No Time to Read? Here’s What You Need to Know

If you’re short on time, here’s a quick breakdown of the key takeaways from this guide on Airbnb income tax in New Zealand:

- Yes, you must declare Airbnb income—even if it’s just a few weekends a year. The IRD considers all short-term rental income taxable.

- New tax rules for 2025: Airbnb now automatically collects 15% GST from most bookings, interest deductibility has been reduced, and the Bright-line test applies if you sell a property used for Airbnb.

- Earning under $4,000 per year? You still need to declare it, but you may not owe tax. If you earn above $4,000, you must include it in your tax return and pay tax on your profit.

- GST registration is required if you earn more than $60,000 per year from Airbnb and other short-term rentals. If you’re under this threshold, Airbnb still deducts GST, but you don’t need to register.

- You can claim expenses like cleaning, maintenance, insurance, and advertising, but mortgage interest deductions are now limited due to recent tax changes.

- The IRD automatically tracks Airbnb income, so failing to declare it can lead to penalties, back taxes, and audits.

Need help sorting out your Airbnb taxes? BH Accounting connects you with the perfect accountant to ensure you stay compliant while maximizing your deductions. Get in touch today! 📞

Let’s Talk Airbnb and Taxes (Because the IRD will anyway !)

So, you’ve made a bit of extra cash on Airbnb—nice! Maybe it’s a spare room, a holiday home you barely use, or you just decided to turn your place into a mini-hotel while you’re off traveling. Whatever the case, you’re probably wondering:

👉 Do I actually have to declare this income?

👉 Will the IRD come knocking if I don’t?

Short answer? Yes, Airbnb income is taxable (sorry). The IRD considers any rental earnings income, even if it’s just for a few nights a year. The long answer? Well, that depends on a few things—like how much you make, whether GST applies, and what deductions you can claim.

Before you panic and start deleting your Airbnb listing, let’s break it down in plain English. By the end of this guide, you’ll know exactly what you need to declare, what you can claim back, and how to stay on the right side of the taxman—without spending hours decoding IRD jargon.

Let’s get into it.

Understanding Airbnb Tax Rules in New Zealand

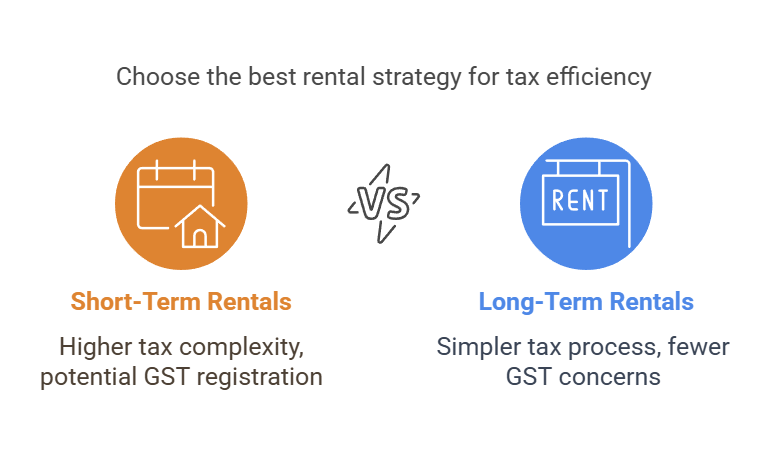

If you’re renting out your place on Airbnb, you’re officially in the short-term rental business—whether it’s for a couple of nights or all year round. And like any business, there are tax rules you need to follow.

The IRD treats Airbnb income just like any other rental income, meaning you need to declare it, pay tax on it, and possibly register for GST (depending on how much you earn). But here’s where things get tricky: short-term rentals have different tax rules compared to long-term rentals, especially when it comes to GST, deductible expenses, and property sales tax (Bright-line test).

Before we dive into the details, let’s look at what the IRD actually says about your Airbnb earnings.

What Does the IRD Say About Short-Term Rental Income?

The IRD classifies Airbnb rentals as “short-stay accommodation”, meaning:

📌 All Airbnb income must be declared on your tax return.

📌 You may need to pay GST if you earn more than $60,000 per year from short-term rentals.

📌 You can claim expenses related to running your Airbnb, but only if they directly relate to your rental activity.

📌 Selling a property used for Airbnb? It could be subject to the Bright-line test, meaning you might pay tax on any capital gain.

The IRD doesn’t care if Airbnb is just a “side hustle” or if you’re renting out your bach a few weekends a year—rental income is rental income. The only way to avoid declaring it? Don’t earn any.

New Zealand Tax Laws Updated for 2025

The tax rules for Airbnb hosts changed in 2024, and 2025 is the first full tax year where the new laws apply. Here’s what’s different:

🆕 GST Now Applies Automatically

- As of December 2023, Airbnb automatically collects 15% GST on behalf of the government.

- Even if you’re not GST-registered, Airbnb will still withhold GST from your bookings.

- This means your Airbnb earnings may be lower than expected since GST is deducted before you receive the payout.

🆕 New Interest Deductibility Rules

- Previously, Airbnb hosts could claim mortgage interest as a rental expense to reduce taxable income.

- Under the new rules, interest deductions are partially or completely phased out, depending on the type of property.

- This directly impacts profitability for Airbnb hosts with mortgages.

🆕 Bright-Line Test Changes

- If you sell a property used for Airbnb, you may have to pay tax on any capital gains under the Bright-line test.

- The test period is currently 10 years (previously 5 years for some properties).

💡 What This Means for You: Airbnb hosting is still profitable, but you need to be aware of how GST, deductible expenses, and property sales tax affect your bottom line.

How Much Airbnb Income is Tax-Free?

Not all Airbnb earnings are immediately taxable. In New Zealand, the $4,000 exemption rule determines whether you need to pay tax on your Airbnb income. However, this does not mean you can earn up to $4,000 tax-free without reporting it. Let’s break it down.

The $4,000 Exemption – Who Qualifies?

The $4,000 exemption applies to casual rental income, including Airbnb and other short-term stays.

Key points to consider:

- If your total rental income (Airbnb and any other rental income) is under $4,000 per tax year, you still need to declare it on your tax return, but you may not be required to pay tax on it.

- This exemption applies only to individuals, not companies or trusts.

- If Airbnb is your primary business activity, you cannot use this exemption. It is intended for occasional or part-time hosts.

For example, if you rent out a spare room 🏡 for a few weekends a year and make $3,500 in Airbnb income, you still need to report it to the IRD. However, depending on your overall income, you may not have to pay tax on it.

If your earnings exceed $4,000, different rules apply.

What If You Earn Above $4,000?

If your Airbnb earnings exceed $4,000 in a tax year, the following applies:

- You must declare the full amount as taxable income.

- You are required to file an income tax return, even if Airbnb is not your primary source of income 💰.

- You may be eligible for deductions on expenses related to running your Airbnb, such as cleaning, maintenance, and insurance.

- If your total rental earnings (Airbnb and other short-term rentals) exceed $60,000 per year, you must register for GST and charge 15% GST on bookings.

For example, if you earn $6,000 from Airbnb, you must:

- Declare the full $6,000 as income.

- Pay tax on your profit after deducting eligible expenses.

- Consider GST registration if your total rental income exceeds $60,000.

Key Takeaway

The $4,000 exemption does not mean the income is tax-free ⚖️. It determines whether tax applies, but all Airbnb income must still be declared. Once you exceed the threshold, tax is payable on the full amount.

Tax Obligations for Airbnb Hosts in NZ

Earning income from Airbnb means you have tax obligations to the IRD, just like any other rental income. Whether you’re hosting occasionally or running a full-scale Airbnb business, you need to understand income tax, GST, and deductible expenses to stay compliant and optimize your tax position.

Income Tax on Airbnb Earnings

Airbnb income is taxable in New Zealand and must be included in your annual tax return. How much you’ll pay depends on your total income for the year.

Airbnb Income Tax Brackets & How Much You’ll Pay

New Zealand uses a progressive tax system, meaning the more you earn, the higher your tax rate. Your Airbnb earnings are added to any other income (salary, wages, investments) and taxed accordingly.

| Income Bracket (NZD) | Tax Rate |

|---|---|

| $0 – $15,600 | 10.5% |

| $15,601 – $53,500 | 17.5% |

| $53,501 – $78,100 | 30% |

| $78,101 – $180,000 | 33% |

| Over $180,000 | 39% |

Note: These rates are effective from 1 April 2025.

How to Calculate Your Taxable Airbnb Profit

Your taxable income is not just what you earn—it’s what’s left after deducting eligible expenses. Here’s the basic formula:

📌 Airbnb income – allowable expenses = taxable profit

For example, if you earn $10,000 from Airbnb but have $3,000 in deductible expenses, your taxable profit is $7,000, which is what you’ll be taxed on.

Declaring Airbnb Income on Your Tax Return (Step-by-Step) 📝

1️⃣ Log in to your myIR account (or register if you don’t have one).

2️⃣ Navigate to the “Rental Income” section in your tax return.

3️⃣ Enter your total Airbnb income for the tax year.

4️⃣ Subtract eligible expenses (more on this below).

5️⃣ Submit your return before 7 July to avoid penalties.

Failing to declare Airbnb income can result in fines, penalties, or IRD audits, so it’s best to report everything correctly.

GST (Goods and Services Tax) on Airbnb Rentals ⚖️

New Zealand’s GST rules for short-term rentals changed in 2024, and Airbnb now automatically collects 15% GST on behalf of the government. This means Airbnb guests are already paying GST on their bookings, even if you’re not registered for GST.

New 2024 Rule: Airbnb Collects 15% GST Automatically

Under the new “platform economy” tax law, Airbnb now withholds and remits GST directly to the IRD for most bookings. This simplifies GST compliance for hosts but also affects how much you receive from Airbnb after fees and tax deductions.

When Do You Need to Register for GST? ($60,000 Threshold Explained)

You must register for GST if your total rental income (Airbnb + any other short-term rentals) exceeds $60,000 per year. Once registered:

✅ You must charge 15% GST on all bookings.

✅ You can claim GST back on eligible expenses (e.g., cleaning, repairs, property management fees).

✅ You must file GST returns regularly (usually every two months).

If your Airbnb income is below $60,000, you are not required to register for GST, but you cannot claim GST credits either. You can also read my article about claiming GST on residential properties here.

How to Claim GST Back on Expenses 💡

If you’re GST-registered, you can claim back the GST paid on certain business-related expenses, including:

- Cleaning and maintenance services

- Property management fees

- Advertising costs

- Internet and utilities for Airbnb use

To claim GST, keep all invoices and receipts and file GST returns correctly through myIR.

Deductible Expenses & Claims for Airbnb Hosts 🏡

The IRD allows Airbnb hosts to deduct business-related expenses to reduce taxable income. However, new rules in 2024 have limited what you can claim, particularly for mortgage interest.

What Costs Can You Deduct?

You can claim expenses that are directly related to running your Airbnb, including:

✅ Cleaning, maintenance, and repairs

✅ Utilities (electricity, water, internet)

✅ Insurance (landlord or short-term rental insurance)

✅ Property management fees

✅ Advertising costs (Airbnb listing fees, marketing expenses)

✅ Depreciation on furniture and appliances used in the rental

However, if you rent out only part of your home, you can only claim a portion of these expenses based on how much of the property is used for Airbnb.

Interest Deductibility Limitations Under the New Rules

Previously, Airbnb hosts could claim mortgage interest as a rental expense, reducing taxable income. However, under the new phased-out interest deductibility rules, this benefit is being gradually removed.

Key changes:

- For properties purchased after March 27, 2021, interest is no longer deductible until the 2024 tax year. From 1st April 2025, you will be able to claim 80% and 100% of the interests for the 2026 year.

This change increases taxable profits for Airbnb hosts with mortgages, making tax planning even more important.

Common Mistakes That Trigger IRD Audits 🚨

Airbnb hosts sometimes make errors in tax reporting, which can lead to IRD audits or penalties. The most common mistakes include:

❌ Not declaring Airbnb income (IRD cross-checks Airbnb data).

❌ Claiming 100% of expenses when only part of the home is rented.

❌ Forgetting to register for GST when income exceeds $60,000.

❌ Failing to keep proper records of expenses and deductions.

Keeping accurate records, separating personal and business expenses, and staying informed on tax law changes will help you avoid compliance issues.

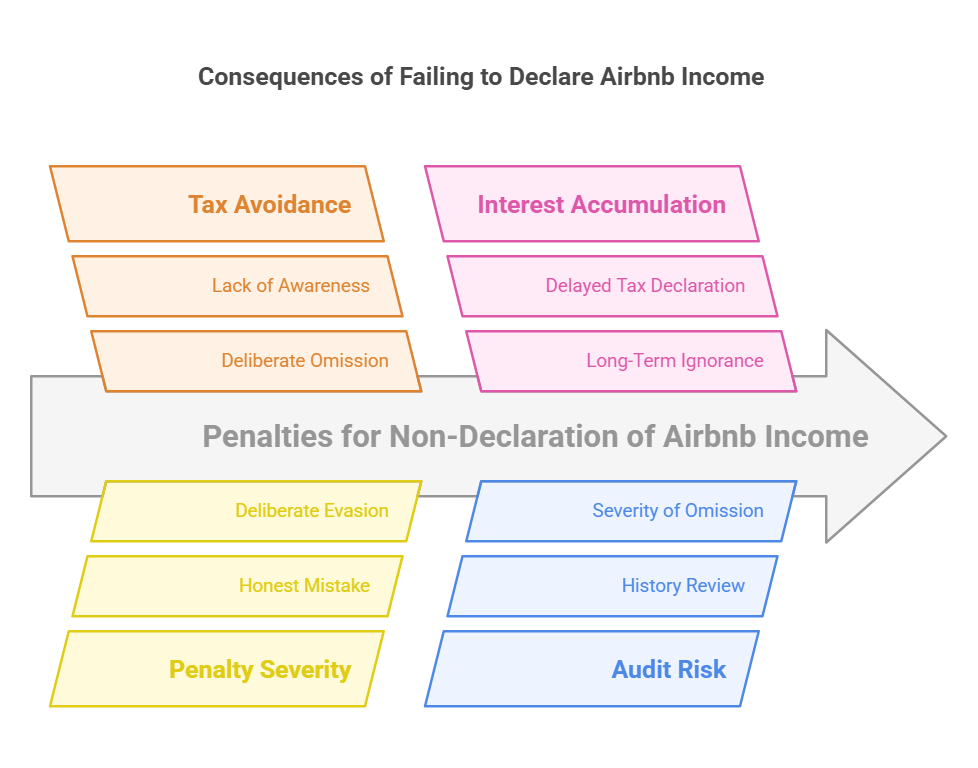

What Happens If You Don’t Declare Airbnb Income?

Thinking about keeping your Airbnb income off the books? Maybe you only rented out your place for a few weekends and figured, “It’s not a big deal, the IRD won’t notice.” Bad news—it’s a very big deal, and yes, the IRD will notice.

Short-term rental income is fully traceable, and failing to declare it can lead to penalties, interest charges, and a whole lot of unnecessary stress. Here’s what happens if you don’t report it—and what to do if you’ve already made that mistake.

IRD Penalties & Interest Charges for Non-Compliance

The IRD doesn’t take tax avoidance lightly. If they find out you’ve failed to declare your Airbnb income, they can issue back taxes, penalties, and interest charges—and the longer you leave it, the worse it gets.

Under New Zealand tax law, penalties can range from 20% to 150% of the unpaid tax, depending on whether they consider the omission an honest mistake or deliberate evasion. If they believe you knowingly left income off your return, expect hefty penalties and possibly an audit of your entire tax history.

Interest is also applied to unpaid tax, meaning even if you get caught years later, you’ll owe the original tax amount plus accumulated interest. Ignoring it doesn’t make it go away—it just makes it more expensive.

How the IRD Tracks Airbnb Income Automatically

You might be wondering, “How would the IRD even know?” The reality is, they already do.

Airbnb, like many other online platforms, shares earnings data with tax authorities. The IRD has automated data-matching systems that cross-check rental income reported on tax returns against information from Airbnb, banks, and other financial institutions. If the numbers don’t match, it raises a red flag.

Even if you operate under the radar, the IRD can still identify unreported income through bank deposits, rental agreements, or tenant complaints. If they launch an audit, they’ll look at your financial records, transaction history, and any undeclared income sources—not just Airbnb.

What to Do If You Forgot to Declare Past Airbnb Income

If you’ve already made Airbnb income but haven’t declared it, fixing the issue before the IRD comes knocking is the best move. The IRD offers a voluntary disclosure process, which allows you to report undeclared income before they investigate. Doing this can reduce penalties and help you avoid serious consequences.

To correct a past tax return, log in to myIR, submit an amendment, and include the missing Airbnb income. If you’re unsure how to do this, talk to an accountant—sorting it out now is far better than waiting for an IRD audit.

If you’ve missed multiple years of reporting, don’t panic. The IRD is generally more lenient with voluntary disclosures than with taxpayers they catch hiding income. Coming forward first reduces penalties and shows good faith. The worst thing you can do? Ignore it and hope it disappears—it won’t.

How to Declare Airbnb Income in NZ (Step-by-Step Guide)

Declaring your Airbnb income isn’t as complicated as it sounds—if you know what you’re doing. The key is staying organised, reporting correctly, and making sure you’re claiming every deduction you’re entitled to. If this is your first time filing, or you’re not sure where to start, here’s an easy-to-follow guide to get it done properly.

Step 1: Register for a myIR Account

Before you can declare Airbnb income, you need an IRD number and a myIR account—this is where all your tax records are managed. If you don’t have an account yet, head to IRD’s website and register.

Once logged in, go to the “Income tax” section. This is where you’ll report your Airbnb earnings when it’s time to file. If you’re already earning rental income, Airbnb is just an additional income source to include.

Step 2: Report Airbnb Earnings Under Rental Income

Airbnb income falls under rental income, and the IRD expects you to declare every dollar earned, even if it’s just a few weekends a year.

To report it:

- Log in to myIR and navigate to your Income tax return.

- Find the “Rental income” section and enter your total Airbnb earnings for the tax year.

- If you earned under $4,000, you still need to declare it, but tax may not apply depending on your overall income.

- If you earned over $60,000 from Airbnb and other short-term rentals, you may need to register for GST—check your total rental income before filing.

📌 Important: The IRD cross-checks Airbnb’s records with tax returns, so accuracy is key. Don’t leave anything out. Also make sure to update your bank account if you are due a refund !

Step 3: Claim Eligible Expenses

One of the perks of renting out your property is that you can claim expenses to reduce your taxable income. But not everything is deductible—only costs directly related to running your Airbnb can be included.

What you can claim:

- Cleaning and maintenance (hiring a cleaner, replacing broken furniture)

- Utilities (electricity, water, internet—proportionate to Airbnb use)

- Insurance (landlord or short-term rental coverage)

- Advertising and listing fees (Airbnb fees, marketing costs)

- Property management services

If you rent out only part of your home, you’ll need to apportion your expenses based on the percentage of space and time used for Airbnb. Overclaiming expenses is a common mistake that can trigger an IRD audit, so keep receipts and records.

💡 Pro tip: Keeping digital records of all receipts and invoices makes tax time much easier.

Step 4: File Your Tax Return on Time

New Zealand’s tax year runs from 1 April to 31 March, and individual tax returns are due by 7 July unless you have an extension.

To file your return:

- Log in to myIR and complete your income tax return.

- Make sure all rental income and deductions are correctly entered.

- Double-check your figures and submit before the deadline to avoid penalties.

- If you owe tax, make payment arrangements with the IRD before the due date to avoid interest charges.

⏳ Missed the deadline? Late filings can result in penalties, so it’s best to get ahead of it early.

If this all feels overwhelming, or you’re not sure if you’ve got it right, we can help. At BH Accounting, we connect you with the perfect accountant for your needs, whether you’re a casual Airbnb host or managing multiple properties. Get in touch, and we’ll find the right expert to help you stay compliant while maximising your deductions. 📞