If your business has taken a hit and you’re wondering how to stay afloat, you’re in the right place. A business loss of income claim could be the financial relief you need to keep going. Whether it’s due to a fire, flood, or a government-mandated closure, these claims help businesses recover by compensating for lost revenue during disruptions.

In this guide, we’ll walk you through exactly how a business loss of income claim works—who’s eligible, what’s typically covered, and how to file your claim the right way. We’ll also show you how to calculate business loss, gather the right documents, and avoid the common mistakes that get claims denied.

You’ll also learn how business interruption insurance differs from other types of coverage, and how to maximise your payout. If you’re looking to protect your livelihood and make sense of the insurance maze, this article gives you everything you need—from lost revenue calculations to claim preparation tips.

Let’s break it all down so you can stop worrying about the “what ifs” and focus on what really matters: rebuilding your business.

What is a business loss of income claim?

A business loss of income claim is a formal request made to your insurer to recover lost profits and fixed expenses due to a disruption beyond your control. It’s usually triggered by events like natural disasters, fires, or government-mandated closures.

This type of claim falls under your business interruption insurance policy. It’s designed to help you get back on your feet—not by covering physical damage, but by replacing the revenue you’ve lost while your business operations were down.

Who can make a claim? Eligibility & common scenarios

If your business has experienced forced downtime due to external events, there’s a good chance you’re eligible to file a business loss of income claim. However, not every situation is covered, and insurers often have strict criteria.

Most insurance policies require you to prove that the income loss was directly caused by a covered event and that the business was profitable before the disruption.

Common events that justify a claim:

- Fire damaging your business premises

- Floods or storms leading to forced closure

- Power outages or supply chain interruptions

- Public health orders or lockdowns (e.g. COVID-19)

Who can claim this type of coverage?

- Retailers forced to close after flooding

- Cafés or restaurants closed due to kitchen fires

- Service providers losing clients due to road closures

- Freelancers unable to work after equipment damage

If you’ve had to dip into savings or rely on government schemes like the Small Business Cashflow Loan Scheme, this coverage could be critical.

How to calculate your business income loss

Calculating your business income loss isn’t just about subtracting revenue—it’s about comparing your actual income during the affected period with what you would have earned in normal conditions. Insurers want proof, not estimates.

Here’s where solid bookkeeping matters. Tools like Xero or Hnry can simplify this process if your records are up to date.

IMAGE – bar graph comparing historical average monthly revenue vs. affected months

Key documents you’ll need:

- Monthly income statements for the past 12–24 months

- Payroll records showing ongoing wage obligations

- Expense summaries (rent, utilities, debt servicing)

- Tax filings or profit & loss reports

Bullet list – Income loss calculation tips:

- Use at least 12 months of historical data for comparison

- Account for seasonal patterns if relevant (e.g., tourism)

- Include projected growth if you can justify it with trends

- Back claims with external market data or client contracts

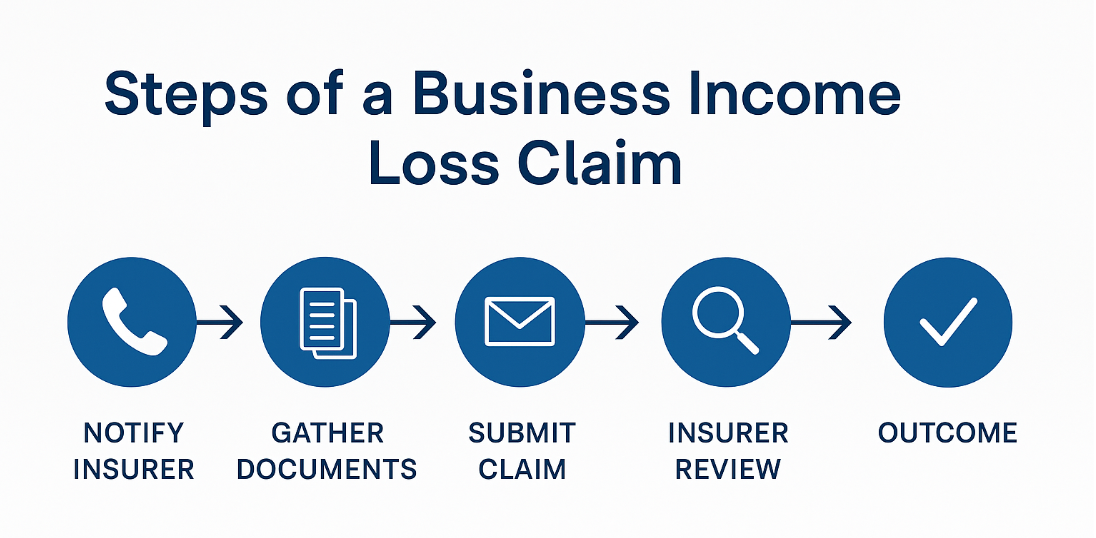

Filing a claim step-by-step (with tips)

Filing a business loss of income claim can be time-consuming—but doing it right makes a huge difference in how quickly and successfully you’re compensated.

Follow these steps to streamline the process and avoid common pitfalls.

Claim process summary

| Step | What to Do | Who Handles It |

|---|---|---|

| 1. Notify Insurer | Contact your broker or insurer ASAP | Business owner |

| 2. Gather Documents | Assemble all financial reports | You or your accountant |

| 3. Submit Claim | Provide written explanation and evidence | Business owner |

| 4. Insurer Review | Assessment and potential audit | Claims adjuster |

| 5. Outcome | Approval, partial payout, or dispute | Both parties |

Helpful tips for the process:

- Keep a written timeline of events (when the disruption began, how it progressed)

- Use cloud accounting software to share files instantly with your broker

- Consult an accountant experienced in insurance claims – if you don’t have one, get in touch with us

What’s typically covered and what’s not?

Understanding what your policy actually covers is key. Many business owners assume everything is included—but exclusions and limits are common.

Insurers generally cover fixed costs and net profits you would have earned if not for the disruptive event.

Covered under most policies:

- Lost profits (based on historical earnings)

- Ongoing rent or mortgage payments

- Employee wages and benefits

- Costs of temporary relocation

- Accounting/legal fees for claim preparation

Often excluded:

- Losses due to economic downturn or market changes

- Undocumented income (e.g., cash without receipts)

- Gradual income declines unrelated to a specific event

- Losses due to voluntary closures

To learn more about common coverage limitations, check out this MBIE guide on business insurance.

If you’re already using a health cover for your team, see if you can combine it with business expense health insurance for broader protection.

Bonus for business loss of income claim

We’ve put together a free downloadable checklist to help you prepare and document your business loss of income claim step-by-step. This tool helps ensure you don’t miss any critical documents or actions.

It includes:

- A claim preparation timeline

- List of all required documents

- Payout maximisation tips

- Templates to write a claim summary

Conclusion

A business loss of income claim can be the difference between survival and shutdown when your operations take a hit. Whether you’ve been forced to close temporarily, lost a major supplier, or faced unexpected disruptions, acting fast—and smart—matters.

The key is preparation: know what your policy covers, gather strong financial records, and follow the claim process step by step. Most importantly, don’t try to do it all alone. A good accountant can help you calculate your loss, document everything properly, and give you the best shot at getting paid quickly and fairly.

If you want help with your claim—or need a referral to a specialist—we’re here to connect you with the right professionals. Get in touch with our team today.

FAQ about business loss of income claim

How long do I have to file a claim?

Most policies allow 30 to 60 days from the date of the incident, but always check the deadline in your specific contract.

Can I claim income I expected to make?

Generally no. You need to show proven revenue losses based on your actual financial records, not future projections.

Is my insurance payout taxable?

Yes. In New Zealand, insurance payouts that replace lost income are typically treated as taxable income by the IRD.

What if my claim is denied?

You can request a formal review, escalate via your insurer’s complaints process, or use the Insurance & Financial Services Ombudsman (IFSO).

Do I need professional help to file the claim?

Absolutely. Accountants can help calculate accurate income loss and gather the right evidence. If you need help, reach out to BH Accounting.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.