So, you’ve made a profit — now what? Should you take the money out, reinvest it, or just leave it in the business? That’s where retained earnings come into play.

In New Zealand, retained earnings are profits that your company chooses to keep instead of distributing as dividends. They’re reinvested into the business — to pay for new staff, upgrade equipment, cover unexpected costs, or simply build a financial buffer.

But here’s where many business owners get stuck: how are retained earnings taxed, how do they show up on your balance sheet, and what happens if you just leave them sitting in your company for years?

In this guide, we’ll break down everything you need to know about retain earnings NZ — including how they work, how they’re taxed, the pros and cons of keeping profits, and how to use them wisely.

What are retained earnings?

Retained earnings are the after-tax profits that your company decides to keep instead of distributing to shareholders as dividends. These funds are reinvested into the business — or simply held as a reserve for future use.

Retained earnings accumulate over time and appear in the equity section of your balance sheet. They’re not the same as cash in your bank account, but they do represent profits that haven’t left the business.

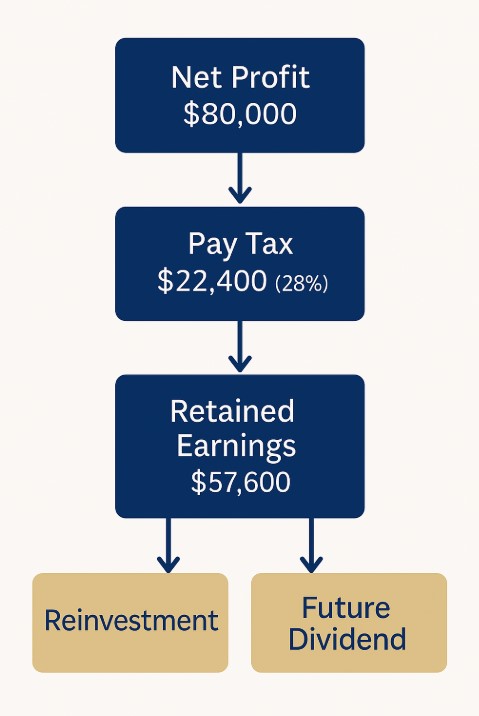

Example:

Your company earns $80,000 in net profit. You pay $22,400 in company tax (28%), leaving $57,600. If you decide not to pay yourself or any other shareholders a dividend, that entire $57,600 becomes retained earnings.

How are retained earnings taxed in New Zealand?

Here’s the good news: retained earnings are not taxed again once they’re retained. They’ve already been taxed at the 28% corporate rate when your company lodged its income tax return.

However, if and when you decide to distribute those retained earnings as dividends, shareholders may have to pay additional tax — depending on imputation credits and their personal tax rate.

Key tax facts:

- Retained earnings are after-tax profits

- No FBT, PAYE, or GST applies

- Dividends paid out of retained earnings may trigger tax for shareholders

- You can hold earnings indefinitely — but excessive accumulation may attract IRD scrutiny

Want to pay yourself instead of keeping profits in the business? Check out how to pay yourself properly as a shareholder

Retained earnings vs dividends: What’s the difference?

The difference comes down to what you do with the profits.

- Retained earnings stay in the business and increase its equity.

- Dividends are paid out to shareholders and reduce retained earnings.

Retained earnings vs dividends:

| Feature | Retained Earnings | Dividends |

|---|---|---|

| Tax paid by company? | Yes (28%) | Yes (28%) |

| Tax paid by shareholder? | No (until distributed) | Yes (depends on imputation credits) |

| Appears on balance sheet? | Yes | No |

| Reduces company equity? | No | Yes |

| Used for reinvestment? | Yes | No |

Curious about how shareholder funds are tracked? Read our guide to shareholder current account interest rates

Why retain earnings? Pros and cons

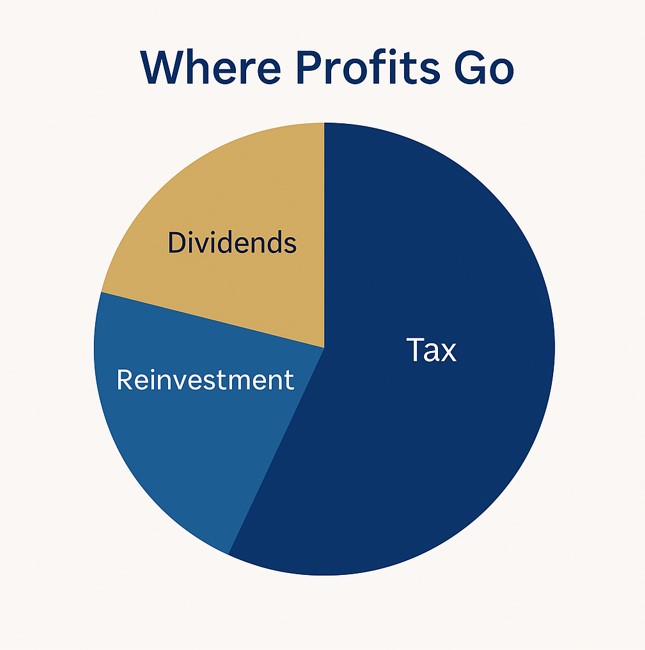

Keeping profits in the company isn’t just about tax — it’s about strategy.

Retained earnings give you the flexibility to grow, protect cash flow, and delay personal tax. But there are trade-offs.

Why businesses retain earnings:

- To fund new hires, marketing campaigns, or equipment

- To build a cash buffer for future costs or downturns

- To avoid paying immediate personal tax on dividends

- To boost shareholder equity and company valuation

But be careful — if you retain too much for too long without reinvesting or justifying the purpose, IRD may question your intent.

How to manage retained earnings on your balance sheet

In accounting terms, retained earnings sit in the equity section of your company’s balance sheet — right alongside capital contributions and shareholder current accounts.

They are updated each year based on:

- Net profit after tax

- Dividends declared

Example:

Opening retained earnings: $30,000

- Net profit after tax: $50,000 – Dividends paid: $20,000 = Closing retained earnings: $60,000

Use your accounting software (like Xero) to keep a running total. If you’re unsure how to handle this properly, your accountant can guide you — especially when planning dividends, salaries, or capital reinvestment.

Need help with your year-end planning? Here’s how to find an accountant for small business

Conclusion: Retain earnings with purpose

Understanding how to retain earnings in NZ isn’t just good accounting — it’s smart business.

By keeping profits in your company, you give yourself the freedom to grow, strengthen your balance sheet, and reduce immediate tax for shareholders. But retained earnings aren’t just numbers on paper. They represent the value you’re building — and the financial decisions you make about where that value goes next.

Whether you’re planning to reinvest, hold funds for future use, or declare dividends down the line, it pays to get advice. At BH Accounting, we help business owners make confident decisions about retained earnings, shareholder strategies, and long-term planning.

Because every dollar you keep is a decision — and we’ll help you make the most of it.

FAQ about retained earnings in NZ

Are retained earnings taxed again when distributed?

No, but when paid out as dividends, shareholders may owe tax based on their personal tax rate — minus any imputation credits.

Can I leave profits in my company indefinitely?

Yes, but if you accumulate large amounts without a clear business reason, IRD could see it as a tax avoidance strategy.

Do retained earnings affect company valuation?

Yes. Retained earnings increase shareholder equity, which can boost the company’s valuation in a sale or investment round.

Are retained earnings the same as cash in the bank?

No. They’re an accounting entry — your cash might already be tied up in assets, debts, or operating costs.

Can I use retained earnings to pay myself?

Not directly. You need to either pay yourself a salary or declare a dividend to access that money personally.