So, are vouchers tax deductible or not? That’s the kind of question that sounds simple but quickly turns into a rabbit hole if you’re trying to stay compliant with IRD.

If you’ve ever given out a gift card, petrol voucher, or coffee credit to a client or team member, you might wonder whether it counts as a business expense. And if it does, how much of it is actually claimable? Does it trigger FBT? What about GST? And where does the 50 percent entertainment rule come into play?

In this article, we’ll break down exactly how the IRD views vouchers, who you can give them to, what makes them tax deductible, and what to watch out for. Whether you’re rewarding staff or thanking a client, here’s how to do it the smart way — without blowing your tax deductions.

Are vouchers tax deductible in New Zealand?

Let’s start with the big question: yes, vouchers can be tax deductible — but it depends on who you’re giving them to, why, and how much.

Under IRD rules, vouchers are considered non-cash benefits. If you’re giving them to employees, they may trigger fringe benefit tax (FBT). If you’re giving them to clients or suppliers, they may fall under the entertainment expense category. The tricky part is knowing when they’re 100% deductible, when they’re only 50%, and when you need to factor in FBT.

Do vouchers trigger fringe benefit tax (FBT)?

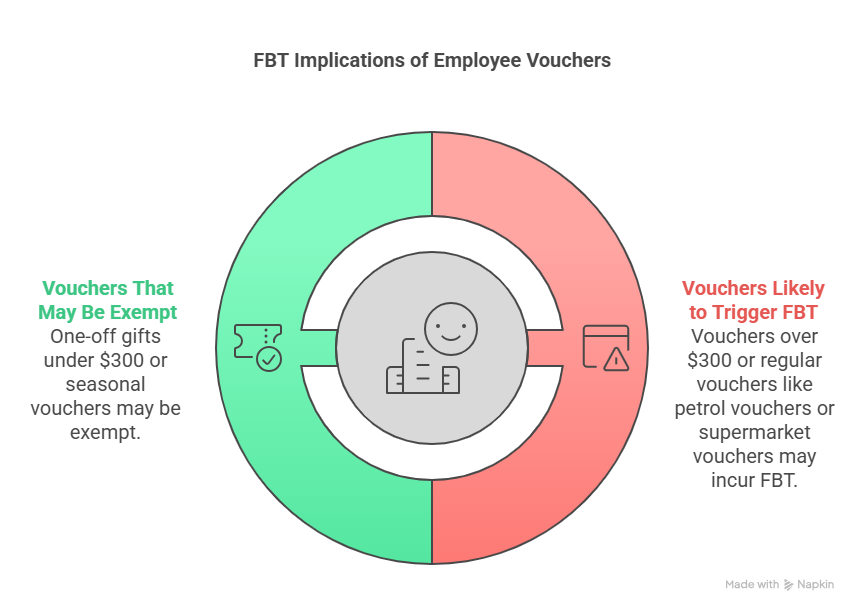

Here’s the deal. If you give a voucher to an employee, the IRD may view it as a fringe benefit — which means you could be on the hook for FBT.

But there’s a helpful rule: if the value of all non-cash benefits (including vouchers) stays under $300 per employee per quarter, you’re in the clear. Go over that, and FBT kicks in.

Vouchers likely to trigger FBT:

- Christmas or birthday vouchers worth more than $300

- Monthly supermarket or petrol vouchers

- Gift cards given as bonuses or rewards

Vouchers that may be exempt:

- One-off gifts under $300

- Seasonal thank-you vouchers (e.g. for the holidays)

- Vouchers given to multiple employees as part of a team celebration

This is similar to other borderline expenses like gym memberships for employees, where the intent and frequency matter just as much as the amount.

Can you claim vouchers given to clients or suppliers?

When it comes to gifting vouchers to clients, suppliers, or prospects, things shift into the entertainment zone.

- If the voucher is for food, drink, or entertainment, it’s usually only 50% deductible

- If it’s a promotional item or part of a sales strategy, it may be fully deductible

Voucher deductibility examples

| Recipient | Voucher Type | Deductibility |

|---|---|---|

| Employee | Supermarket card | Deductible, FBT may apply |

| Client (promo) | Coffee voucher | 100% deductible |

| Supplier (thank you) | Wine gift card | 50% deductible |

| Prospect (lead gen) | Fuel voucher | 100% deductible if for business purposes |

As with other grey-zone expenses, the rule is this: if it feels like a gift, it’s often only partially deductible. If it’s part of your marketing or brand strategy, you’re more likely to get the full tax benefit.

For other common grey areas, check out can I claim lunch expenses if I am self-employed?

How to record and claim vouchers correctly

If you’re giving out vouchers, documentation is key. This is one of those expenses IRD could ask about — especially if it involves gifts, employees, or anything that looks like extra income.

Here’s what to track:

- Who received the voucher (name or group)

- Why the voucher was given (thank you, reward, promotion)

- When it was given and how much it was worth

- Whether it was part of employee remuneration

Best practices:

- Keep receipts or invoices for each voucher purchased

- Record whether FBT was applied

- Avoid giving personal vouchers through the business — it muddies the waters

Bonus: Tax-smart ways to reward with vouchers

Vouchers can be a great tool to build goodwill — as long as you use them smartly. Here are a few ways to stay compliant and maximise the deductibility.

Tax-efficient voucher ideas:

- Group gifting under $300 per employee per quarter

- Fuel vouchers as incentives for leads or survey participation

- Supermarket vouchers as part of a promotional event

- One-off spot prizes during a company celebration

Need help setting this up in your business? Here’s how to find an accountant for small business who can guide you through FBT and expense claims without the headaches.

Use vouchers wisely, claim them correctly

So, are vouchers tax deductible? Yes — but only when used strategically and in line with IRD rules.

Whether you’re thanking a loyal client, celebrating a staff milestone, or offering a little fuel voucher as a promotion, it’s all about intention, value, and record keeping. Some vouchers are fully deductible. Others may trigger fringe benefit tax or fall under the entertainment category, limiting your claim to just 50%.

The takeaway? Don’t stop using vouchers. Just be smart about how, when, and to whom you give them. Keep your receipts, know your limits, and when in doubt — get help. At BH Accounting, we help business owners across New Zealand stay compliant without the stress.

Because a thoughtful gift should never become a tax headache.

FAQ about voucher deductibility in NZ

Can I deduct vouchers given to my employees?

Yes, but if they exceed $300 per employee per quarter, FBT may apply.

Are gifts to clients 100% deductible?

Only if they’re part of a promotion. Otherwise, many fall under entertainment rules and are only 50% deductible.

Is GST claimable on voucher purchases?

Only if the voucher is a “duty-paid” item. Some vouchers are GST-inclusive; others are not.

Do I need to issue a receipt or note for a voucher?

Yes — record the amount, recipient, reason, and date in case IRD ever asks.

Can vouchers replace bonuses or salary?

Yes, but then they’re considered remuneration, which means PAYE or FBT may apply.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.