Can you really deduct life insurance premiums as a business expense? If you’ve ever stared at your tax forms wondering if you could claim that hefty premium as a write-off, you’re in the right place. I know—it sounds like one of those convoluted tax myths that only seems to make sense after a few too many cups of coffee. Trust me, I’ve been there.

Over the years, I’ve sifted through more tax jargon and confusing financial rules than I care to admit. And while I might not have all the textbook answers (or remember every single detail), I do know one thing: practical, real-life insights trump boring legalese any day. In this article, we’re going to cut through the mumbo-jumbo and break down exactly when, how, and if you can claim life insurance premiums as a business expense.

Grab your favorite mug of coffee (or tea, if that’s your jam) and let’s dive into the nitty-gritty—because understanding this could save you some serious cash (and maybe a few headaches come tax season).

Understanding Life Insurance Premiums

What Are Life Insurance Premiums?

Life insurance premiums are simply the regular payments you make to keep your life insurance policy active – your little safety net subscription. Whether you’re paying monthly, quarterly, or annually, these premiums ensure that your policy stays in force so your whānau (family) can be looked after if the unexpected happens. It’s all about peace of mind here in Aotearoa.

Types of Life Insurance Policies

Not every policy is the same, and the type you choose can even affect how your premiums are treated for tax purposes. Here’s the rundown in true Kiwi style:

- Term Life Insurance: Think of term life like renting protection for a set period – maybe 10, 20, or even 30 years. It’s generally cheaper because it’s pure coverage without any cash value. As a result, these premiums are usually not deductible as a business expense.

- Whole Life Insurance: Whole life is more of a long-haul mate – it covers you for life and builds up some cash value along the way. These policies tend to have higher premiums, and because they offer that dual benefit, the tax treatment can get a bit more complicated. Depending on your situation, parts of the premium might be viewed differently when it comes to tax.

Understanding which type of policy you’ve got is the first step in figuring out if and how your premiums could be claimed as a business expense. Let’s keep it simple and get down to the nitty-gritty, Kiwi style.

Business Expense Deductions: The Basics

What Qualifies as a Business Expense?

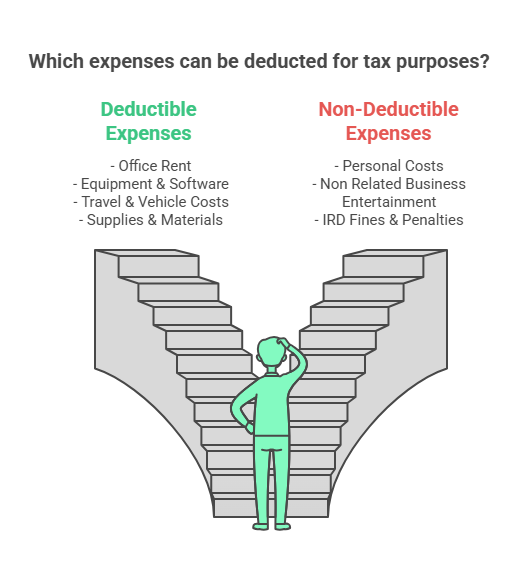

Alright, Kiwi entrepreneurs, let’s break this down. A business expense is any cost that you incur as part of running your business – but it’s got to be both ordinary and necessary. In plain English, it means the expense should be common in your line of work and directly related to earning your income. Whether it’s your office rent, internet bill, or that essential piece of software, if it helps keep your business ticking over, you might just be able to claim it. Just remember, keeping solid records is key – no one’s going to take your word for it without proof!

Overview of Deductible vs. Non-Deductible Expenses

Now, not every expense can be written off. Let’s lay out a few examples to clear up the confusion:

- Deductible Expenses:

- Office Rent & Utilities: If you’ve got a dedicated workspace, the rent and power bills are typically fair game.

- Equipment & Software: Computers, phones, and the tech that keeps you connected are usually deductible.

- Travel & Vehicle Costs: Business trips or using your car for work-related journeys can often be claimed, as long as you’ve got the receipts and a clear log.

- Supplies & Materials: Think office stationery, cleaning supplies, or any items you need to keep your business humming.

- Non-Deductible Expenses:

- Personal Costs: That cheeky coffee run or your home mortgage won’t cut it – personal expenses are off the list.

- Entertainment: While a client lunch might be partly deductible, a night out with mates is generally not.

- Fines & Penalties: Any fees you’ve racked up due to legal or regulatory issues? Not deductible, mate.

In short, if the expense is directly tied to generating income for your business and isn’t for personal enjoyment, you’re likely in safe territory. Always check with your trusted tax advisor to ensure you’re playing by the rules – and keeping your deductions above board.

Are Life Insurance Premiums Deductible as a Business Expense?

The General Rule

Alright, Kiwi business owners – here’s the straight-up truth. In most cases, life insurance premiums are seen as a personal expense rather than a business one. That means, generally speaking, you can’t claim them as a deduction on your business tax return. The reasoning is simple: these premiums are meant to provide personal security for you or your whānau, rather than directly generating income for your business. 🚫

Exceptions and Special Cases

Now, before you chuck your policy in the bin, there are a few scenarios where things might be a bit more nuanced:

- Collateral for Business Loans: If your life insurance policy is used as collateral to secure a business loan, a portion of the premiums might qualify as a business expense. The idea here is that the policy is serving a direct business purpose.

- Key Person Insurance: In cases where you’ve taken out a key person insurance policy to protect your business against the loss of a vital employee, some of the premiums could potentially be deductible. However, this comes with specific conditions, and you’ll need to keep detailed records to prove that the expense is truly tied to safeguarding your business.

Always have a yarn with your tax advisor to confirm whether your situation fits one of these exceptions – the devil’s in the details! 😉

Jurisdictional Considerations

Since we’re talking about New Zealand, our rules here are pretty clear-cut. But if you’re operating internationally or comparing notes with mates overseas, keep in mind that tax treatment can vary. In some countries, similar premiums might be treated differently, so always check the local tax laws if your business has a cross-border element. Here in Aotearoa, though, the general stance is that life insurance premiums remain on the personal side of the ledger unless they meet those specific exceptions mentioned above.

Cheers to keeping your books in order and knowing exactly where you stand with your deductions!

Tax Implications of Deducting Life Insurance Premiums

Impact on Companies Taxes

When you manage to squeeze in a deduction for life insurance premiums, it can lower your overall taxable income – meaning you might just end up paying a bit less in tax. However, remember that since these premiums are typically considered personal expenses, any deduction that slips through has to be spot on. In other words, if you’re lucky enough to qualify under one of those special cases, it’ll directly reduce your profit on paper, which then shrinks the amount of tax your business owes. Keep your calculations tight and your records tighter. 💼

Reporting Requirements

Alright, mate – if you’re claiming these deductions, the NZ tax authority (IRD) is going to expect you to back it up. This means you’ll need to maintain detailed records that show:

- How the policy is linked to your business: Whether it’s collateral for a loan or key person insurance, make it crystal clear.

- The breakdown of the premiums: Document which portion, if any, is being claimed as a business expense.

- Supporting evidence: Invoices, contracts, or any other relevant paperwork.

It’s all about transparency, so don’t cut corners – keeping tidy records now can save you heaps of hassle down the line.

Potential Pitfalls and IRD Audits

Here’s a heads-up: the IRD folks are pretty good at sniffing out deductions that don’t quite add up. Common mistakes include:

- Over-claiming: Trying to write off the entire premium when only a portion might qualify.

- Insufficient documentation: Failing to provide clear evidence that the expense is directly linked to your business operations.

- Misclassifying expenses: Confusing personal expenses for business ones can raise red flags faster than a dodgy invoice.

These pitfalls can trigger audits – and nobody wants a surprise visit from the tax man. So, play it safe, be honest, and double-check everything with your trusted tax advisor. Stay on the right side of the law and your books will thank you! 👍

Common Misconceptions About Life Insurance and Business Deductions

Myth vs. Reality

There’s a lot of chatter out there, and a common myth is that “all insurance premiums are non-deductible.” Well, let’s set the record straight: while it’s true that most life insurance premiums are considered personal expenses, there are those special situations where a slice of the premium might actually be deductible. It’s not a one-size-fits-all scenario – the specifics of your policy and how it’s used in your business really matter. So, don’t buy into the blanket statement without checking the fine print and your own circumstances. 🤔

Clarifying Policy Owner vs. Beneficiary Roles

Another frequent mix-up happens when people don’t distinguish between the policy owner and the beneficiary. Here’s the lowdown: if the business is the owner of the policy (or if the policy is structured in a way that benefits the business, like key person insurance), then parts of the premium might be seen as a business expense. On the flip side, if it’s purely a personal policy meant to protect your family, then it’s generally off-limits for a business deduction. Knowing who holds the reins on the policy can make all the difference when it comes to tax treatment. Keep that in mind, and you’ll avoid some common pitfalls. 👍

Quick Reference Table

| Aspect | Common Misconception | Reality |

|---|---|---|

| Insurance Premium Deductibility | All insurance premiums are non-deductible. | Most premiums are personal, but in specific cases – such as using a policy as collateral for a business loan or as key person insurance – parts may be deductible. |

| Policy Ownership | It doesn’t matter who owns the policy. | It does! If the business owns the policy or it’s structured to benefit the business, then deductions may apply. Otherwise, if it’s solely for personal protection, it won’t qualify. |

This table should help clear up any confusion at a glance. Cheers to keeping things simple and sorted!

Practical Tips for Business Owners

Reviewing and Selecting the Right Insurance Policy

Alright, Kiwi entrepreneurs – when it comes to insurance, there’s no one-size-fits-all. Here’s what to keep in mind:

- **Match the Policy to Your Business Needs:**Ensure the policy not only protects your personal interests but also aligns with your business goals. For example, if you’re considering key person insurance, check that it’s structured to support your business in times of crisis.

- **Consider Tax Implications:**Look for policies that might offer tax benefits or at least won’t complicate your tax situation. Always read the fine print and understand how the policy is treated for tax purposes.

- **Do Your Homework:**Compare different providers, ask questions, and see if they offer guidance on how their policies fit into your overall financial strategy. Remember, a well-chosen policy can be a valuable asset to your business.

Best Practices for Record-Keeping

When it comes to tax deductions, solid documentation is your best mate:

- **Keep Detailed Records:**Save invoices, contracts, and any correspondence related to your insurance policy. This isn’t just for tax time – it helps you keep a clear picture of your business expenses all year round.

- **Organize Your Files:**Whether you’re using digital tools or good old folders, make sure everything is neatly organized. This will save you time and headaches when it comes to filing or if you’re ever audited.

- **Regular Reviews:**Schedule a regular review of your documents and deductions. Staying on top of your paperwork means you’re less likely to miss out on any legitimate deductions.

When to Consult a Tax Professional

Sometimes, even the best of us need a bit of expert advice:

- **Complex Situations:**If your insurance policy has multiple components or if you’re unsure whether a portion of your premium qualifies as a business expense, it’s time to chat with a tax pro.

- **Stay Updated:**Tax laws can change, and a professional will be on top of these changes to ensure your deductions remain compliant.

- **Peace of Mind:**Investing in expert advice not only helps keep you on the right side of the law but also gives you the confidence that you’re maximising your deductions correctly.

Quick Reference Table

| Tip | Key Action | Why It Matters |

|---|---|---|

| Reviewing & Selecting Policies | Choose a policy that aligns with your business needs and tax objectives. | Ensures your policy supports your business goals and doesn’t complicate your tax situation. |

| Record-Keeping | Maintain detailed and organised records of all policy-related documents. | Solid documentation is critical to support your deductions and can save you headaches during audits. |

| Consult a Tax Professional | Seek expert advice when your insurance policy has complex features or when in doubt about deductibility. | A tax pro can keep you compliant, informed, and help maximise your legitimate deductions. |

Cheers to making smart, informed decisions for your business – and here’s to keeping those books as tidy as a well-kept Kiwi backyard!

Frequently Asked Questions (FAQ)

- Can I claim the full cost of my life insurance premium as a business expense? No, mate – generally, life insurance premiums are treated as a personal expense. Only in special cases, such as when the policy is used as collateral for a business loan or as key person insurance, might a portion of the premium be deductible.

- Which types of life insurance policies might qualify for a deduction? Typically, term life insurance isn’t eligible because it’s seen as pure personal protection. However, if you have a policy like key person insurance structured to benefit your business, you might be able to claim a part of that premium as a deduction. Always check the specifics of your policy.

- Does it matter if my business owns the policy or if it’s a personal policy? Absolutely – it makes all the difference. If your business is the policy owner or the policy is structured to protect the business, you could be in a better position to claim a deduction. On the other hand, a personal policy designed solely for family protection is usually non-deductible.

- What documentation should I keep if I want to claim these deductions? You’ll need to maintain detailed records, including invoices, contracts, and any correspondence that links the policy to your business needs. Keeping your paperwork organised is essential if you ever need to prove your claim to the tax authorities.

- When should I consult a tax professional about my life insurance and deductions? If you’re unsure about the deductibility of your policy or if your situation has multiple components that could affect your taxes, it’s wise to get in touch with a tax pro. They can help ensure you’re staying compliant and making the most of any deductions available to you. 👍

Got more questions? Don’t hesitate to reach out – we’re all in this together to keep our financial house in order here in Aotearoa!