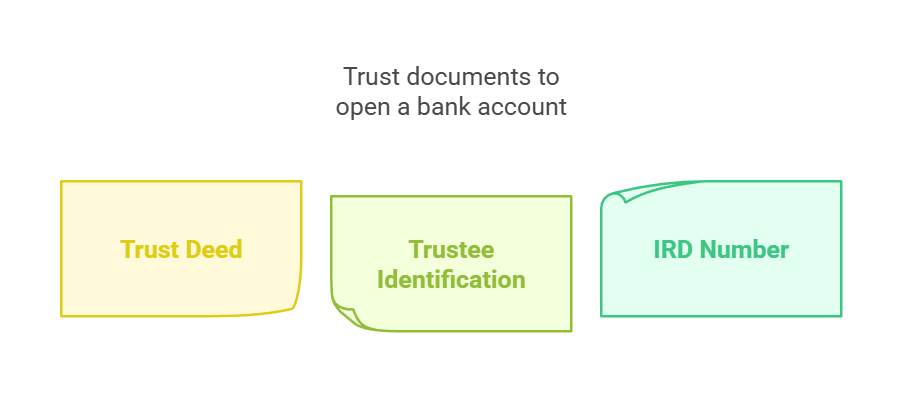

To open a trust bank account, you’ll need:

- The trust deed

- Identification for all trustees (passport, proof of address)

- An IRD number for the trust (if required)

Choose a bank that offers trust accounts, and compare fees—some banks charge extra for managing trust accounts.

Step 6: Register the Trust with the IRD (If Required)

Not all trusts need to register with the IRD, but if your trust will earn income (like rental income, dividends, or interest), it must have an IRD number and file annual tax returns.

Trustees are responsible for:

✔ Keeping tax records

✔ Filing tax returns on time

✔ Paying any trust-related tax obligations

If you’re unsure whether your trust needs to register, speak to an accountant—getting this wrong could lead to penalties.

Step 7: Manage and Maintain the Trust

A trust isn’t a “set and forget” arrangement—it requires ongoing management to stay valid. Trustees must:

- Hold annual trustee meetings and keep records of key decisions.

- Manage trust assets properly (investments, property, financial decisions).

- Keep financial records and file tax returns if required.

- Review the trust deed periodically to make sure it still aligns with your goals.

If a trust isn’t actively managed, it can lose its legal protections, and the IRD or courts could challenge its validity.

Setting up a family trust in New Zealand isn’t just for the wealthy—it’s a smart move for asset protection and estate planning. But a trust only works if it’s set up and managed correctly.

If done right, a trust can protect your assets for generations—but getting professional advice is the best way to make sure it works for you. 🚀

Costs and Legal Considerations

How Much Does It Cost to Set Up a Family Trust?

The total cost of establishing and maintaining a family trust depends on factors like legal complexity, the type of assets involved, and professional services required. Here’s a breakdown of common costs:

| Expense | Estimated Cost (NZD) | What It Covers |

|---|---|---|

| Legal fees | $2,000 – $5,000 | Drafting the trust deed, legal advice, and setup. |

| Accounting fees | $500 – $2,000 annually | Ongoing trust tax returns, compliance, and audits. |

| Trust administration | Varies (bank fees, trustee costs) | Managing trust accounts, annual reporting, and trustee meetings. |

💡 Pro Tip: Costs can be higher if your trust is complex (e.g., multiple properties, businesses, or international assets). To keep expenses in check, get clear pricing from your lawyer and accountant upfront.

Common Legal Requirements

New Zealand’s Trusts Act 2019 introduced stricter legal obligations for trustees, meaning trusts must now be actively managed and transparent.

✔ Trustees must act in good faith – They must make decisions in the best interest of beneficiaries.

✔ Beneficiaries have rights – Trustees must provide certain information to beneficiaries upon request.

✔ Annual reviews are important – If a trust is not properly managed, it can lose legal protections and be challenged in court.

Ignoring these rules can lead to legal issues, so it’s crucial to stay compliant and get professional guidance if needed.

FAQs: Setting Up a Family Trust in New Zealand

Thinking about setting up a family trust? Here are some common questions and answers to help you decide if it’s the right move for you.

1. Do I need a lawyer to set up a family trust?

Yes—While you can create a trust without a lawyer, it’s risky. A trust is a legal structure that needs to be set up correctly to be effective. A lawyer ensures your trust deed is legally sound and meets NZ regulations.

2. Can I change or cancel a family trust once it’s set up?

Yes, but it’s not always simple. Some trusts can be amended or dissolved, but once assets are transferred, getting them back can be complicated. Always think long-term before setting up a trust.

3. Does a family trust have to pay tax?

Yes. If the trust earns income (rental income, dividends, or interest), it must file tax returns and pay tax at 39%. However, distributions to beneficiaries may be taxed at lower personal rates.

4. Can I put my house into a family trust and still live in it?

Yes, but… Once your house is in the trust, you don’t legally own it anymore—the trustees do. This means you may need a ‘right to occupy’ agreement or pay rent to the trust. Talk to a legal expert before transferring property.

5. Can a family trust protect assets from divorce settlements?

Not always. While a trust can offer asset protection, NZ courts can override trusts if they believe assets were moved into a trust to avoid relationship property claims. If protecting assets from a divorce is a concern, get legal advice before setting up a trust. ✔