Navigating today’s financial landscape can be challenging. For both individuals and businesses in New Zealand, maintaining proper tax compliance with the Inland Revenue Department (IRD) can sometimes feel overwhelming and challenging.

To help you with filing income tax returns, managing your GST obligations, or planning your business taxation strategy, tax agents play a key role in simplifying these processes. These qualified tax practitioners will guide you through the complexity of tax legislation, maximizing the tax deductions you can claim and the tax credits you’re entitled to receive.

Tax regulations and requirements are constantly evolving. That’s why it’s important to have a knowledgeable tax professional by your side to help you understand and navigate New Zealand’s tax code. In this article, we’ll talk about how tax agents can assist with your tax obligations while ensuring you benefit from available tax relief and tax planning opportunities under New Zealand law.

What Is a Tax Agent?

A tax agent in New Zealand is a professional with two main goals. The first is to manage the tax obligations of individuals and businesses. The second is to ensure compliance with the Inland Revenue Department (IRD). They are experts in areas like filing income tax returns or managing GST and also ensure all financial records are accurate.

Think of a tax agent as your guide through New Zealand’s tax system. Their expertise will help you stay up to date with the latest complex rules. They will also optimize your tax payments by claiming all the deductions you’re entitled to. As individuals or business owners, we all have limited time during the day, and many of us are not familiar with accounting. That’s why a tax agent’s role is to make tax compliance simple, efficient, and stress-free for you.

History and Evolution of the Profession in New Zealand

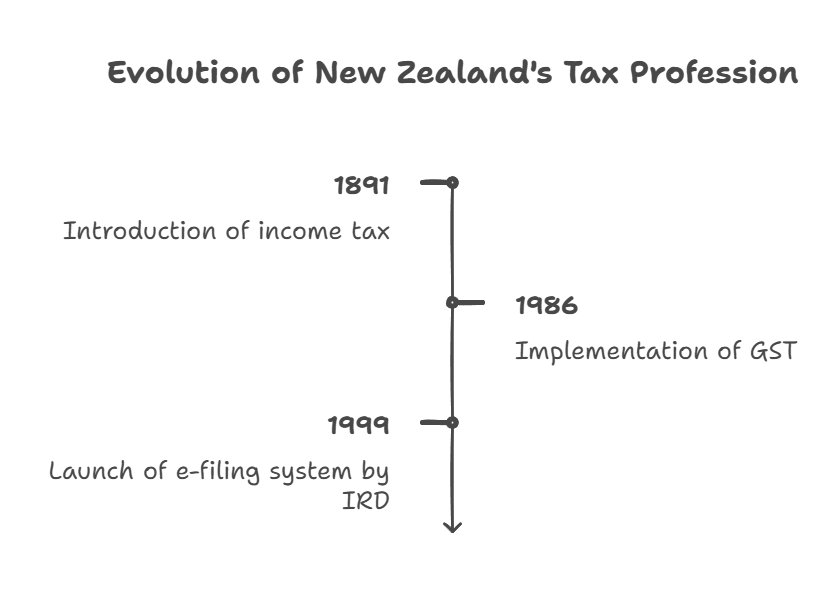

Back in the day, taxpayers managed their tax obligations directly with minimal guidance. Over time, New Zealand’s tax system evolved and became more complex. With the introduction of Income Tax in 1891, the demand for professionals to assist with compliance increased dramatically.

Another key date marked a turning point: the implementation of GST (Goods and Services Tax) in 1986. This change significantly increased the complexity of tax compliance and created a greater need for specialized tax agents.

Finally, in 1999, the IRD launched an e-filing system for tax returns. It revolutionized how tax agents manage and submit returns for their clients, streamlining the process and making tax filing more efficient.

These milestones highlight the growing importance of tax agents in New Zealand’s evolving financial landscape.

The Role of a Tax Advisor

A tax advisor has a crucial role in helping companies, trusts, partnerships, or individuals remain compliant with tax laws.

Beyond compliance, they are the best professional to provide strategic guidance and help clients optimize their financial decisions to reduce future tax obligations. For example, if you have a business, they can plan for major investments or structure operations in a tax-efficient way.

Additionally, tax advisors act as intermediaries with the IRD. If you face audits or disputes with the tax office, they will work on your behalf and present arguments in your favor. Their role is to provide peace of mind for their clients while they focus on their priorities.

Let’s look at a simple example to illustrate this.

Imagine a small business owner preparing for tax season. A bookkeeper tracks daily expenses and sales, while an accountant reviews these records and prepares financial statements. The tax advisor then uses this information to file tax returns, claim deductions, and plan strategies to minimize taxes. Together, they ensure compliance, organization, and optimized savings for the client.

Below is a summary to help you understand the different roles of a tax agent, an accountant, and a bookkeeper.

| Service | Tax Agent | Accountant | Bookkeeper |

|---|---|---|---|

| Filing tax returns | ✔ | ✔ | ✔ |

| GST and PAYE returns | ✔ | ✔ | ✔ |

| Tax planning and strategy | ✔ | ✔ | ✘ |

| Representing clients to IRD | ✔ | ✘ | ✘ |

| Financial reporting | ✘ | ✔ | ✔ |

Who Can Be a Tax Professional?

There is no single path to becoming a tax professional in New Zealand. It is a job that requires specific qualifications, skills, and personal traits. You need to have a strong understanding of New Zealand’s tax laws, GST regulations, and income tax. It is also valuable to have skills with accounting software like Xero or MYOB, as these programs simplify compliance tasks.

Chartered accountants, bookkeepers, and financial advisors with prior experience in managing financial records, preparing tax returns, or advising clients on financial matters are professionals who are likely to become tax agents.

In addition to technical expertise, you need to possess strong attention to detail, analytical thinking, and excellent communication skills. These traits are crucial for interpreting complex tax laws, identifying opportunities for clients, and providing clear advice in an ever-evolving financial landscape. To finish, continuous learning is essential as tax laws and regulations evolve.

- Qualifications: Degree in accounting, finance, or taxation.

- Skills: Knowledge of tax law, attention to detail.

- Professionals: Accountants, bookkeepers, financial advisors.

How to Become a Tax Agent?

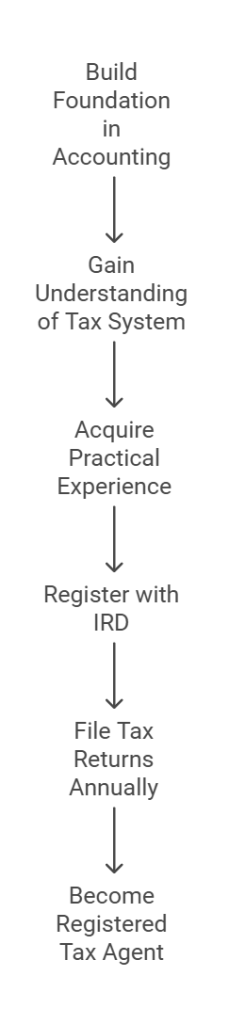

To become a tax agent in New Zealand, you need to meet specific criteria and develop the right skills. There is no mandatory licensing process, but the majority of tax agents begin with qualifications in accounting, finance, bookkeeping, or taxation.

Once you have these skills and qualifications, the next step is to register with the Inland Revenue Department (IRD) as a tax agent. To do this, you must file at least 10 tax returns annually on behalf of others. Registration grants access to exclusive tools and benefits, such as extended filing deadlines for your clients.

With dedication and the right skills, you can build a rewarding career as a tax agent in New Zealand.

Should I Use a Tax Consultant?

Should you hire a tax professional? It’s a question many people ask! The answer depends on your specific needs and circumstances. Below is a summary of the pros and cons to help you decide if a tax professional is the right fit for your team.

Pros

- Time-saving: Tax agents handle complex filings, GST returns, and other tax-related tasks, giving you more time to focus on personal or business priorities.

- Maximizes savings: They identify eligible deductions and tax credits you might miss, ensuring you pay only what’s necessary.

- Expert representation: In case of audits or disputes, tax agents communicate with the IRD on your behalf, protecting your interests.

- Extended deadlines: Registered tax agents can secure filing extensions, reducing stress during busy tax periods.

Cons

- Cost: Hiring a tax agent can be expensive, especially for individuals or small businesses with simple tax needs.

- Dependency: Relying on a tax agent might mean you’re less informed about your own financial and tax situation.

- Errors and accountability: While rare, mistakes by a tax agent can still occur, and you remain ultimately responsible for your tax compliance.3

Ultimately, the decision to hire a tax agent depends on your specific circumstances and comfort level with managing taxes independently.

Frequently Asked Questions

Do I need a tax agent to file my personal tax returns?

Not always, but it can be helpful! If your taxes are simple (like just salary income), you might not need one. However, if you have multiple income sources, investments, or claims for deductions, a tax agent can save you time and ensure everything is done correctly.

How can a tax agent help my small business?

A tax agent can handle your tax returns, GST filings, and PAYE, so you don’t have to worry about deadlines or mistakes. They can also help you find legal ways to reduce your taxes and make sure your business is following IRD rules.

What’s the difference between a tax agent and a tax accountant?

Both help with taxes, but not all accountants are tax agents. Tax agents are registered with the IRD and can get special perks for their clients, like extended deadlines. Accountants may focus more on overall finances, while tax agents specialize in taxes.

Is hiring a tax agent expensive?

The cost depends on the services you need, but for many people, the benefits outweigh the expense. A tax agent can help you avoid penalties, save money by finding deductions, and give you peace of mind that your taxes are done correctly.

Can a tax agent represent me during an IRD audit?

Yes! A tax agent can communicate with the IRD on your behalf during an audit. They’ll help explain your tax situation, provide the necessary documents, and work to resolve any issues.

How do I know if a tax agent is registered with the IRD?

You can ask them directly or check with the IRD. Registered tax agents have official recognition, which means they follow IRD rules and can get extra benefits like filing extensions for their clients.