”The two most important things in any company do not appear in its balance sheet: its reputation and its people.” Henry Ford

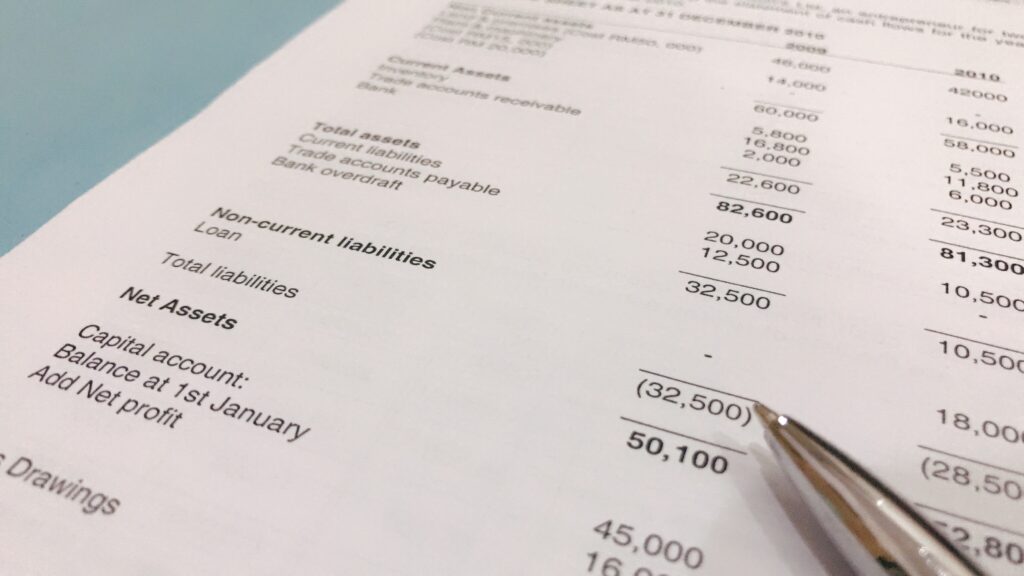

Ever wondered what a balance sheet really means? Don’t worry, you’re not alone. The definition of a balance sheet can sound like accounting jargon—but it’s actually a simple snapshot of your finances at a given point in time. Think of it as a tool that shows your assets, liabilities, and owner’s equity—aka what you own, what you owe, and what’s left.

It’s one of the big three financial statements (alongside the income statement and cash flow statement) that help you track your business performance and financial health. Whether you’re a business owner or just want to understand your net worth, knowing how to read a balance sheet is key.

We’ll walk you through the balance sheet meaning, break down current assets, long-term liabilities, and retained earnings, and explain how the accounting formula fits into it all. Let’s demystify this crucial piece of your business finances together.

Understanding the basics of a Balance Sheet

Balance Sheet meaning in simple words

Let’s keep it real—a balance sheet isn’t just for accountants in suits or corporate boardrooms. It’s simply a financial statement that shows your assets, liabilities, and owner’s equity at a specific moment. That’s it. It’s like pressing pause on your business finances to see where you stand right now.

Imagine looking at your wallet, your bank account, your debts, and what’s left over. That’s basically a personal balance sheet. For businesses, it’s just on a bigger scale.

What is the main purpose of a Balance Sheet ?

The purpose of a balance sheet is simple: it gives you a snapshot of your finances and shows how strong (or shaky) your financial health is. It’s one of the key tools investors, banks, and business owners use to assess business performance, track growth, and make decisions.

You want to know your net worth? This is where you start.

The Balance Sheet formula explained

Here comes a bit of accounting, but I promise it’s not scary:

Assets = Liabilities + Owner’s Equity

This classic accounting formula, rooted in double-entry bookkeeping, shows that everything you own (assets) is financed either by what you owe (liabilities) or what belongs to you (owner’s equity).

Example breakdown:

Let’s say Sarah runs a mobile coffee cart in Wellington. She’s been trading for a year and wants to check on her financial health. So, she puts together a simple balance sheet.

Here’s what she comes up with:

| Category | Amount (NZD) |

|---|---|

| Assets | $35,000 |

| Liabilities | $15,000 |

| Owner’s Equity | $20,000 |

Here’s what’s behind those numbers:

- Her assets include $5,000 in her business bank account, $3,000 worth of coffee supplies, and a coffee cart worth $27,000.

- Her liabilities are a $10,000 business loan and $5,000 still owed to her equipment supplier.

- The remaining $20,000 is owner’s equity—that’s Sarah’s stake in the business. It could include money she initially invested, plus profits she’s kept in the business.

So when Sarah sees this balance sheet, she gets a quick snapshot of her finances. She’s built some solid value in her business, and she knows exactly what she owns, what she owes, and how much is hers.

The 3 key components of a Balance Sheet

Alright, now that you’ve got the big picture, let’s zoom in. A balance sheet has three main parts. If you remember nothing else, just remember this trio: assets, liabilities, and owner’s equity.

Each one tells you something important about your business’s fiscal position.

Assets: What you own

Assets are everything your business owns—or will soon get—that has value.

Current Assets (Short-term)

These are assets you expect to use, sell, or turn into cash within a year. Think:

- Cash in the bank

- Accounts receivable (invoices you’ve sent but haven’t been paid for yet)

- Inventory

- Prepaid expenses

Example: You’ve invoiced a client for $2,000. They haven’t paid yet, but it still counts as a current asset because it’s money you expect to receive soon.

Fixed Assets (Long-term)

These are big-ticket items you use over time—usually longer than a year:

- Vehicles

- Machinery

- Computers

- Furniture

They’re also called non-current assets, and you might hear accountants talk about “depreciation” here—but we’ll keep that for another post.

Liabilities: What you owe

Now we move on to the stuff that makes your stomach tighten a little—liabilities. These are your debts or anything you owe to someone else.

Current Liabilities

These are bills and debts due within the next 12 months. For example:

- Supplier invoices

- Credit card balances

- PAYE or GST owed to the IRD

- Short-term business loans

Long-term Liabilities

These are bigger debts you’ll be paying off over a longer period, like:

- Business loans with more than 1 year to go

- Equipment finance

- Mortgages (if your business owns property)

Liabilities aren’t necessarily bad! Most businesses have them. The key is knowing what they are and managing them wisely.

Owner’s Equity: What’s yours to keep

Owner’s equity is the juicy part—it’s what’s left for you after you subtract all the liabilities from your assets.

It represents:

- Your initial investment in the business

- Any profits you’ve kept in the business (retained earnings)

- Contributions you’ve made over time

Think of it like this: if your business sold everything and paid all its debts, owner’s equity is what’s left in your pocket.

How to read and use a Balance Sheet

Now that you know what a balance sheet is and what it’s made of, let’s make it practical. Whether you’re running a business or just want to understand your personal finances better, this is where it all starts to click.

How to read a Balance Sheet (for beginners)

Reading a balance sheet is like reading a story—but with numbers. Here’s a step-by-step breakdown:

- Start with assets – What does the business own right now?

- Look at liabilities – What does it owe?

- Check owner’s equity – What’s left for the owner?

If assets = liabilities + owner’s equity, you’re good. If not? Something’s off and needs fixing.

Pro tip: Compare balance sheets over time. Are assets growing? Are liabilities shrinking? That’s a sign of improving business performance and financial health.

Quick Example

Here’s a simplified balance sheet for a fictional freelance graphic designer:

| Category | Amount (NZD) |

|---|---|

| Assets | $12,000 |

| – Laptop & equipment | $4,000 |

| – Business bank account | $6,000 |

| – Invoices owed | $2,000 |

| Liabilities | $3,500 |

| – Credit card balance | $1,500 |

| – Tax owed (IRD) | $2,000 |

| Owner’s Equity | $8,500 |

Formula check:

$12,000 (Assets) = $3,500 (Liabilities) + $8,500 (Owner’s Equity) ✅

Easy, right?

How to prepare your own Balance Sheet

You don’t need to be an accountant to build your own balance sheet. Here’s how to do it in 4 simple steps:

- List all your assets

- Include cash, equipment, inventory, unpaid invoices, etc.

- List all your liabilities

- Loans, taxes due, credit cards, unpaid bills.

- Use the formula

- Assets – Liabilities = Owner’s Equity

- Make sure it balances

- Total Assets should always equal Liabilities + Equity

You can use a spreadsheet, a notebook, or even software like Xero, MYOB or Excel. The goal is clarity, not complexity.

Update your balance sheet regularly—monthly, quarterly, or at least at the end of each financial year. It’s your best tool for tracking your fiscal position and making smarter decisions.

FAQ: Everything you wanted to know

What is a balance sheet in simple words ?

A balance sheet is like a financial selfie of your business. It shows what you own (assets), what you owe (liabilities), and what’s left over for you (owner’s equity)—all at one point in time. Super useful for understanding where your money’s at.

What is the balance sheet defined as ?

The official definition of a balance sheet is: a financial statement that summarizes a company’s assets, liabilities, and equity at a specific date. It follows the accounting formula:

Assets = Liabilities + Owner’s Equity

How to calculate balance sheet ?

Here’s how to calculate it:

- Total up your assets (cash, equipment, money owed to you).

- Add up your liabilities (loans, bills, credit card debt).

- Subtract liabilities from assets = owner’s equity.

Or just use the formula:

Assets = Liabilities + Owner’s Equity

If both sides of the equation balance, you’re good.

How do I prepare a balance sheet ?

Easy steps:

- List all your assets

- List all your liabilities

- Calculate owner’s equity

- Make sure Assets = Liabilities + Equity

You can do it on Excel, or use software like Xero or QuickBooks.

Ready to take control of your finances ?

If you’re a business owner, freelancer, or just someone who wants to understand your money better, knowing how to read a balance sheet is a game-changer. It helps you make smarter decisions, track your progress, and boost your confidence around money.

So go ahead—try building your own balance sheet today. You might be surprised by what you learn!

And if you’re not sure where to start or want help connecting with a great accountant in New Zealand, BH Accounting is here to help. We’ll point you to someone who gets your goals and speaks your language—no jargon, just straight talk.

Contact us to get matched with a professional who fits your needs.

Disclaimer

This article is for information only—not legal, financial, or tax advice. Every business is different, and rules change, so don’t make major decisions based on what you read here. If you’re unsure, talk to a professional—it’s cheaper than fixing a costly mistake later.