If you’re scratching your head wondering what the heck a Look-Through Company (LTC) is and how it might help you keep more of your hard-earned cash, you’re in the right place. In New Zealand, LTCs have become a popular option for savvy investors and business owners looking to take advantage of unique tax benefits and streamlined reporting – all while keeping things simple.

In this article, we’ll break down exactly what a Look-Through Company is, who qualifies, and the practical benefits and challenges that come with it – all in plain Kiwi language. Our aim is to give you a clear, no-nonsense explanation that cuts through the jargon and helps you decide if an LTC is the right fit for your financial goals.

So, grab your favourite cuppa, settle in, and let’s dive into the world of Look-Through Companies. Cheers to smarter tax planning and a brighter financial future !

What is a Look-Through Company?

Definition and Overview

Alright, mate – let’s break it down in plain Kiwi language. A Look-Through Company (LTC) is a special type of company where the income and losses “flow through” directly to its shareholders. In other words, instead of the company being taxed on its earnings, the tax liability is passed on to you, the investor. This structure was introduced in New Zealand to help investors avoid double taxation and to simplify the tax process, making it easier for savvy Kiwis to manage their investments and potentially save a pretty penny. 💡

Key Features and Benefits

Now, here’s where it gets interesting. One of the main advantages of an LTC is its ability to minimise tax liabilities. Because the income and losses flow directly to shareholders, you can offset your investment losses against other income, which might help reduce your overall tax bill. This not only helps in keeping more of your hard-earned cash but can also boost your net worth over time.

Additionally, LTCs differ from traditional company structures in that they’re designed to avoid the corporate tax layer – meaning you’re not hit with tax twice on the same earnings. This streamlined approach is a big win for investors who want to keep things simple and efficient. 🚀👍

Eligibility and the Process to Become an LTC

Eligibility Criteria

Before you jump into the LTC game, you need to check that your company meets the statutory requirements set out by the IRD. In simple terms, there are specific criteria that your entity must tick off to qualify as a Look-Through Company. Here’s a handy table to give you an at-a-glance view of the key eligibility requirements:

| Requirement | Details/Conditions | Notes |

|---|---|---|

| Resident Company | The company must be tax-resident in New Zealand. | Typically, the company’s central management must be in NZ. |

| Shareholder Restrictions | Only Kiwi individuals, certain trusts, or qualifying entities can hold shares. | Ensures that benefits flow to eligible Kiwis. |

| Income Flow-Through | The company must agree to pass its income and losses directly to shareholders. | This is the core feature of an LTC. |

| No Capital Gains Tax Impact | The structure should be designed to avoid double taxation on gains. | Aimed at simplifying the tax process. |

| Compliance with IRD Guidelines | Must adhere to any additional conditions as specified by the IRD. | Always check the latest IRD updates. |

Make sure you review these requirements carefully – not meeting even one of these could mean you’re not eligible to be an LTC. 👍

Steps to Register as an LTC

Once you’ve confirmed that you meet the eligibility criteria, the next step is to register as an LTC with the IRD. Here’s a step-by-step breakdown to simplify the process:

- Gather Your Documents:

- Compile all necessary documents such as your company’s registration details, shareholder information, and financial records.

- Ensure that all records are up-to-date and compliant with the IRD’s guidelines.

- Complete the Application:

- Fill out the required forms (for instance, the IR7L form if applicable) accurately.

- Double-check your entries to avoid delays or errors in processing. 📝

- Submit to the IRD:

- Lodge your completed application either online or by post as per the IRD’s instructions.

- Keep copies of all submitted documents for your records.

- Await Confirmation:

- The IRD will review your application and confirm your LTC status.

- If additional information is required, be prompt in providing it to keep the process moving smoothly.

- Implement Ongoing Compliance Measures:

- Once approved, ensure that you meet all ongoing administrative requirements, such as regular reporting and shareholder communication.

Pro Tips to Simplify the Process:

- Stay Organized: Keep all your documents and records in one place so that when tax time comes, you’re not scrambling.

- Consult a Pro: If you’re unsure about any part of the process, don’t hesitate to reach out to a tax professional – it could save you time and money in the long run.

- Set Reminders: Use digital calendars or apps to mark important deadlines for filings and updates.

By following these steps and staying on top of the requirements, you can streamline the registration process and set your company up as an LTC without the usual hassle. Cheers to a smoother tax journey ! 🚀

Tax Implications and Ongoing Administration

Tax Benefits and Impact on Net Worth

Alright, mate – here’s where the LTC really shines. One of the key perks of the Look-Through Company structure is that it allows income and losses to “flow through” directly to shareholders. What does that mean for you? Instead of the company being taxed on its earnings, the profits (or losses) are passed on to you, meaning you can offset losses against other income and potentially lower your overall tax liabilities.

Imagine you’ve had a bit of a rough patch with one of your investments, and your LTC records a loss – that loss can be used to reduce the taxable income you report on your personal tax return. This not only eases your tax burden for the year but also has a positive impact on your net worth over time. For example, if your LTC generates a $10,000 loss in one year, that loss might offset other taxable income, meaning less tax to pay and more money staying in your pocket. It’s a clever way to balance out the ups and downs of investment returns while keeping your tax bill in check. 🚀

Shareholder Considerations and Reporting Requirements

Now, let’s talk about the nitty-gritty of managing ownership and keeping everything above board. In an LTC, the shareholders are directly impacted by the company’s income and losses. This means that how the income or loss is distributed is a key part of the structure. When it comes to selling shares, the tax implications can differ from traditional companies, so it’s important to be clear on how these distributions work.

Shareholders need to be aware of the ongoing administrative requirements too. For instance, regular filing of income/loss distributions is a must, and maintaining accurate records is crucial for ensuring compliance with the IRD. This involves keeping up-to-date documentation of all financial transactions, distributions, and any changes in share ownership. These steps help ensure that when the tax time rolls around, you’re well-prepared to demonstrate that all income has flowed through as intended.

In essence, while the LTC structure offers some serious tax benefits, it also comes with the responsibility of diligent reporting and record-keeping. Keeping a tight ship on these administrative tasks not only keeps the IRD happy but also gives you peace of mind knowing your financial affairs are in order👍.

Common Challenges and Practical Considerations

Common Issues in Practice

Even the best-laid plans can hit a few bumps along the way, mate. With Look-Through Companies (LTCs), there are some typical pitfalls and misunderstandings you need to be aware of:

- Misinterpreting the Flow-Through Benefit: Some investors expect every dollar of loss to completely wipe out their taxable income. However, there are limits and nuances in how losses can be applied. For instance, if your LTC has a bad year, you might not be able to offset all of that loss against your other income immediately.

- Complexity in Record-Keeping: LTCs require diligent documentation. A common issue is not maintaining clear records of income, losses, and distributions, which can lead to complications during tax time. One client of ours once mixed personal and LTC-related transactions, resulting in a lengthy audit process.

- Misunderstanding Shareholder Impact: Some Kiwis mistakenly assume that any distribution is automatically tax-free or beneficial. In reality, the tax implications can vary depending on your overall financial situation and the timing of these distributions.

Staying informed and maintaining proper documentation can help you dodge these common issues, keeping your LTC running smoothly and your tax benefits intact.

Alternatives for Property Investors

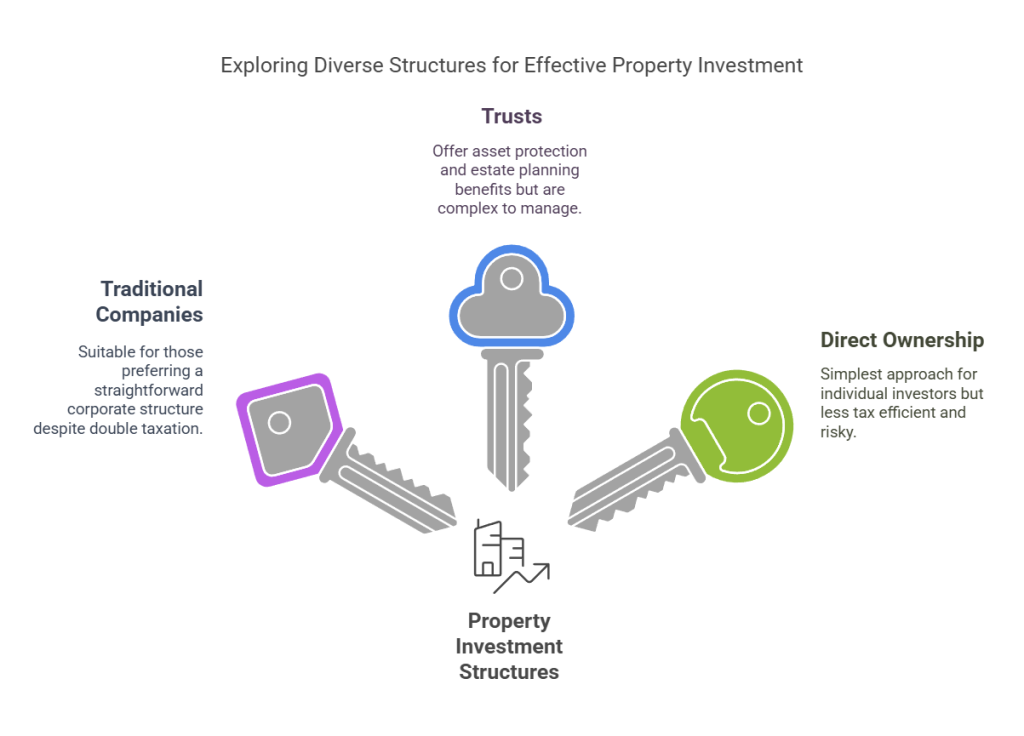

While LTCs offer enticing tax advantages, they aren’t the only option for Kiwi property investors. Sometimes, another structure might be a better fit depending on your specific situation:

- Traditional Companies: Regular companies might be more suitable if you prefer a straightforward corporate structure and are comfortable with the double taxation that sometimes applies. They offer more flexibility in terms of raising capital but might not deliver the same tax benefits as an LTC.

- Trusts: Many property investors opt for trusts to manage their investments. Trusts can offer asset protection and estate planning benefits, though they come with their own set of regulatory requirements and complexities.

- Direct Ownership: In some cases, holding property directly in your name might be the simplest approach, especially if you’re not dealing with multiple investors or complex distributions. However, this method may not offer the same level of tax efficiency or risk mitigation as an LTC.

In short, while LTCs can be a powerful tool for minimising tax and managing investments, they aren’t a one-size-fits-all solution. Evaluate your personal circumstances, investment goals, and risk appetite carefully. Sometimes, the traditional company or trust route might be a smarter option – it’s all about finding the right fit for your financial journey.

Is a Look-Through Company Right for You?

Assessing Suitability

Alright, before you jump into the LTC bandwagon, it’s crucial to figure out whether this structure really fits your financial or investment goals. Ask yourself some key questions and use the checklist below to assess if an LTC is your ticket to smarter tax planning. Here’s a handy table to help you evaluate your situation:

| Key Consideration | Questions to Ask Yourself | Your Response/Notes |

|---|---|---|

| Investment Goals | Are you looking for long-term tax efficiency and asset protection? | e.g. “I’m planning to grow my portfolio over 10+ years.” |

| Financial Situation | Can your current cash flow absorb potential fluctuations in income/loss distributions? | e.g. “My finances are stable enough to ride out the ups and downs.” |

| Record-Keeping Discipline | Do you have the systems in place to maintain detailed records and compliance? | e.g. “I already use Xero and keep all receipts digitally.” |

| Risk Tolerance | How comfortable are you with the administrative demands and potential audit risks? | e.g. “I prefer a structure that’s straightforward and low-risk.” |

| Professional Guidance | Are you ready to consult with a tax pro for tailored advice? | e.g. “I’m open to getting expert advice if needed.” |

Take a moment to fill in the table or simply mull these over. If the answers line up with what an LTC offers, you might be on the right track. If not, there may be a better option for your unique circumstances. Remember, it’s all about finding the right fit for your financial journey. 👍

Next Steps and Professional Advice

If you’re leaning towards forming or managing an LTC, it’s a smart move to get tailored advice to ensure you’re making the best choice for your situation. Don’t go it alone – a seasoned tax professional can help you navigate the specifics and keep you on the right side of the IRD. Here’s what you can do next:

- Reach Out for a Chat: Get in touch with a tax expert or our consultancy for a personalized consultation. We can help assess your needs, review your financial setup, and determine if an LTC is the way to go. 📞💬

- Explore More Resources: Check out our additional guides, case studies, and FAQs to learn more about the benefits and challenges of LTCs. Knowledge is power, mate!

- Take Action: Don’t let uncertainty hold you back. Use your checklist, weigh the pros and cons, and then take the next step towards smarter tax planning.

Ready to see if an LTC is right for you? Contact us today for a free consultation or explore our online resources to get started. Your financial future is too important to leave to chance – let’s get you on the path to tax efficiency and a brighter financial future! 🚀