Thinking of claiming overseas travel expenses on your next business trip? You’re not alone — and yes, tax-deductible travel expenses can be a great way to reduce your tax bill… if you know what you’re doing.

But here’s the catch: the IRD won’t just hand over deductions because you flew business class and took a few Zoom calls from a beachfront resort. Whether you’re self-employed, a small business owner, or an investor travelling internationally, understanding what counts (and what doesn’t) is key.

In this guide, we’ll break down overseas travel expenses from a New Zealand tax perspective. You’ll learn exactly what expenses are claimable, how to deal with mixed-purpose trips, when family costs are excluded, and what kind of records you need to back everything up. We’ll also go over travel allowance rules in New Zealand, plus some bonus tips to help you stay compliant and save money.

Let’s be real — tax rules can be confusing. But with the right info, claiming your business travel tax deductions doesn’t have to be. Let’s dig in.

What are overseas travel expenses?

Not all travel is created equal — especially when the IRD gets involved. Before you start claiming deductions, you need to understand what overseas travel expenses actually cover.

These are costs related to international trips that serve a genuine business purpose. If the intent of the trip is to grow your business, meet clients, attend a conference, or do research directly tied to income, then the related expenses might be tax-deductible.

Typical expenses you may incur on international trips

Here’s a breakdown of common business travel tax deductions you might be able to claim:

- Airfare (economy or business class — both are acceptable if justified)

- Hotel accommodation for business-related stays

- Taxis, Uber, rental car, or public transport used during business activities

- Meals (to a certain extent and with clear business purpose)

- Roaming charges and Wi-Fi used for business

- Travel insurance (only if it’s directly linked to business needs)

Difference between business and personal travel

This is where things often get blurry. The IRD draws a clear line: if a trip is purely for personal enjoyment (like a holiday), none of it is claimable — even if you respond to emails along the way.

Here’s a quick cheat sheet:

You can claim if:

- The trip is 100% for work

- Every day has a clear business agenda

You can’t claim if:

- The trip is mainly for a holiday

- Business was only a side note

Want the fine print? The IRD’s official guide on Business and private expenses breaks it down well.

Are overseas travel expenses tax-deductible in New Zealand?

Let’s get to the big question: Are overseas travel expenses tax-deductible? The answer is: yes — but only when you can clearly show they relate to earning income.

You’ll need to demonstrate that the primary purpose of the trip was business not moving overseas indefinitely, and that all expenses were “necessary and incurred in carrying on a business” as per IRD rules.

When can you claim?

- Visiting clients, attending conferences, supplier meetings

- Research or training directly linked to income

- Entire days allocated to business activities

When can’t you claim?

- Travelling for a wedding and dropping by a client

- Working remotely during your vacation

- Leisure days mixed into a business trip — those are not claimable

IRD rules on claiming overseas costs

According to IRD’s official travel expense guidance, your claim must meet two conditions:

- The expense must be necessary for your business.

- The expense must be incurred while generating income.

You must keep documentation proving the business purpose — think meeting invitations, event registrations, or emails confirming appointments.

Travel allowance and per diem rates in NZ

Instead of tracking every meal or taxi ride, businesses can use travel allowances (per diems). These are daily rates approved by the IRD, particularly helpful for larger companies with frequent travellers.

| Region | Daily Rate (NZD) | Includes |

|---|---|---|

| Australia | $150–$180 | Meals, incidentals |

| USA/Canada | $200–$250 | Meals, tips, incidentals |

| Asia (avg.) | $120–$160 | Meals, incidentals |

| Europe (avg.) | $170–$230 | Meals, incidentals |

Note: These are indicative only. Check the latest MBIE guidance or your company policy.

Can I mix business and leisure on the same trip?

This is a super common scenario — you’ve got meetings in Singapore, but you’re also taking a few days to chill in Bali afterward. So, what can you claim?

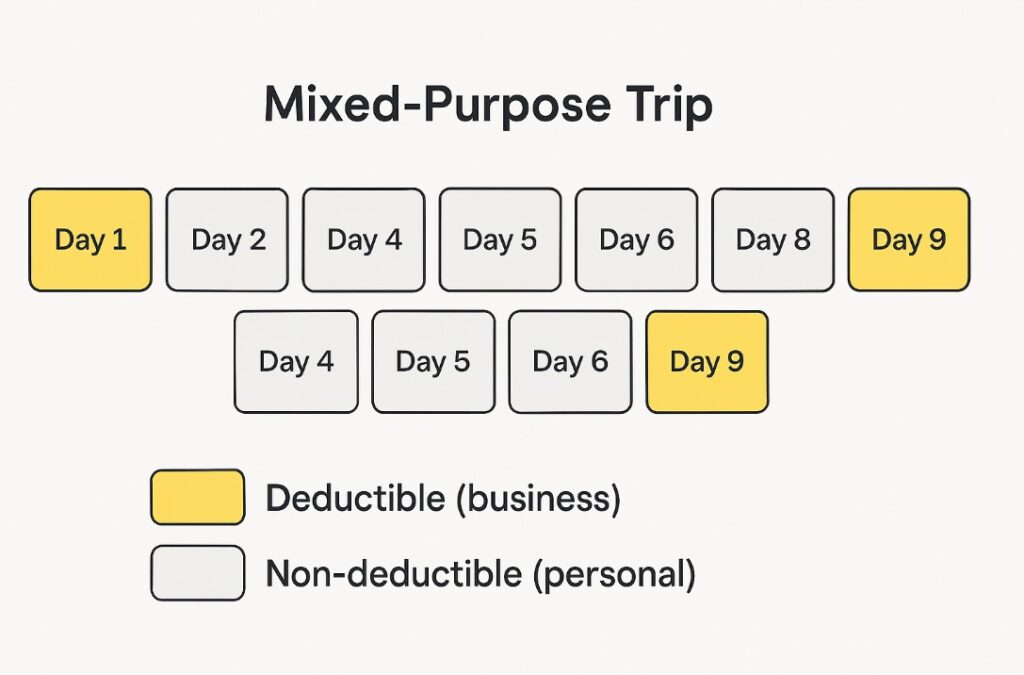

The key is in apportioning your costs. You can only claim the business part of the trip, not the leisure days.

Business + holiday travel: What’s claimable?

Here’s how to split your expenses based on days or activities:

- Airfare: Partial if you return later for leisure

- Accommodation: Only for business nights

- Meals: Only on workdays

- Tours, sightseeing, or family dinners — not claimable

Examples

- 5-day conference + 2-day holiday: only 5 days are claimable

- 10-day trip: 6 days business, 4 days leisure → claim 60% of shared expenses

Examples of mixed-purpose travel claims

Let’s say you spent:

- $2,000 on return flights

- $1,400 on 7 nights’ hotel

- $300 on meals

If only 5 of the 7 days were business-related, you’d claim:

- ~$1,430 (5/7 of flight + hotel + meals)

Need help with the maths? That’s where BH Accounting can make life easier.

Can I claim for my partner or family’s travel costs?

You’re heading to a trade show, and your partner tags along. Fair enough. But can you claim their plane ticket too? Spoiler: probably not.

When accompanying person’s costs are deductible

You may claim your partner’s costs if:

- They’re also employed by your business

- They play a direct role (e.g., translator, presenter, admin support)

In all other cases, their share of the cost is private and must be excluded.

Grey areas: Shared accommodation or transport

Say you rent a car and both use it. Or you book a room and share it with your partner. You’ll need to apportion these costs — the IRD expects it.

Example:

- $1,200 for 6 nights at a hotel

- Partner joins for 3 nights → you can claim 50% of the room for those 3 nights, and 100% for the solo nights

Want a second opinion? We are happy to put you in the right direction and have a great explainer on deductibility of mixed-use travel.

Conclusion

Claiming overseas travel expenses can be a powerful way to lower your tax bill — but only if you understand the rules. Whether you’re flying out for a client meeting, attending a conference, or scouting international suppliers, your expenses need to be clearly business-related and well-documented.

From flights and hotels to business travel tax deductions for meals and transport, knowing what’s allowed (and what’s not) is key. Always separate personal and professional costs, keep your receipts, and don’t forget — apportion where needed.

Got questions? Reach out to a tax advisor or let BH Accounting help you connect with a trusted professional. Better safe than audited!

FAQ about Overseas travel expenses

Are overseas travel expenses 100% tax-deductible?

Only if the entire trip is for business purposes. Mixed trips must be apportioned between business and personal use.

Can I claim meals during international business trips?

Yes, but only if meals are part of a work-related day. The IRD may question lavish or excessive spending, so stay reasonable.

Do I need receipts for all my travel expenses?

Yes. Keep itemised receipts, travel plans, and proof of business purpose. Some minor expenses may be claimable without receipts but check IRD rules.

Can I include my partner’s travel costs in the claim?

Only if they work in the business and contribute to the trip’s purpose. Otherwise, their share must be treated as a private expense.

How do I convert foreign currency expenses into NZD?

Use the exchange rate on the date of the transaction or apply the average monthly rate from IRD’s official list.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.