So, you’ve found yourself needing a Tax Agent Authority Form, right? Not the most exciting paperwork, but trust me, it’s more useful than you think. 📑

If you’re wondering why you need it, well, it’s not because you’ve suddenly developed a love for tax jargon (I promise, you’re not alone here). The form is simply your way of giving your tax agent permission to handle the paperwork you’d rather ignore.

I know, it doesn’t sound like a huge deal, but once you fill it out, you’ll be miles ahead when it comes to managing your tax matters. And no, you don’t need to have a degree in accounting to get it right.

Let’s walk through it. Filling out this form? Simple. Getting the right tax agent on your side? Priceless. 💼 Keep reading, and we’ll get you sorted.

What is the Tax Agent Authority Form?

Define the Tax Agent Authority Form

Alright, let’s start with the basics. A Tax Agent Authority Form is just a fancy way of saying you’re giving someone else (usually your tax agent) the right to handle your tax stuff. It’s your official nod of approval to let them represent you with the tax office. Simple, right? You fill it out, sign it, and boom—your agent can now talk to the tax authorities on your behalf.

Why It’s Essential for Both Businesses and Individuals

Now, why should you care about this form? Well, whether you’re running a business or just managing your personal finances, this form lets your tax agent take care of all that paperwork you’d rather avoid. Think of it as a backstage pass for them to access your tax records and file things like GST, income tax returns, and other bits of business tax wizardry. For businesses, it’s essential—your agent needs to be able to do the heavy lifting when it comes to managing taxes. For individuals? It makes everything easier, so you don’t have to deal with all those forms yourself.

Relevant Legal or Tax Obligations

Let’s not beat around the bush: there are a few legal and tax obligations tied to this form. In New Zealand, Inland Revenue requires this form to let your tax agent do their job. Without it, they can’t act on your behalf. This means you’d be stuck dealing with tax returns, audits, or any tax matters yourself. And trust me, you don’t want to be on hold with IRD for hours. Filling out this form ensures that your tax matters are handled legally, accurately, and without all the stress. It’s about keeping you compliant and avoiding any nasty surprises down the line.

Need an accountant? BH Accounting can put you in the right direction and help you take control of your tax matters!

How to Complete the Tax Agent Authority Form

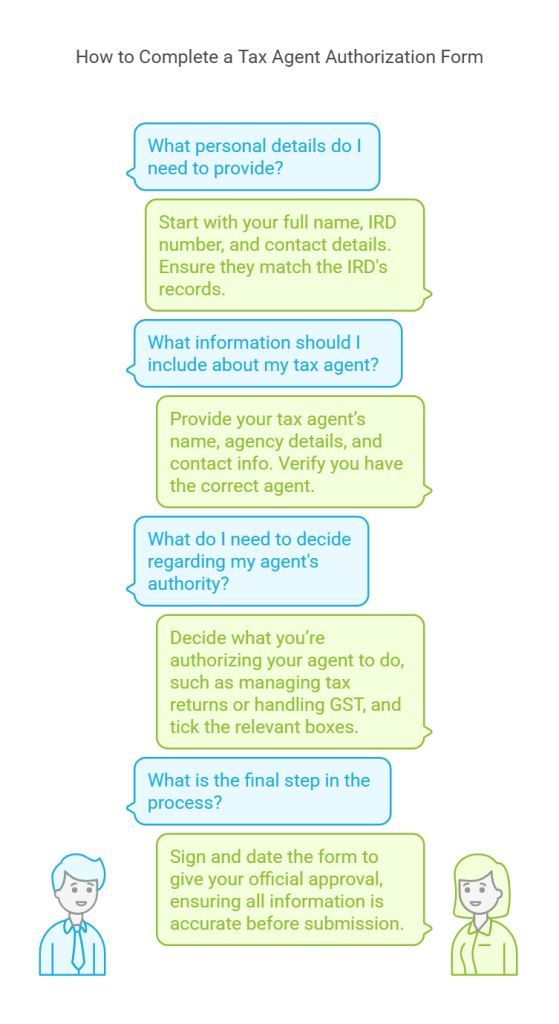

Step-by-step guide on how to fill out the form

Filling out the Tax Agent Authority Form isn’t as complicated as it sounds. Just follow these simple steps:

- Personal Details: Start with your full name, IRD number, and contact details. Make sure these match what the IRD has on file, so there’s no confusion.

- Agent’s Details: Next, provide your tax agent’s information. This includes their name, agency details, and contact info. Double-check you’ve got the right agent here—this is who will represent you.

- Authority to Act: Now, you’ll need to decide what exactly you’re authorizing your agent to do. Whether it’s managing your tax returns or handling your GST, tick the relevant boxes.

- Sign and Date: Finally, sign the form and date it. This is your official approval, so take a moment to ensure everything’s accurate before sealing the deal.

That’s it! Easy peasy.

Detailed explanations of any sections or fields that might be confusing

Now, I know tax forms aren’t always straightforward. Let’s break down a couple of areas that might cause confusion:

- Personal Details: This is pretty self-explanatory, but make sure your IRD number is up to date. If you’re a business, make sure your business number is listed here as well.

- Agent Details: The key here is to get your agent’s full contact details right. If they’re part of a firm, make sure you list the agency name and number. The IRD will need this info to link the agent to your account properly.

- Authority to Act: This is where you outline exactly what you’re giving your agent permission to do. Be clear—tick the boxes that match the tasks you want them to handle. If you’re unsure, don’t hesitate to ask your agent for clarification.

- Sign and Date: Pretty obvious, but remember, your signature is like a stamp of approval. If you don’t sign it, the form is useless.

Common mistakes to avoid when filling out the form

Let’s talk about the mistakes that could trip you up. We’ve all made them, so here’s a list to make sure you don’t:

- Incorrect Personal or Agent Details: Double-check your IRD number and your agent’s details. If they don’t match what the IRD has, your form could be rejected.

- Missing Signatures: Sounds obvious, but people forget to sign! Without your signature, Inland Revenue won’t recognize the form. Don’t skip this step.

- Not Specifying Authority: Be clear about what you’re allowing your agent to do. General terms like “manage taxes” won’t cut it. Fill in the specifics, so there’s no ambiguity.

- Rushing the Process: Take your time and double-check everything. Tax forms are like puzzles; one wrong piece can mess up the whole picture.

With these tips, you’ll breeze through filling out your form. Keep it simple, stay focused, and you’ll be good to go!

Need help with the form? BH Accounting can guide you through the process and ensure everything’s filled out correctly!

Why You Need a Tax Agent Authority Form

Discuss the benefits of having a tax agent on your side

Having a tax agent by your side is like having a financial superhero who knows all the tricks of the trade. These professionals are experts in navigating the maze of tax regulations, deadlines, and forms. They’re there to save you time, money, and a whole lot of stress. Whether it’s optimizing your tax deductions or making sure you’re compliant with the latest tax laws, a tax agent is a game-changer. They handle all the hard work, leaving you free to focus on what you do best—whether that’s running a business or just living life.

Explain how it simplifies tax filing and ensures compliance

Let’s be honest, taxes are confusing. The Tax Agent Authority Form makes it easy by allowing your agent to take over the paperwork. They’ll file your returns on time, track any changes in tax laws, and ensure you don’t miss any deductions you might be entitled to. This reduces the chance of errors and ensures compliance with Inland Revenue’s requirements. In short, you can trust them to take care of the complicated stuff, leaving you with peace of mind.

Highlight any specific scenarios where the form is required

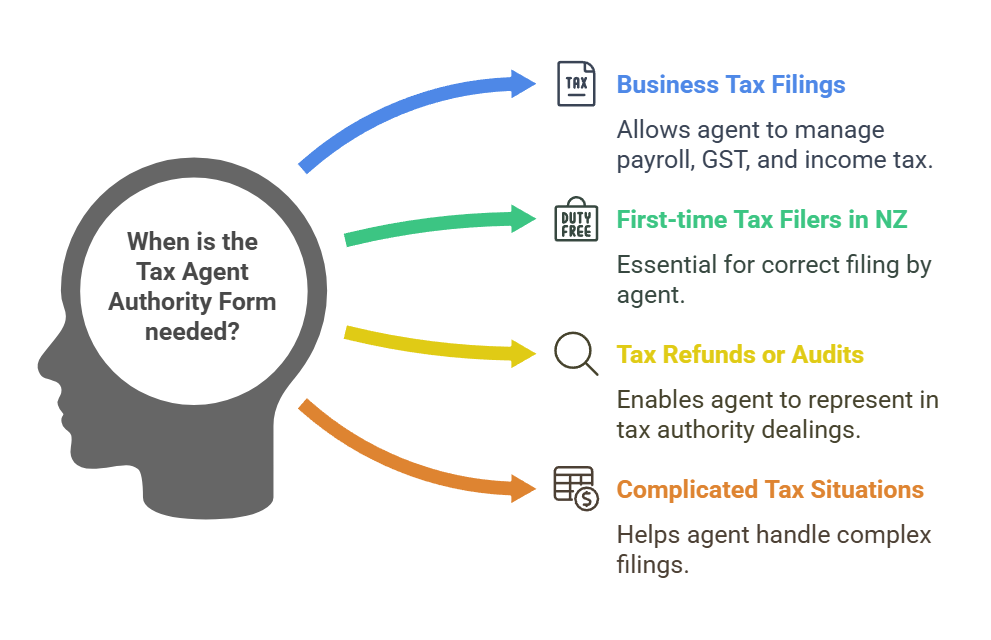

There are certain situations where you absolutely need this form. If you’re a business owner, it’s essential for managing payroll, GST, and income tax. If you’re filing taxes for the first time in New Zealand or you’re dealing with more complex returns, your tax agent will need the form to handle all the filings on your behalf. For individuals, it’s helpful if you’re claiming tax refunds or dealing with tax audits. In each of these cases, the Tax Agent Authority Form is what allows your tax agent to represent you and handle these matters efficiently.

Here’s a quick look at some specific scenarios where the form comes in handy:

ScenarioWhy the Form is Needed

- Business tax filings: Allows your agent to manage payroll, GST, and income tax.

- First-time tax filers in NZ: Essential for allowing your agent to file your returns correctly.

- Tax refunds or audits: Ensures your agent can represent you in dealing with the tax authorities.

- Complicated tax situations: Helps your agent handle more complex filings on your behalf.

Having the right form ensures everything runs smoothly, giving you the freedom to focus on other things.

Need help with your tax filings? BH Accounting is here to guide you through every step and ensure your tax matters are in good hands!

Final Thoughts

Filling out the Tax Agent Authority Form might seem like a small step, but it’s huge for keeping your tax game strong 💪. Letting a professional handle your filings means fewer headaches, fewer mistakes, and more time to focus on what matters. Whether you’re running a business or just managing your personal finances, this form simplifies everything. Don’t stress about it—get the right help, and you’re good to go! Need guidance? BH Accounting has your back and will make sure your tax journey is smooth sailing 🚀.