If you’ve ever received a dividend in New Zealand and noticed something called imputation credits on your statement, you might have asked yourself — what is this and how does it affect my tax?

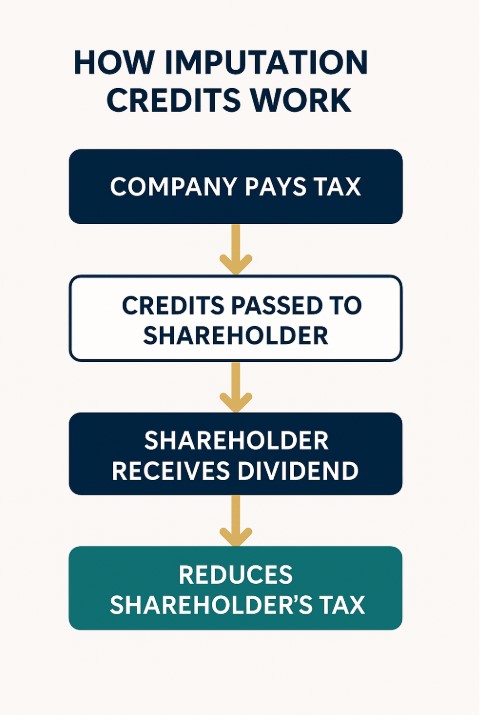

Put simply, imputation credits are a smart feature of the NZ tax system designed to avoid double taxation. When your company earns profit, it pays tax at the standard 28% corporate rate. Later, if it distributes some of that profit to shareholders as dividends, those shareholders would normally have to pay tax again — unless imputation credits are attached.

These credits pass on the tax already paid by the company to you, the shareholder, reducing your personal tax bill. Whether you’re running a small business or investing in a company that pays dividends, understanding how imputation credits NZ work can help you avoid overpaying tax and plan your income more effectively.

In this guide, we’ll break it all down — from how imputation credits are calculated, to how they reduce your tax, and tips to use them wisely.

What are imputation credits in NZ?

Imputation credits are a way for New Zealand companies to pass on the tax they’ve already paid on their profits to their shareholders. This system helps prevent double taxation — where both the company and the shareholder would otherwise be taxed on the same income.

Here’s how it works in simple terms:

- A company earns profit and pays 28% company tax

- When it distributes a dividend to shareholders, it can attach imputation credits

- These credits reduce the amount of tax shareholders have to pay on those dividends

Real-world scenario:

Let’s say your company earns $100,000 in profit and pays $28,000 in company tax. If you later distribute a dividend of $72,000, you can attach $28,000 in imputation credits to that dividend. This tells the IRD: “Hey, we’ve already paid tax on this.”

How do imputation credits affect dividend tax?

Without imputation credits, you’d be taxed twice — once when the company earns the profit, and again when you receive the dividend. That’s why credits are so useful — they reduce or eliminate that second layer of tax.

Let’s look at an example of how this plays out for a shareholder.

Tax on imputed dividend example:

| Description | Amount (NZD) |

|---|---|

| Cash dividend received | $700 |

| Imputation credit attached | $300 |

| Gross dividend | $1,000 |

| Tax due at 33% | $330 |

| Less imputation credit | $300 |

| Tax to pay | $30 |

So instead of paying $330 on the full dividend amount, you only pay $30 extra. The $300 of tax the company already paid gets credited to your personal account.

Who benefits from imputation credits?

Imputation credits are designed for New Zealand tax residents. If you live in NZ and receive a dividend from a NZ company, those credits directly reduce your personal income tax.

Typical beneficiaries:

- Small business owners who pay themselves a dividend

- Shareholders in private companies

- Investors holding shares in NZ-listed firms

- Trusts and look-through companies distributing income to individuals

However, if you’re a non-resident, imputation credits generally can’t be used in your home country — and won’t reduce your non-resident withholding tax (NRWT).

Also, if your personal income is low, you may not need the full value of the credit. In some cases, it can create a refund or carry-forward balance depending on how your return is filed.

Note: Imputation credits are not the same as resident withholding tax (RWT), though they often appear together on dividend statements.

How to use imputation credits correctly

You don’t need to “do” anything to receive imputation credits — they’re automatically attached to eligible dividends by the company. But you do need to declare them correctly on your tax return to benefit from them.

Here’s how to make sure you get it right:

How to report them:

- If you file an IR3 return, enter both the cash dividend and the imputation credit

- Credits will show on your dividend statement

- Use myIR or accounting software to pre-fill this info, or work with your accountant

Mistakes to avoid:

- Forgetting to declare the gross dividend (cash + credit)

- Double-claiming the credit

- Assuming every dividend has full credits attached

Internal link: Running your own company? You might also want to read how to pay yourself a shareholder salary — and how dividends fit into the picture.

Bonus: Tips for small business owners and shareholders

If you’re a company owner, imputation credits can play a big role in when and how you distribute profits. By keeping your Imputation Credit Account (ICA) up to date and planning your dividend timing, you can make tax work in your favour.

Pro tips:

- Declare dividends when you have enough ICA balance to attach full credits

- If you retain earnings, you’re building future credits — don’t forget to file an ICA return

- If paying both salary and dividends, work with your accountant to balance income and credits

Imputation credits also reduce the risk of overpaying tax when distributing profits to multiple shareholders.

Not sure what else affects your ICA? Learn more in Shareholder current account interest rate explained

Conclusion: Make the most of imputation credits

Imputation credits might sound like accountant-speak, but they play a real role in helping you keep more of your money. Whether you’re a shareholder, a small business owner, or someone just getting started with investing, understanding how these credits work can save you hundreds — or even thousands — in tax each year.

The key? Know how and when to use them. Make sure you’re declaring dividends correctly, keeping your ICA account up to date, and working with a tax advisor who understands how to balance salary, dividends, and credits effectively.

At BH Accounting, we help New Zealanders make smarter tax decisions — so your hard-earned profits work just as hard as you do.

FAQ about imputation credits in NZ

Do imputation credits reduce my personal tax?

Yes. They reduce the tax you owe on dividends by crediting the amount already paid by the company.

Can non-residents use imputation credits?

No. Non-residents can’t use them — their dividends are usually subject to NRWT instead.

What happens if my credits exceed my tax bill?

You may be eligible for a refund or can carry the unused portion forward, depending on your tax position.

Do all dividends have imputation credits?

No. Some companies may distribute unimputed dividends (often start-ups or loss-making firms).

Is this the same as franking credits in Australia?

Yes, it’s the NZ equivalent. The principles are similar, but the rules are specific to New Zealand.