Ever asked yourself how to work out travel expenses for your business — and instantly felt overwhelmed?

You’re not alone. Whether you’re a freelancer heading to client meetings, a tradie moving between sites, or a small business owner flying out for a conference, figuring out what counts as deductible (and what doesn’t) can be a headache.

The IRD has clear rules around business travel deductions, but applying them correctly takes more than guesswork. From mileage calculations to meal limits, knowing what you can claim — and how to claim it — could save you hundreds at tax time.

In this guide, you’ll learn how to accurately calculate and document work-related travel expenses in New Zealand. We’ll cover what qualifies, how to claim for using your own vehicle, and smart ways to stay compliant (and get the most out of every trip).

What counts as a business travel expense?

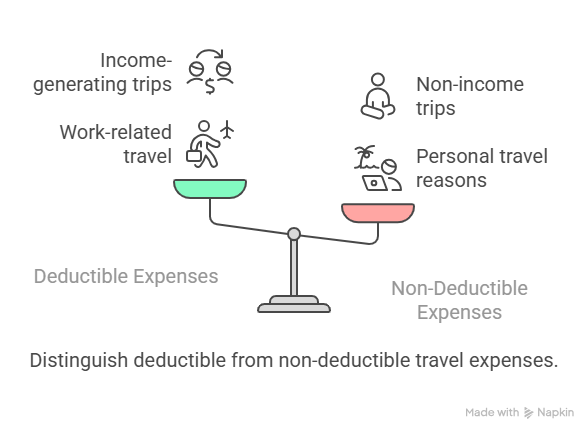

Let’s start with what qualifies. A business travel expense is any cost incurred while travelling specifically for work. This might be to meet a client, attend a training event, visit a site, or build partnerships.

The key here is purpose. If the travel helps you generate income or grow your business, the associated expenses may be deductible.

Common work-related travel expenses:

- Flights to attend business meetings or conferences

- Rental cars or public transport for client visits

- Hotel stays during overnight work trips

- Meals while travelling overnight for work

Not deductible:

- Daily commute from home to your usual workplace

- Travel for purely personal reasons (e.g. holidays)

- Meals and accommodation when you’re not travelling for work

How to calculate mileage for work travel

If you use your personal car for work, you can claim vehicle-related expenses — but only for the work portion.

There are two accepted methods in NZ:

- Kilometre rate method (simpler): Multiply business kilometres by IRD’s mileage rate.

- Actual cost method: Claim a percentage of your total vehicle costs (fuel, insurance, WOF, etc.) based on a logbook.

Claiming mileage tips:

- Keep a logbook for 90 consecutive days (good for 3 years)

- Track date, destination, reason, and distance

- Use IRD’s current mileage rate (e.g. $1.04/km for first 14,000 km)

External link: IRD mileage rates

Let’s say you’re a sole trader who drove 5,000 km for business last year. At $1.04/km, that’s $5,200 you could claim — as long as you’ve kept good records like a log book for a 3 month period.

What travel expenses can you claim?

Here’s a breakdown of what’s typically claimable — and what’s not — when travelling for work.

Table – What you can and can’t claim:

| Expense Type | Deductible? | Notes |

|---|---|---|

| Airfare | Yes | For business-related travel only |

| Hotel/accommodation | Yes | Must relate to an overnight work trip |

| Meals | 50% deductible | Only when away overnight or entertaining a client |

| Daily commute | No | Considered personal |

| Rental car | Yes | If used solely for work |

| Taxi/Uber | Yes | From airport to business event, for example |

If you’re unsure about food deductions, check one of our article on this subject: can I claim lunch expenses if I am self-employed?

Real-life example: Combining business and personal travel

Let’s talk about one of our French clients who runs a travel website called Voyages Intrépides, which helps French speakers plan trips to New Zealand.

Each year, he flies back to France to visit travel agencies and partnership contacts, promoting his platform and strengthening business ties. Of course, while he’s there, he also takes the opportunity to visit his family.

Can he claim this trip? Partially, yes.

Because the primary purpose of the trip includes business meetings and relationship-building for his travel company, many of the expenses — like the return airfare and business-related accommodation — are deductible. However, any personal expenses (extra nights with family, leisure outings) are not.

This is a great example of how to split travel costs:

- Flights: 50–100% deductible depending on the balance of business vs personal time

- Accommodation: Nights booked for business purposes = deductible

- Meals: Only during business portions, and usually 50% deductible

- Train/taxi in France: Deductible when used for business travel

Just keep records that clearly separate business and personal.

How to track and document your travel costs

Now that you know what you can claim, it’s all about proving it. If IRD ever reviews your return, you’ll need detailed documentation.

What to record:

- All travel receipts (flights, meals, taxis)

- Itinerary with dates, purpose, and meeting details

- Vehicle logbooks for mileage

- Copies of emails or agendas (for conferences or business meetings)

Good documentation practices:

- Use a cloud folder to save travel receipts

- Note down who you met and why

- Use accounting software like Xero or Hnry to tag expenses

- Take photos of paper receipts as soon as you get them

Even one missing receipt could cost you part of your deduction.

Bonus: Smart travel planning to maximise deductions

You can make the most of your travel by planning intentionally. A few smart strategies can turn an average business trip into a tax-efficient investment.

Tax-smart tips:

- Book trips around confirmed meetings to make the purpose clear

- If mixing personal travel, split invoices or book separately

- Travel during the week instead of weekends to avoid IRD suspicion

- Use per diem allowances when applicable (for overseas trips)

Looking for help? Here’s how to find an accountant for small business who can help you plan smarter and claim more.

Know what to claim, and claim it confidently

Learning how to work out travel expenses isn’t just about ticking a tax box — it’s about getting rewarded for the real costs of running your business.

Whether you’re driving to client sites, flying overseas for meetings, or attending a conference, you deserve to claim what’s legitimately deductible. But the key is planning ahead, keeping your records tidy, and knowing where business ends and personal travel begins.

Need help figuring out your next move? At BH Accounting, we help business owners across New Zealand travel smarter, track better, and claim more — all while staying IRD-compliant.

FAQ about working out travel expenses in NZ

Can I claim fuel if I use my personal car for work?

Yes. You can use IRD’s kilometre rate method or keep a logbook and claim actual costs.

Can I deduct meals during day trips?

Usually not. Exceptions apply if you’re entertaining a client or travelling overnight.

What if my trip includes both business and personal days?

Only the business portion is deductible. Make sure to clearly document the split.

Do I need receipts for everything?

Yes. IRD expects proof for all deductions claimed, especially travel-related ones.

Can I reimburse myself for travel as a sole trader?

Yes — through valid methods like mileage rates, as long as you keep proper records.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.