Buying a business in NZ—exciting, right? But let’s be honest, it’s also a bit of a minefield if you don’t ask the right questions. I mean, we all know what it’s like to jump in headfirst without thinking it through—whether it’s the business history, the financial health, or those legal obligations you didn’t even know existed. It’s easy to get swept up in the excitement and miss the details that really matter.

You want to avoid buying someone else’s headache, right? Well, that’s why you need to ask the tough questions. Things like why they’re selling, what’s in the purchase agreement, and what’s the real value of the business, not just the price tag. We’ll cover all the important stuff you need to know to protect yourself and ensure you’re making a solid, informed decision. You’ll feel a lot better knowing you did your homework—trust me. Let’s get into it! 💡💼

Essential questions to ask yourself before buying a business

Before you get all excited about buying a business, you’ve got to check in with yourself. What’s really driving this decision? It’s easy to think it’s the perfect opportunity, but it’s important to ask the tough questions upfront. Let’s dig into what you really need to figure out before diving in.

What motivates me to buy this business instead of starting my own?

Is it the idea of hitting the ground running, or are you just looking for a shortcut? There’s nothing wrong with buying a business, but you’ve got to know your motivation. Starting from scratch has its challenges too, but you get to shape it your way. What’s your end goal here?

Do I have the necessary skills and experience to run this business?

Being excited is one thing, but can you actually run the show? Do you know the ins and outs of the industry? What about the leadership side—managing people, handling finances, making tough decisions? Be real with yourself about the skills you bring to the table.

What are my long-term goals for this business?

Is this just a stepping stone, or are you looking to grow and scale? Do you plan on being hands-on every day, or are you building something to eventually sell? Know what you want out of this business, not just today, but years down the line. It’ll help you make smarter decisions along the way.

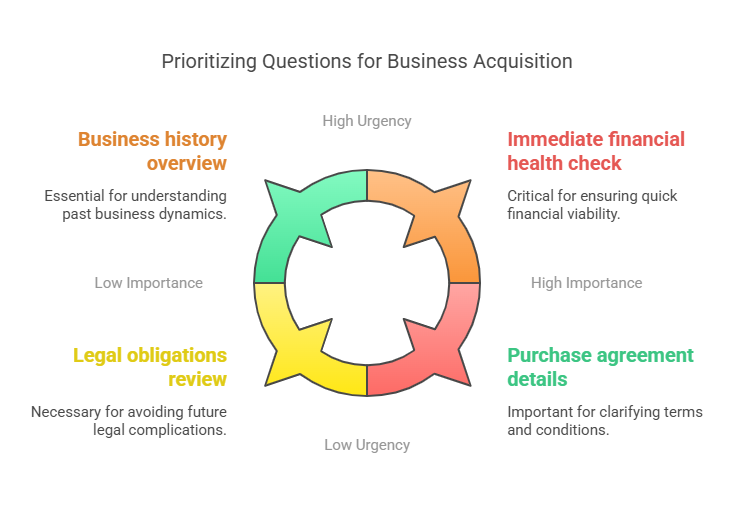

Critical Questions to Ask the Seller

Alright, now we’re getting to the nitty-gritty. It’s time to put on your detective hat and ask the seller some serious questions. These aren’t just small talk questions—these are the ones that’ll give you the truth behind the curtain. Let’s go.

Why are you selling the business?

This is the big one. Don’t just take the “I’m ready for a change” answer at face value. Why are they really selling? Are they stepping away for personal reasons, or is there something bigger going on behind the scenes? You need the full story, no fluff.

How long have you owned the business, and what’s its history?

Knowing how long the seller’s been running the business gives you a sense of stability. Has it been a smooth ride, or has it been a series of bumps and setbacks? The business history will give you important context and help you gauge its future potential.

What’s included in the sale—assets, liabilities, or both?

Make sure you know exactly what you’re buying here. Are you getting the business assets like equipment, inventory, and intellectual property, or are there liabilities like debts, contracts, and obligations that will be hanging over your head? Get the details, so there are no surprises.

Are there any ongoing legal issues or disputes?

You don’t want to walk into a legal minefield. Ask about any lawsuits, disputes, or pending issues that could impact the business down the line. The last thing you need is to inherit a mess you weren’t prepared for. Ask now to avoid a headache later.

Financial and Operational Due Diligence Questions

Alright, now we’re talking money. When it comes to buying a business, the financial and operational side is where you’ve got to be extra careful. Ask the right questions, and you’ll know exactly what you’re getting yourself into. Let’s break it down.

What are the business’s financial records and profit margins?

You need to see the books, and I mean all of them. Look at the business’s financial records, including income statements, balance sheets, and tax returns. What’s the profit margin like? Are they making money, or are they barely scraping by? This will help you figure out if this is a solid investment or just a shiny package with cracks underneath.

Are there any key liabilities or debts attached to the business?

A business can look great on the surface, but are there liabilities or debts lurking under the hood? Are there any unpaid loans, outstanding invoices, or contracts that could come back to haunt you? Make sure you know exactly what kind of financial baggage you’ll be inheriting.

What are the current employee arrangements and key staff?

The team makes the business run, so it’s important to know who’s who. Who are the key staff members, and what’s the overall employee arrangement? Are there any non-compete agreements, or are employees likely to leave once the sale goes through? Knowing the team dynamic helps you plan for a smoother transition.

How do you evaluate the business’s market position and competition?

What’s the business’s place in the market, and who are its biggest competitors? If it’s struggling to keep up with the competition, that’s a red flag. Ask about its market share, strengths, and weaknesses. Knowing where the business stands in relation to its competitors will help you decide if it’s a smart buy.

Final words

Buying a business in NZ is an exciting step, but it’s crucial to ask the right questions to ensure you’re making an informed decision. From understanding the financial records and profit margins to evaluating any liabilities or debts, thorough due diligence is key. Be sure to ask the seller why they’re selling, what’s included in the sale, and if there are any ongoing legal issues. Also, consider the market position and competition to understand the business’s potential. Taking the time to ask these critical questions will set you up for success and help avoid any nasty surprises down the line.

GET ACCOUNTING HELP TODAY ➜