So, you’re thinking about renting out a room in your house? Sweet, extra income coming your way! But before you start counting those dollars, let’s talk taxes. I know, I know—tax stuff isn’t the most exciting topic, but trust me, it’s worth knowing the ins and outs.

If you’ve got a flatmate, you’re listing on Airbnb, or you’re doing some short-term stays, you’ll need to keep track of those taxable earnings and understand how to claim deductions for things like utilities, furniture, and even that part of the mortgage. Because, guess what? Those expenses can actually help lower your taxable income.

Don’t leave money on the table just because you didn’t read the fine print. Let’s dive into the nitty-gritty of tax obligations and what you can and can’t deduct when renting out a room in your house.

What You Need to Know About Renting Out a Room and Taxation

Alright, so you’ve made the decision to rent out a room. Maybe it’s a spare bedroom or the room you used for storage (who knew that stuff could make you money, right?). But before you get all excited about the extra cash, there’s one thing you absolutely need to understand: taxation. Like a Airbnb, renting out a room in New Zealand might seem straightforward, but when it comes to taxes, it’s a different story. Let’s dive into what you need to know.

Is Rental Income Taxable in New Zealand?

Yes, rental income is taxable in New Zealand, no matter how much you’re earning. That means every dollar you make from renting out a room must be declared to the IRD. It’s important to remember that all rental income—even from short-term rentals—is considered taxable unless certain conditions apply.

Example: If you rent out a room for $200 per week, that’s $10,400 a year. That’s $10,400 of taxable income you need to report to the IRD, whether you like it or not. But don’t freak out—there’s a silver lining. You can claim deductions for expenses related to that room, like utilities, furnishings, or even a portion of your mortgage interest.

How to Handle Rental Income from Boarders, Tenants, or Flatmates

Not all renters are the same. Depending on whether you’re renting to a boarder, a tenant, or a flatmate, the way you report income can change.

- Boarders: A boarder is someone who rents a room and shares common areas with you, but often their arrangement is more like a personal agreement. They might eat your food, join you for Netflix, and sometimes it feels more like a big flat share than a landlord-tenant relationship. With boarders, you’re often still considered to have shared expenses (like groceries or electricity), which means there are different tax rules to consider.

Example: If you have a boarder in your home, they could be considered part of the household, and you may not need to report their rental income in the same way you would for a tenant. They might even be exempt from some income tax rules, depending on your arrangement.

- Tenants: A tenant is more formal. They sign a lease, pay rent, and are generally a bit more hands-off. For tenants, the income you receive is more straightforward and taxable, and you’ll need to follow all the usual tax rules for rental income.

- Flatmates: If you’re sharing your space with a flatmate, it’s somewhere between a boarder and a tenant. While you’ll probably get rent and utilities paid for, the tax implications may depend on how much of your home they’re using and whether you’re sharing costs in a more casual arrangement. Flatmates may not always need a full tenancy agreement, but their rent is still considered taxable income.

Example: A flatmate could pay you a weekly rent, and it’s very likely that this rental income will be taxable. But if you’re only renting out a small portion of your home, there may be some deductions available, like your share of utilities or the internet.

Deductions and Expenses You Can Claim

So, you’ve decided to rent out that spare room, and now you’re thinking, “How do I make sure I’m not leaving money on the table when it comes to expenses?” Well, don’t worry—I’ve got you covered. There are plenty of expenses you can claim to lower your taxable income. Think of it as a tax hack to keep more money in your pocket. Let’s get into the juicy details of what you can deduct.

Claimable Expenses When Renting Out a Room

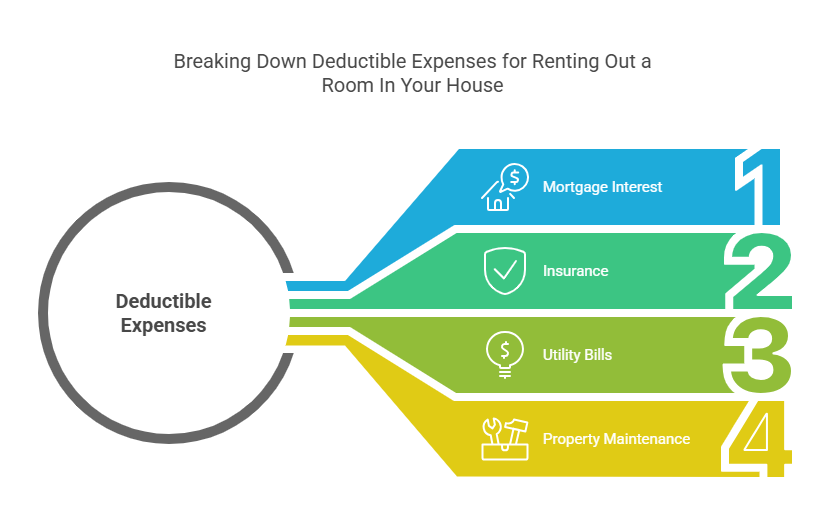

When you rent out a room, you’re essentially running a mini-business in your home, so it makes sense that some of your home expenses are deductible. Mortgage interest, insurance, utility bills, and even a portion of your property maintenance can all be written off like a normal rental property. You just need to keep track of it all.

Example: Let’s say your mortgage interest for the year is $10,000. If the room you’re renting out takes up about 25% of your home’s total area, you can claim $2,500 as a tax-deductible expense. That’s a nice chunk off your taxable income!

But it’s not just mortgage interest—you can also claim a portion of your insurance premiums, electricity bill, and more, as long as those expenses are linked to the part of the home being rented out.

Here’s how it works: the bigger the portion of your home rented out, the more expenses you can deduct. So, if you’ve got a flatmate in the whole upstairs area, you’re looking at claiming a larger percentage of your bills than if you’re just renting out a small room.

Apportioning Costs Between Private and Rental Use

It’s time to get your math hat on. To claim your expenses, you need to calculate what portion of your home is being used for rental purposes. This involves apportioning costs based on how much of your home is actually rented out. The general rule is that you can claim a percentage of your total household costs based on the area being rented.

Here’s a handy table that shows you how to split those costs. Let’s say you’re renting out a room that takes up 25% of your house’s total area:

| Expense | Total Annual Cost | Percentage for Room | Amount You Can Claim |

|---|---|---|---|

| Mortgage Interest | $10,000 | 25% | $2,500 |

| Electricity Bill | $1,200 | 25% | $300 |

| Insurance | $1,500 | 25% | $375 |

See how easy that is? With these expenses, you’re turning those household bills into tax savings. But, remember, the percentage is based on how much of your house is rented out, so be sure to get that right to avoid any issues down the line.

Conclusion

Alright, that’s a wrap! Renting out a room in your house can definitely help boost your income, but it also comes with some tax responsibilities. By understanding the deductions you can claim and how to properly apportion costs, you can reduce your taxable income and keep more of your hard-earned cash.

Always remember, the key to claiming expenses is accurate record-keeping and making sure everything is proportional to the space being rented. And hey, if you’re ever in doubt or need a hand navigating the details, get in touch with us at BH Accounting. We’ve got your back!