So, you’re wondering how to pay yourself a shareholder salary without getting on the wrong side of the IRD? You’re not alone. Whether you’re running a small company or just starting out as a director, understanding the rules around shareholder salary, dividend payments, and PAYE for shareholders is crucial. And that’s exactly what this guide is here for.

Paying yourself as a shareholder isn’t as straightforward as transferring money from your business bank account into your personal one. There are tax implications, reporting requirements, and some serious questions around what’s considered “reasonable” pay—especially if you’re wearing both the director and employee hats.

In this article, we’ll break down everything you need to know about a shareholder salary in New Zealand: what it is, how it compares to owner remuneration and dividends, how to actually pay it (the legal way), and how to stay compliant with your company tax obligations. You’ll also get some practical tax tips, a few mistakes to avoid, and answers to common questions.

Let’s get into it—because if you’re going to pay yourself, you might as well do it right.

What is a shareholder salary?

Before diving into tax strategies or PAYE requirements, let’s get clear on what a shareholder salary actually is. It’s not the same as drawing profits or getting dividends. In New Zealand, a shareholder salary is a payment made to working shareholders—those actively involved in the day-to-day running of the business. It’s considered taxable income and must be declared accordingly.

Unlike passive dividend payments, a shareholder salary compensates the shareholder for services rendered—just like a regular employee.

Shareholder salary vs dividend payments: Key differences

Many new business owners confuse these two. Both are ways to take money out of your company, but the way they’re taxed and reported is very different. Knowing the difference helps you plan better and stay compliant.

Here’s a quick comparison of the two:

Pros of paying a shareholder salary:

- Considered a deductible expense for the company

- Helps with KiwiSaver contributions

- May offer ACC coverage

- Provides steady income flow

Pros of taking dividends:

- Flexibility: can be declared anytime there’s profit

- No PAYE obligations

- May be more tax-efficient depending on your income bracket

- Doesn’t affect shareholder loans

Table – Comparison of shareholder salary vs dividends:

| Feature | Shareholder Salary | Dividend Payment |

|---|---|---|

| Tax treatment | PAYE + income tax | Taxed at shareholder level |

| IRD filing requirement | Employer Monthly Schedule | Dividend statements |

| KiwiSaver eligibility | Yes | No |

| Regularity | Monthly/fortnightly | As declared |

| Deductible for company | Yes | No |

How to pay a shareholder salary in New Zealand

Now that you know what a shareholder salary is, let’s walk through how to pay it properly. This isn’t just about transferring funds. You need to follow PAYE rules, ensure you’re registered as an employer, and document everything clearly.

Steps to pay yourself as a shareholder:

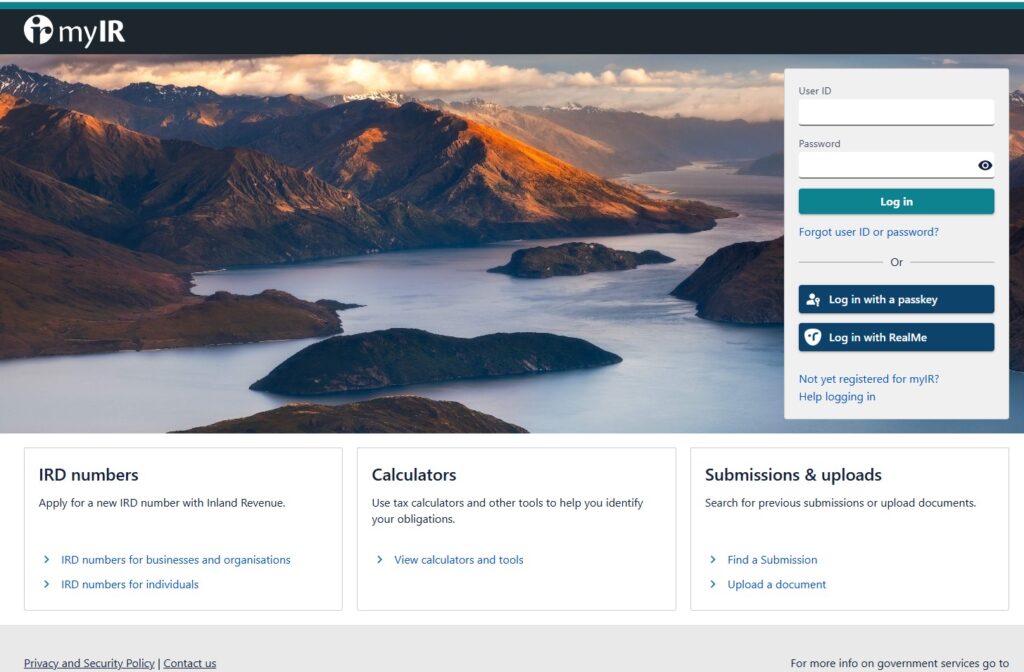

- Register as an employer with Inland Revenue (IRD)

- Determine a fair and reasonable salary for your work

- Withhold PAYE, ACC, and other applicable deductions

- File your Employer Monthly Schedule (EMS) via myIR

- Keep records in case IRD ever questions the arrangement

This process can feel overwhelming at first, but once set up, it becomes part of your regular business routine.

If you’re unsure how much to pay yourself, or how to handle PAYE filings, working with a professional might be worthwhile. Here’s an article to help you estimate the cost of a personal tax accountant.

Tax implications of shareholder salaries

Tax is often the biggest motivator behind how and when shareholders decide to pay themselves. The good news? A shareholder salary is generally tax-deductible for your company. But it comes with some obligations too.

Key points to keep in mind:

- The salary is subject to PAYE, KiwiSaver, and ACC levies

- The company must report this salary and make monthly deductions

- You cannot pay a salary retroactively once the financial year ends

- The salary must be “reasonable” based on your role and market standards

Paying yourself too little (or nothing at all) to avoid tax could trigger an audit. The IRD may determine a “deemed salary” and tax you anyway.

External link: For more detail on audit risks, visit Business.govt.nz’s page on IRD audits.

Internal link: If your salary impacts your shareholder current account, check out this breakdown of shareholder current account interest rates.

Common mistakes to avoid when paying yourself

Even with the best intentions, small business owners can get tripped up when paying themselves. Here are the most frequent missteps we see:

Bullet point list – Mistakes to avoid:

- Skipping PAYE registration while paying a regular salary

- Paying yourself too late in the financial year

- Not documenting the salary properly in accounting software

- Mixing personal and company funds

- Assuming you can adjust it retroactively

Getting these wrong can result in penalties, interest, and a messy audit trail. Better to get it right the first time—or talk to someone who can guide you through it.

Bonus for shareholder salary: Tax tips and planning strategies

Once you’ve got the basics locked in, it’s time to think smarter. Paying a shareholder salary isn’t just about compliance—it’s also a tool to manage your tax burden and income planning.

IMAGE: Visual of a financial planning calendar with income streams labeled.

Smart planning strategies include:

- Splitting income between salary and dividend to reduce your tax rate

- Using shareholder loans carefully (not as tax-free income)

- Leveraging KiwiSaver contributions for long-term benefit

- Planning in advance with your accountant before year-end

- Maintaining clean, clear financial records

Remember: a bit of proactive planning can help you keep more of your hard-earned income and avoid nasty surprises come tax season.

Make your shareholder salary work for you

Paying yourself a shareholder salary is more than just ticking boxes—it’s about getting rewarded for your work, staying compliant with tax obligations, and setting your business up for long-term success. Whether you’re a solo director, a hands-on shareholder, or part of a small business team, understanding the rules and benefits around shareholder remuneration is essential.

From dividend vs salary comparisons to smart tax strategies and PAYE compliance, this guide has walked you through the key points to get it right. Don’t wing it—plan ahead, document everything, and if you’re unsure, ask for help. A well-managed salary isn’t just good accounting—it’s good business.

Need tailored advice or help finding the right accountant for your situation? At BH Accounting, we’re here to help you connect with trusted professionals who can guide you through the process and help you grow with confidence.

FAQ about shareholder salary

Got questions? You’re not the only one. Here are some quick answers to the most common concerns we hear.

Can a shareholder take a salary and dividends at the same time?

Yes, and many do. It’s often the most tax-efficient approach.

Does a shareholder salary need to go through PAYE?

Absolutely. If you’re taking a salary, you need to withhold PAYE and file it like any employer.

How much can I pay myself as a shareholder?

There’s no strict cap, but it needs to be reasonable—based on your role, hours worked, and company profit.

Is shareholder salary tax-deductible for the company?

Yes. It reduces your company’s taxable income, unlike dividends which are paid from after-tax profit.

What if I don’t pay myself a salary at all?

If you’ve been working in the business, IRD may still tax you based on a deemed salary—so it’s safer to declare it properly.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.