If you’re running a company in New Zealand or receiving dividends from one — especially as a non-resident shareholder — you’ve probably come across the term dividend withholding tax. But what exactly is it, and how does it affect you?

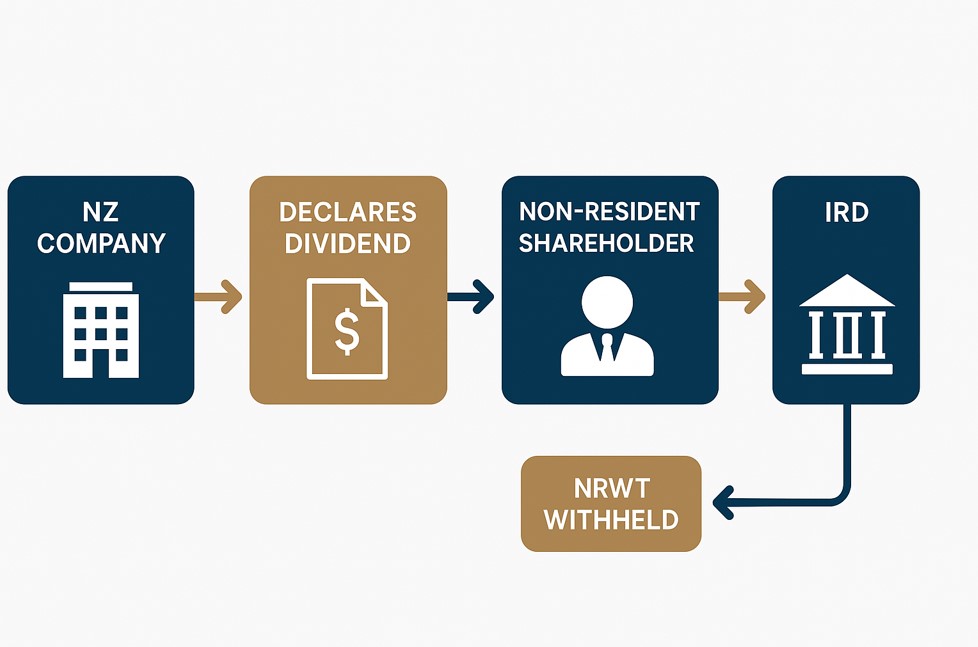

In short, dividend withholding tax NZ (commonly known as NRWT) is a tax that must be withheld and paid to the IRD when dividends are paid to overseas shareholders. It’s New Zealand’s way of making sure that tax is still collected on NZ-sourced income — even when the person receiving it doesn’t live in the country.

Depending on the situation, the withholding tax rate can vary between 0% and 30%, and things like imputation credits or double tax agreements (DTAs) can make a big difference.

In this guide, we’ll walk you through how NRWT on dividends works in New Zealand, when it applies, the current rates, and how to stay on the right side of the IRD.

What is dividend withholding tax in New Zealand?

Dividend withholding tax, or non-resident withholding tax (NRWT), is a tax applied when a New Zealand company pays dividends to a shareholder who lives overseas. It ensures that New Zealand collects tax on income that has its source in New Zealand, even if the recipient lives abroad.

This tax is deducted at the time the dividend is paid, and the New Zealand company is responsible for calculating, withholding, and paying it to Inland Revenue (IRD).

Key facts:

- Applies only to non-resident shareholders

- Calculated on the gross dividend (including any imputation credits)

- Different rates apply depending on credits and tax treaties

When does NRWT apply to dividends?

NRWT applies when all three of the following are true:

NRWT is triggered when:

- The shareholder is a non-resident of New Zealand

- The company is NZ-based

- The dividend is paid or credited to the shareholder

It applies whether or not the dividend has imputation credits attached. The presence of credits simply changes the rate — it doesn’t eliminate the obligation.

What is the NRWT rate for dividends?

In general, the NRWT rate is 30%. However, that rate can drop depending on two factors:

- Whether the dividend is fully imputed

- Whether the shareholder lives in a country with a Double Tax Agreement (DTA) with New Zealand

Dividend NRWT rates by situation:

| Dividend Type | NRWT Rate | Notes |

|---|---|---|

| Unimputed dividend | 30% | Default rate with no imputation credits |

| Fully imputed dividend | 15% | Reduced under New Zealand tax rules |

| With DTA (e.g. Australia) | 0–15% | Depending on treaty, often 15% or less |

The most common scenario is a 15% rate on fully imputed dividends, which is the minimum rate under New Zealand law — even if the DTA would otherwise allow for a lower rate.

Note: If the dividend is not imputed, the full 30% NRWT applies unless the DTA allows a lower rate.

How are imputation credits treated under NRWT?

Many business owners and shareholders assume that imputation credits reduce or eliminate NRWT. Unfortunately, that’s not how it works for non-resident shareholders.

Important points:

- Imputation credits do not reduce NRWT directly

- They can reduce the NRWT rate to 15% (if the dividend is fully imputed)

- Non-residents cannot claim imputation credits as a refund or personal tax offset

This is different from NZ resident shareholders, who use imputation credits to offset their personal tax on dividends. For non-residents, credits serve only to lower the withholding rate if the dividend is fully imputed.

For full clarity, read our article on how imputation credits work in NZ

How to stay compliant with IRD

If you’re a company paying dividends to non-resident shareholders, you have legal obligations under the NRWT system. The IRD expects companies to withhold and file these payments correctly and on time.

How to stay compliant:

- Deduct NRWT at the time of payment

- File your NRWT return by the 20th of the month following the payment

- Pay the withheld tax to the IRD on time

- Confirm the shareholder’s residency and eligibility for any DTA rates

- Keep dividend statements and ICA balances well documented

If you fail to comply, IRD may apply penalties, interest, and audits — even if the amount seems small.

Final words: Know your dividend tax obligations

Dividend withholding tax in NZ might seem complex at first, but once you understand how it works — especially for non-resident shareholders — it becomes much easier to manage.

Whether you’re a small business owner paying out dividends to offshore investors, or a non-resident receiving income from a New Zealand company, it’s essential to know the rates, the rules, and your filing obligations with the IRD.

The good news? With the right structure — like attaching imputation credits or making use of double tax agreements — you can often reduce the NRWT rate and stay fully compliant.

And if you’re not sure where to start, BH Accounting is here to help you set up clean dividend processes, track your imputation credits, and meet your filing deadlines — so you avoid costly penalties and make smarter tax decisions.

FAQ about dividend withholding tax in NZ

Do I have to pay NRWT as a non-resident?

Yes, unless exempt through a DTA or if the dividend qualifies for a zero rate under special conditions.

Can imputation credits be refunded to non-residents?

No. They can reduce the NRWT rate, but they cannot be refunded or used to offset other taxes.

What happens if NRWT isn’t paid correctly?

IRD may issue penalties, interest, and possible audit flags. The responsibility lies with the company, not the shareholder.

Are NZ resident shareholders affected by NRWT?

No. NRWT only applies to shareholders who are non-residents of New Zealand.

Where do I declare NRWT on my IRD forms?

Through the NRWT return, which can be filed via your myIR business account.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.