Donation tax credit — sounds good, right? But if you’re like most people, you’re probably not using it to its full potential. Every year, thousands of dollars are left on the table simply because taxpayers don’t realize how much they can actually claim back from their charitable donations.

In this guide, we’ll break down exactly how the donation tax credit works, which eligible charitable donations qualify, how to avoid common mistakes, and the smartest way to claim donations on your tax return.

Whether you’re giving to your local school, a charity you love, or a national organization, understanding how to maximize your donation tax credit could save you a lot more than you think.

Ready to turn your generosity into real tax savings? Let’s dive in.

What is a donation tax credit?

If you’ve ever made a donation and wondered if it could help your taxes, you’re not alone. A donation tax credit is a direct reduction in the amount of tax you owe when you donate to a registered organization. Unlike a tax deduction that lowers your taxable income, a credit cuts straight into your final tax bill — saving you real money.

Governments offer this incentive to encourage people to support charities, schools, religious groups, and other approved causes.

For the official New Zealand definition, you can visit the IRD’s donation tax credit page.

How does the donation tax credit work?

The idea is simple: donate, claim, save. But the details can trip people up if they’re not careful.

In New Zealand, for example, you can claim back 33.33% of the amount you donate to an approved organization — up to the total amount of tax you paid for the year. Other countries have similar systems, with varying refund rates and limits.

To claim successfully, you usually need to:

- Donate to a registered charity or approved organization.

- Obtain and keep an official donation receipt.

- File the claim alongside your tax return.

If you want more help managing your receipts digitally, check out What is the impact of accounting software?.

What donations are eligible for a tax credit?

Not every good deed qualifies. To maximize your savings, you need to know exactly what counts as an eligible charitable donation.

Common eligible donations include:

- Donations to registered charities

- Contributions to religious organizations

- Gifts to approved schools and universities

- Certain donations to foundations and public hospitals

However, the following are not eligible:

- Political party contributions

- Private gifts to individuals

- Donations where you received a significant benefit in return (e.g., gala dinners)

Bullet points:

- Cash donations: Always eligible with proper receipt.

- Payroll giving: Claimed differently, but still valuable.

- Material gifts: Only if officially accepted and valued.

You can check if a charity is officially registered in New Zealand using the Charities Register.

How to claim your donation tax credit step-by-step

Claiming your donation tax credit isn’t complicated, but missing one small step can delay your refund.

Here’s what you need:

| Document | Description |

|---|---|

| Official donation receipt | Must show charity’s name, amount, and date |

| Your IRD number or tax ID | Used to process your claim |

| Completed tax return or rebate form | Where the donation info gets entered |

Key points:

- Submit your claim online through the tax department portal (e.g., MyIR in NZ).

- Keep physical or digital copies of all receipts for at least 7 years.

- File claims for donations made in the previous tax year.

Need help filing? Here’s how to find an accountant for small business who knows donation claims inside out.

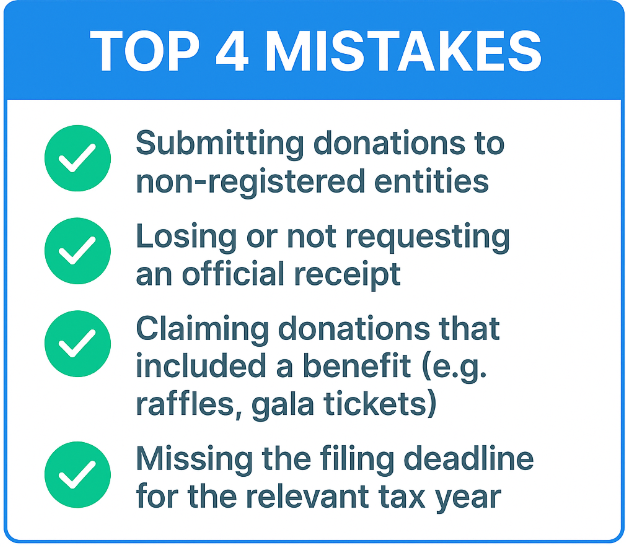

Common mistakes to avoid when claiming donation tax credits

Even seasoned donors can slip up.

Here are the most common errors that cost people their refund:

- Submitting donations to non-registered entities.

- Losing or not requesting an official receipt.

- Claiming donations that included a benefit (e.g., raffles, gala tickets).

- Missing the filing deadline for the relevant tax year.

Avoid these mistakes, and you’ll keep your donation claims smooth and stress-free.

For more tips on reducing accounting errors, visit Accountant Stress Level: How to Manage Pressure and Thrive in Your Career.

Bonus for donation tax credit

To help you plan ahead, here’s a quick checklist to maximize your donation tax credit every year:

Quick checklist:

- Donate before March 31 (or before the end of your local tax year).

- Always request an official receipt immediately after donating.

- Verify the charity’s registration number before giving.

- Upload receipts into your accounting software or cloud storage right away.

- Submit your claim early to avoid last-minute stress.

The earlier you organize, the faster you’ll enjoy your tax refund.

FAQ about donation tax credit

How much can I claim back for my donations?

In New Zealand, you can claim back 33.33% of the total amount donated, up to the value of the tax you paid for the year. Other countries vary.

Can I claim donations made overseas?

Generally, no. Most tax credits apply only to donations made to organizations registered in your country of tax residency.

What if I don’t have a receipt for my donation?

Without a valid receipt, you won’t be able to claim. Always request and keep donation receipts for every contribution.

Is there a limit on donation tax credits?

Yes. In some countries like New Zealand, you can’t claim back more than the total tax you’ve paid in that year.

What’s the deadline to claim my donation tax credit?

You must submit your claim within four years of the end of the tax year when the donation was made (for NZ). Deadlines vary by country.

Conclusion

Donation tax credit claims are one of the easiest ways to boost your tax refund while making a real difference.

By understanding the rules, keeping proper records, and filing correctly, you can turn your generosity into meaningful savings every single year.

Start tracking your donations now, and make sure you’re not leaving money behind when tax time rolls around.