Are monthly franchise fees tax deductible? It’s a question every franchise owner asks at some point—and for good reason. Whether you’re just starting out or managing an established business, knowing if your franchise tax deductions can lighten your tax bill is essential. The short answer? Most monthly franchise fees are tax deductible. But as always, the details matter.

In this guide, we’ll break down exactly what counts as deductible business expenses, when your franchising costs and taxes qualify, and what exceptions might apply. We’ll also cover some allowable business expenses you might be overlooking and share real-life examples so you can see how it works in practice.

If you want to stop guessing and finally understand how to claim those monthly fees, you’re in the right place. Let’s dive in.

What are monthly franchise fees?

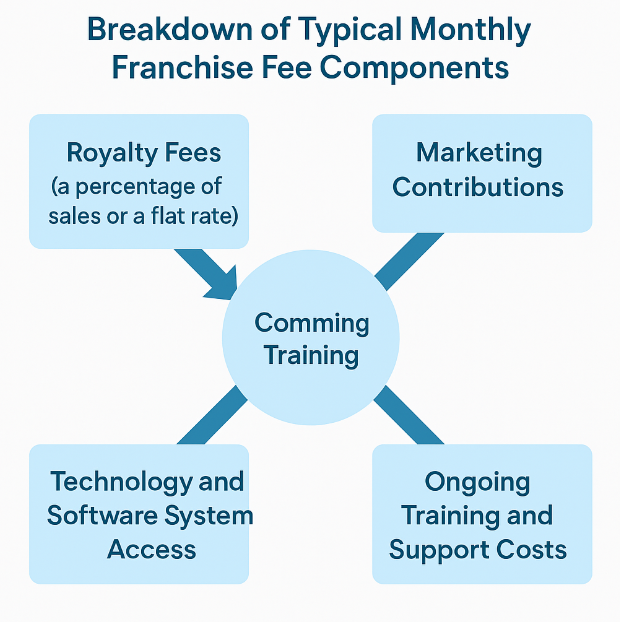

Monthly franchise fees are the regular payments franchisees make to franchisors in exchange for the right to operate under the brand’s name and receive ongoing support. These fees typically cover a range of services that help the business run smoothly.

The exact nature of the fees can vary depending on the franchise agreement, but they usually include several standard charges.

Common types of monthly franchise fees include:

- Royalty fees (a percentage of sales or a flat rate)

- Marketing contributions

- Technology and software system access

- Ongoing training and support costs

Are monthly franchise fees tax deductible?

In most cases, monthly franchise fees are tax deductible because they are considered ordinary and necessary business expenses. According to IRD, expenses that are essential for the operation of your business can usually be claimed to reduce taxable income.

These fees are treated much like other recurring deductible business expenses, such as marketing costs or travel expenses.

To learn more about deductible business expenses, refer to this IRS guide or the IRD’s general tax deduction rules. You may also be interested in this article: Are marketing expenses tax deductible ?.

Key conditions to claim franchise fees as tax deductions

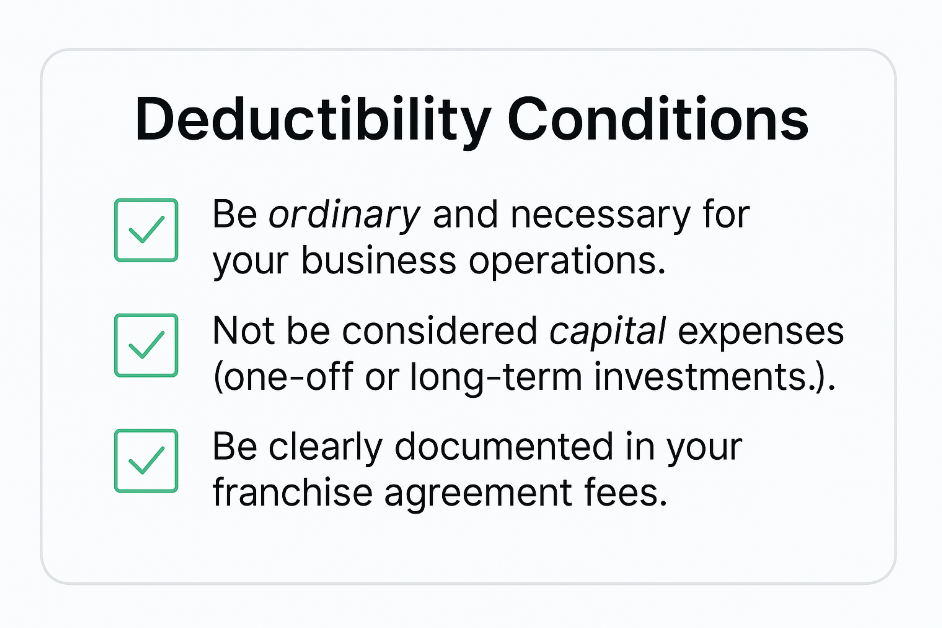

While franchise tax deductions are generally allowed, there are important conditions to meet.

To deduct monthly franchise fees, they must:

- Be ordinary and necessary for your business operations.

- Not be considered capital expenses (one-off or long-term investments).

- Be clearly documented in your franchise agreement fees.

Also, it’s important to separate startup costs from ongoing monthly fees. Startup or initial franchise fees often need to be capitalized and amortized over time instead of being deducted outright.

Common limitations and exceptions

Even though most franchising costs and taxes are deductible, some situations might limit your ability to claim certain fees.

Typical limitations include:

- Startup franchise fees: Usually treated as capital expenses, not deductible in full.

- Non-operational fees: Payments not directly linked to your day-to-day business activities.

- Fees that don’t qualify as allowable business expenses (like fines or penalties).

Franchisees operating internationally should also check local rules, as deductibility might differ based on tax jurisdiction.

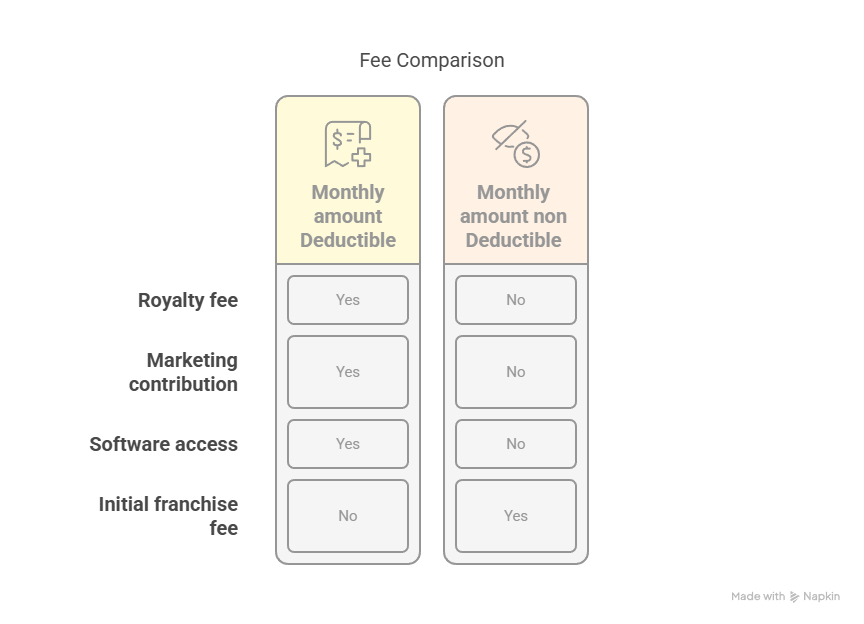

| Fee type | Monthly amount | Deductible? |

|---|---|---|

| Royalty fee | $1,500 | Yes |

| Marketing contribution | $500 | Yes |

| Software access | $200 | Yes |

| Initial franchise fee | $10,000 | No (capitalized) |

Related read — Business entertainment expenses: what to claim ?.

Real example: how franchise fee deductions work

Let’s look at a practical example.

Imagine you run a fast-food franchise. Every month, you pay:

- $1,500 in royalties

- $500 for marketing

- $200 for software systems

All these are deductible business expenses.

By claiming them, you reduce your taxable income by $2,200 monthly, or $26,400 annually.

However, the initial franchise fee of $10,000 you paid to get started is not fully deductible in the first year. It would need to be spread out (amortized) over several years.

IMAGE: Illustration of a franchise owner reviewing a tax summary sheet with a tax professional.

Bonus for franchise owners: maximize your deductions

To make the most of your franchise tax deductions, follow these tips:

- Track all fee payments carefully. Use accounting software or spreadsheets.

- Separate capital expenses from operational fees. Don’t mix startup costs with monthly expenses.

- **Work with a tax professional.** They can identify additional deductions and ensure compliance.

And don’t forget to review other deductible areas of your business regularly. For instance, you might also claim deductions for certain travel expenses (How to work out travel expenses in NZ ?) or even gym memberships in some cases (Is a gym membership tax deductible for a business ?).

Conclusion

Monthly franchise fees are generally tax deductible, but it’s essential to follow the rules and maintain proper records. Understanding which expenses qualify—and how to claim them—can significantly lower your taxable income and improve your business’s financial health. When in doubt, always consult a tax professional to avoid costly mistakes and maximize your deductions.

FAQ about are monthly franchise fees tax deductible?

Do all monthly franchise fees qualify as deductible business expenses?

Most operational fees do. However, startup or capital-related payments usually don’t qualify for immediate deductions.

Can I deduct franchise fees paid before opening my business?

Typically no. These are considered startup costs and must be amortized over time.

Are marketing fees paid to franchisors tax deductible?

Yes, marketing contributions are generally deductible as part of your ordinary business expenses. (For more, see our article on Are marketing expenses tax deductible ?).

How should I report franchise fee deductions on my tax return?

They should be included as part of your business expenses section—usually on Schedule C (U.S.) or the appropriate IRD form in New Zealand.

What records should I keep to support my deductions?

Keep copies of your franchise agreement, payment records, bank statements, and invoices.